United States Cookies Market Size, Share, and COVID-19 Impact Analysis, By Type (Bar, Molded, Rolled, Drop, and Others), By Distribution Channel (Offline and Online), and United States Cookies Market Insights, Industry Trend, Forecasts to 2035.

Industry: Food & BeveragesUnited States Cookies Market Insights Forecasts to 2035

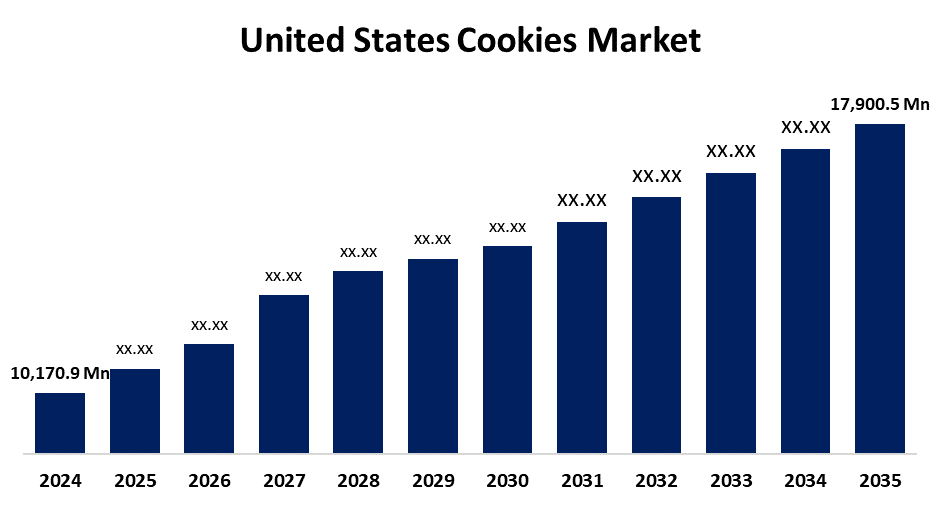

- The US Cookies Market Size Was Estimated at USD 10,170.9 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.27% from 2025 to 2035

- The US Cookies Market Size is Expected to Reach USD 17,900.5 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States Cookies Market Size is anticipated to reach USD 17,900.5 Million by 2035, growing at a CAGR of 5.27% from 2025 to 2035. The expansion of the United States cookie market is propelled by oatmeal, whole-grain, peanut, walnut, almond, and numerous other healthy cookie varieties that are being introduced by producers to satisfy the constantly growing health-conscious population.

Market Overview

Cookies are a sort of sweet baked good. Made of flour, sugar, eggs, and some kind of fat or oil, cookies are usually small, flat, and delicious. Cookies are always changing with the under diet and healthy alternatives to almonds, raisins, apricots, walnuts, and omega-3 seeds. These cookies are often aimed at rich and health-conscious customers and are sold at premium pricing. Some cookies are marketed as energy, and these cookies are gluten-free. Flavours are quickly changing, and new flavours are being introduced that have unusual ingredients to meet the changing customer preferences. Cookies that are baked for less time are commonly a composite protein and fat-free product. The gym-going demographic seeks out protein biscuits and is tolerant of price differences. In the US, cookies are a vital part of the culture. For instance, families will bake cookies for holidays, anniversaries, and birthdays. Cookies are often purchased and gifted to friends and family, and as such, they are common in the daily life of many cultures.

USDA offered $1–2 million in initial financing to public-private teams creating innovative food and nutrition technologies as part of its “Nourishing Next-Gen Agrifood Breakthroughs” Innovation Challenge. This can be pursued by cookie manufacturers and ingredient developers to create new recipes or useful ingredients for healthier desserts.

Report Coverage

This research report categorizes the market for the United States cookies market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States cookies market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States cookies market.

United States Cookies Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 10,170.9 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.27% |

| 2035 Value Projection: | USD 17,900.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 235 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type, By Distribution Channel |

| Companies covered:: | Mondelez International Inc. Class A, Campbell Soup Co, PepsiCo Inc, Kellogg’s, General Mills, Inc, Kellogg Company, McKee Foods Corporation, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States cookies market is boosted by the demand for oats and digestive cookies. The demand for gluten-free cookies will also increase as the population and lifestyle continue to change. Many cookie types, such as oatmeal and oatmeal raisin cookies, contain oats, and digestive cookies are often marketed as a healthier alternative. As more consumers go gluten-free for dietary preferences or surgical issues, the need for gluten-free cookies will continue to grow. This trend is showing increases, and expect the growth period to continue.

Restraining Factors

The United States cookies market faces obstacles like rising production prices come to the price volatility of some major commodities like flour, sugar, and cocoa. Price increases could cut into profits, force manufacturers to raise retail prices, or discourage retail pricing for price-sensitive customers.

Market Segmentation

The United States cookies market share is classified into type and distribution channel.

- The bar segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States cookies market is segmented by type into bar, molded, rolled, drop, and others. Among these, the bar segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by the variety and simplicity of the production bar cookies offer. For instance, it doesn't need special molds during the last phase of manufacturing because these cookies are cut into bar shapes. Bar cookies also have a long shelf life, along with their rectangular convenience and portability for travel and storage. Examples of bar cookies include oatmeal raisin and chocolate chip. Bar cookies are also less expensive to manufacture and allow for greater margins of profit for cookie makers due to the extreme simplicity along automated production lines.

- The offline segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the United States cookies market is segmented into offline and online. Among these, the offline segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by bakeries, supermarkets, and retail outlets in each region devoted to making and selling cookies. These places give cookie businesses plenty of visibility while making cookies accessible to large numbers of customers. Individuals prefer freshly produced cookies over ones that are kept, and when they view cookies in a physical store, they are better able to make selections because they are drawn to the scents, textures, and designs.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States cookies market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Mondelez International Inc. Class A

- Campbell Soup Co

- PepsiCo Inc

- Kellogg's

- General Mills, Inc

- Kellogg Company

- McKee Foods Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States cookies market based on the following segments:

United States Cookies Market, By Type

- Bar

- Molded

- Rolled

- Drop

- Others

United States Cookies Market, By Distribution Channel

- Offline

- Online

Need help to buy this report?