United States Copper Market Size, Share, and COVID-19 Impact Analysis, By Product (Wire, Rods, Bars & Sections, Tube, Foil, and Flat Rolled Products), By Type (Primary Copper and Secondary Copper), and United States Copper Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsUnited States Copper Market Size Insights Forecasts to 2035

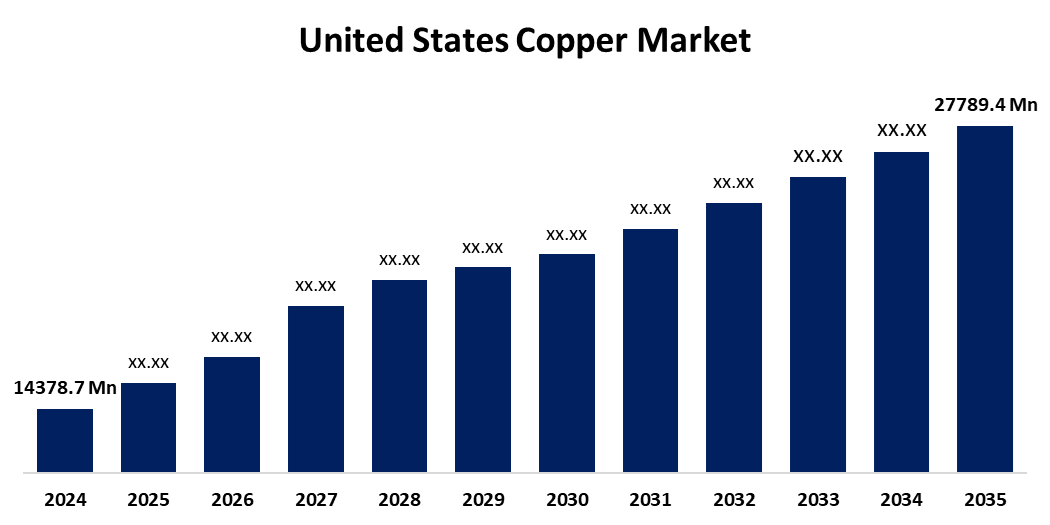

- The US Copper Market Size Was Estimated at USD 14378.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.17% from 2025 to 2035

- The US Copper Market Size is Expected to Reach USD 27789.4 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the United States Copper Market Size is anticipated to reach USD 27789.4 million by 2035, growing at a CAGR of 6.17% from 2025 to 2035. The expansion of the United States copper market is propelled by infrastructure that is valued for its superior electrical conductivity and corrosion resistance.

Market Overview

Copper is a reddish-orange metal with remarkable electrical and thermal conductivity. It is also soft, ductile, and incredibly malleable. It is widely used in roofing, plumbing, wiring, and other structural aspects of construction. For many years, copper has been a crucial metal in the production of electric vehicles, power distribution systems, and telecommunications equipment, all of which have contributed to the development of contemporary infrastructure and technology. As one of the earliest metals used, copper has been instrumental in the development of civilization. Copper has become one of the key industrial metals and is now used as often as iron and aluminum, due to its good electrical and thermal conductivity, shapeability, and resistance to rust. The U.S. copper industry is responding to the electrification of society, which includes energy storage, renewable energy infrastructure, and electric vehicles, because copper is an essential material for electrical systems. These aspects influence the connections and complexities of the U.S. copper market. The supply side is characterized by domestically produced copper from massive mines, such as Morenci and Kennecott, and a significant amount of copper in the market also exists as recycled copper.

Report Coverage

This research report categorizes the market for the United States copper market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States copper market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States copper market.

United States Copper Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 14378.7 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.17% |

| 2035 Value Projection: | USD 27789.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 159 |

| Tables, Charts & Figures: | 127 |

| Segments covered: | By Product, By Type and COVID-19 Impact Analysis |

| Companies covered:: | Freeport-McMoRan Inc., Aurubis Buffalo Inc., Mueller Industries, Inc., Wieland Metals Inc., Southwire Company, LLC, Revere Copper Products, Inc., Cambridge-Lee Industries LLC, Cerro Flow Products LLC, Hussey Copper Ltd., and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States copper market is boosted by industrialisation and economic growth. When industrial sectors and economies expand, the need for copper rises. Copper will be a critical aspect to these periods of growth due to the importance of copper in industry, infrastructure development, and construction. Due to increased urbanisation, growth in the manufacturing sector, and the ongoing construction of buildings, bridges, and electricity grids, a lot of copper is going to be needed. The increased demand for copper is compounded by rapid growth in the electronics industry, largely due to technological advancement.

Restraining Factors

The United States copper market faces obstacles due to increasing environmental concerns. The mining and production of copper have a serious environmental impact because they involve habitat disruption, water pollution, and greenhouse gas emissions.

Market Segmentation

The United States copper market share is classified into product and type.

- The wire segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States copper market is segmented by product into wire, rods, bars & sections, tube, foil, and flat rolled products. Among these, the wire segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by its great electrical conductivity, flexibility, and corrosion resistance. Copper wire is a key material for power distribution, telecommunications, and grounding applications in residential, commercial, and industrial settings. The burgeoning electric vehicle charging networks, investments from the federal government in broadband access, grid reliability, and continual electrification efforts to decarbonize buildings and transportation are key growth drivers for this market.

- The primary copper segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the type, the United States copper market is segmented into primary copper and secondary copper. Among these, the primary copper segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled because copper is known for its superior electrical conductivity and occurs in ore mined directly from the earth. This is incredibly useful in power lines, renewable energy applications, and car components. There is an increasing demand for primary copper of high purity.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States copper market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Freeport-McMoRan Inc.

- Aurubis Buffalo Inc.

- Mueller Industries, Inc.

- Wieland Metals Inc.

- Southwire Company, LLC

- Revere Copper Products, Inc.

- Cambridge-Lee Industries LLC

- Cerro Flow Products LLC

- Hussey Copper Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States copper market based on the following segments:

United States Copper Market, By Product

- Wire

- Rods

- Bars & Sections

- Tube

- Foil

- Flat Rolled Products

United States Copper Market, By Type

- Primary Copper

- Secondary Copper

Need help to buy this report?