United States Contraceptive Market Size, Share, and COVID-19 Impact Analysis, By Product (Oral, Injectable, and Patches), By Distribution Channel (Hospital Pharmacy, Retail Pharmacy, Clinics, Online Channels, Public Channels & NGOs, and Others), and United States Contraceptive Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited States Contraceptive Market Insights Forecasts to 2035

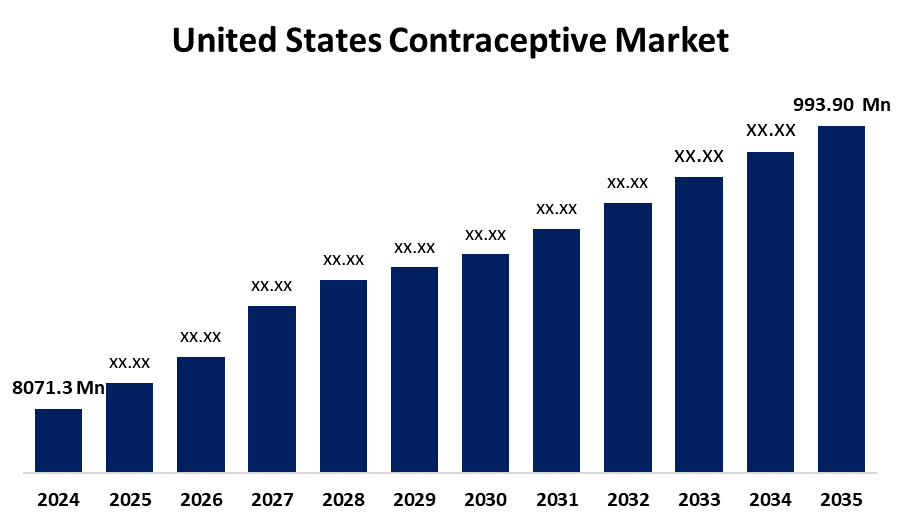

- The US Contraceptive Market Size Was Estimated at USD 8071.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.93% from 2025 to 2035

- The US Contraceptive Market Size is Expected to Reach USD 993.90 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States Contraceptive Market is anticipated to reach USD 993.90 million by 2035, growing at a CAGR of 4.93% from 2025 to 2035. The expansion of the United States contraceptive market is propelled by growing knowledge of family planning and sexual health among teenagers and young adults, as well as the usage of contemporary contraception.

Market Overview

A contraceptive is any tool, drug, or technique intended to avoid getting pregnant. The market is growing because there is an increased awareness of sexually transmitted diseases (STDs) and an increase in unintended pregnancies, approximately 65.7% of women in the U.S. accessible the withdrawal method of contraception, 79.8% of women used the contraceptive pill, and 94.5% of women had accessed a male condom with a partner, according to the CDC National Health Statistics Reports from December 2023. Furthermore, 24.9% of women used long-acting reversible contraception, and 23.5% of women used emergency contraception. As women and couples are accessing contraceptives to space births, improve the health of pregnancies, and reach the desired number of children, access to contraception is becoming more widely available in the nation. Also, it is projected that market growth during the forecast period will be attributed to the invention, the regulations relating to the approval and commercialization of new, long-acting, more effective, reversible contraceptive methods.

The U.S. government has implemented many federal programs to guarantee access to contraception, led by explicit financing, policy directives, and regulations. Under the Affordable Care Act (passed in 2012), the majority of private health insurance plans must provide cost-free coverage for all FDA-approved forms of contraception. This legislation rapidly expanded access and removed out-of-pocket costs for tens of millions of women.

Report Coverage

This research report categorizes the market for the United States contraceptive market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States contraceptive market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States contraceptive market.

Driving Factors

The growth of the United States contraceptive market is boosted by many non-profit organizations, as well as federal and state healthcare organizations, to improve women's sexual wellness and reproductive health. These organizations have developed a variety of public awareness campaigns and initiatives to educate and promote the general public's awareness. For example, in June 2023, a public advisory was issued by the U.S. to help consumers gain access to quality, affordable contraception across the country. In addition, multiple campaigns and initiatives are happening around the country, such as the Free the Pill Campaign, a public education campaign from the U.S. Department of Health and Human Services, the Massachusetts Department of Public Health (DPH)'s prior initiatives to promote the benefits of birth control, etc. It is anticipated that these elements will enable market growth.

Restraining Factors

The United States contraceptive market faces obstacles, like headaches, weight gain, nausea, bleeding, and other side effects that can occur with prolonged usage. There is also blood clots associated with hormonal contraceptives, which are based on oestrogen and progesterone, contributing risk of heart attack and stroke.

Market Segmentation

The United States contraceptive market share is classified into product and distribution channel.

- The oral segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States contraceptive market is segmented by product into oral, injectable, and patches. Among these, the oral segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by the country's high consumption of oral contraceptive tablets and other benefits. The benefits include the ease of use, the clinical benefits over other modes of contraceptives, and the relative ease of obtaining the drugs commercially.

- The retail pharmacy segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the United States contraceptive market is segmented into hospital pharmacy, retail pharmacy, clinics, online channels, public channels & NGOs, and others. Among these, the retail pharmacy segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by the increasing demand for contraceptive products and the availability of generic drugs in retail pharmacies. In addition, the country's favorable regulatory rules have helped this segment grow.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States contraceptive market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Crinetics Pharmaceuticals Inc

- Afaxys

- Veru Inc

- Agile Therapeutics Inc

- Organon & Co Ordinary Shares

- Viatris Inc

- Church & Dwight Co Inc

- Pfizer Inc

- AbbVie Inc

- The Cooper Companies, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States contraceptive market based on the following segments:

United States Contraceptive Market, By Product

- Oral

- Injectable

- Patches

United States Contraceptive Market, By Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Clinics, Online Channels

- Public Channels & NGOs

- Others

Need help to buy this report?