United States Copper Foil Market Size, Share, and COVID-19 Impact Analysis, By Type (Electrodeposited Copper Foil and Rolled Copper Foil), By Application (Electrical & Electronics, Building & Construction, Industrial Equipment, Automotive Battery, and Others), and United States Copper Foil Market Insights, Industry Trend, Forecasts to 2035

Industry: Semiconductors & ElectronicsUnited States Copper Foil Market Insights Forecasts to 2035

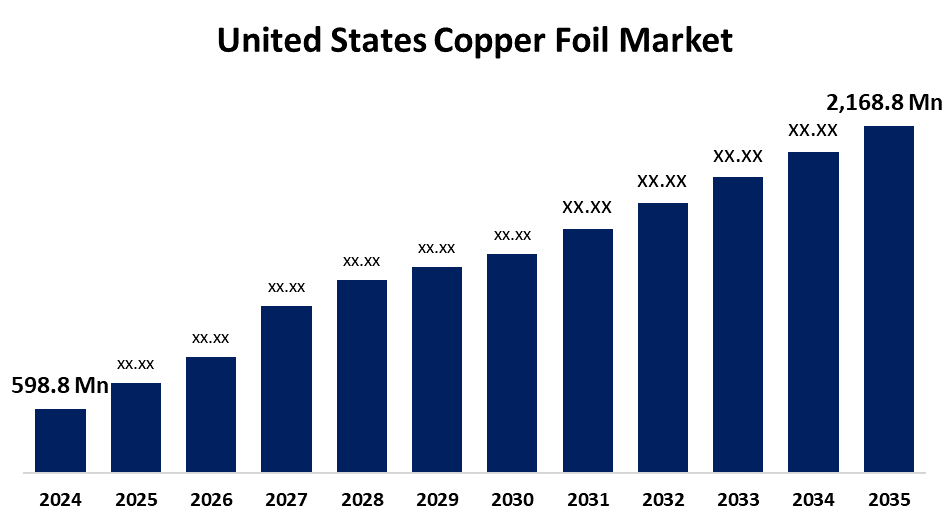

- The USA Copper Foil Market Size was Estimated at USD 598.8 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 12.41% from 2025 to 2035

- The U.S. Copper Foil Market Size is Expected to reach USD 2,168.8 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The USA copper foil market Size is anticipated to reach USD 2,168.8 Million by 2035, growing at a CAGR of 12.41% from 2025 to 2035. The United States copper foil market is growing due to increased demand from electronics, electric vehicles, and renewable energy sectors. Innovations in technology, rising adoption of 5G and smart devices, and government support for clean energy and domestic manufacturing further drive growth.

Market Overview

The U.S. copper foil market defines the production and supply of thin copper sheets used across various applications, including electronics, automotive batteries, construction, and industrial equipment. Copper foil is essential in manufacturing printed circuit boards (PCBs), lithium-ion batteries, and electromagnetic shielding materials. The market is primarily driven by rising demand in the electronics and energy storage sectors, particularly with the growth of electric vehicles (EVs) and renewable energy systems. A key strength of the market lies in the country’s advanced manufacturing capabilities and technological innovation, which support high-quality and precision copper foil production. Opportunities are expanding with the increasing adoption of 5G technology, flexible electronics, and smart devices, all of which require efficient, lightweight conductive materials. Moreover, copper’s recyclability aligns with sustainability goals, enhancing its long-term relevance. Government initiatives such as support for EV infrastructure, clean energy funding, and domestic manufacturing incentives further boost market potential.

Report Coverage

This research report categorizes the market for the United States copper foil market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the USA copper foil market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.S. copper foil market.

United States Copper Foil Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 598.8 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 12.41% |

| 2035 Value Projection: | USD 2,168.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 266 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Type and By Application |

| Companies covered:: | Michigan Metals & Manufacturing, Inc., Oak-Mitsui Technologies, LLC, Revere Copper Products, Inc., Fabri-Tech Components, Inc., Marmetal Industries, LLC, Sequoia Brass & Copper, Concord Industries, Inc., Farmer’s Copper Ltd., Metalmen Sales Inc., Beartech Alloys, Inc., Hussey Copper, Source 21, Inc., Global Metals, Reliance, Inc., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rising demand from the electronics industry, especially for use in printed circuit boards (PCBs) and lithium-ion batteries, along with the growing adoption of electric vehicles (EVs) and renewable energy systems, has significantly boosted the need for high-performance copper foils in energy storage applications. Technological advancements in electronics, such as 5G infrastructure and miniaturized devices, also contribute to market growth. Additionally, the expansion of data centers and the increasing penetration of smart devices across households and industries further fuel demand. Government initiatives promoting clean energy and EV adoption provide supportive policies and funding. Moreover, ongoing R&D in flexible electronics and high-efficiency batteries further drives the market.

Restraining Factors

The fluctuating raw material prices, particularly copper, impact production costs and pricing stability. Environmental regulations related to mining and manuacturing processes also pose challenges. Additionally, the complex manufacturing process of high-quality copper foils, along with intense global competition and the emergence of alternative materials, further limits market expansion and profitability for domestic producers.

Market Segmentation

The United States Copper Foil Market share is classified into type and application.

- The electrodeposited copper foil segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States copper foil market is segmented by type into electrodeposited copper foil and rolled copper foil. Among these, the electrodeposited copper foil segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to its widespread use in the manufacturing of printed circuit boards (PCBs) and lithium-ion batteries. ED copper foil offers uniform thickness, high conductivity, and strong adhesion properties, making it ideal for electronics and energy storage applications, which are major growth sectors.

- The electrical & electronics segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States copper foil market is segmented by application into electrical & electronics, building & construction, industrial equipment, automotive battery, and others. Among these, the electrical & electronics segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to the high demand for copper foil in printed circuit boards (PCBs), flexible circuits, and other electronic components. The rapid growth of consumer electronics, telecommunications, and data centers drives the need for high-performance, conductive materials, making copper foil essential in this sector.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States copper foil market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Michigan Metals & Manufacturing, Inc.

- Oak-Mitsui Technologies, LLC

- Revere Copper Products, Inc.

- Fabri-Tech Components, Inc.

- Marmetal Industries, LLC

- Sequoia Brass & Copper

- Concord Industries, Inc.

- Farmer’s Copper Ltd.

- Metalmen Sales Inc.

- Beartech Alloys, Inc.

- Hussey Copper

- Source 21, Inc.

- Global Metals

- Reliance, Inc.

- Others

Recent Developments:

- In January 2024, Wieland, a leading global supplier of high-quality copper and copper alloy solutions, announced its plans to make a landmark $500 million capital investment to re-equip, expand, and modernize its facility located in East Alton, Illinois. The investment is subject to the approval of state and local incentives.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the U.S., regional, and country levels from 2020 to 2035. Spherical Insights has segmented the USA copper foil market based on the below-mentioned segments:

United States Copper Foil Market, By Type

- Electrodeposited Copper Foil

- Rolled Copper Foil

United States Copper Foil Market, By Application

- Electrical & Electronics

- Building & Construction

- Industrial Equipment

- Automotive Battery

- Others

Need help to buy this report?