United States Conductive Polymers Market Size, Share, and COVID-19 Impact Analysis, By Type (Acrylonitrile Butadiene Styrene, Polycarbonates, and Polyphenylene Polymer-Based Resins), and By Application (Capacitors, Anti-Static Packaging, and Batteries), and United States Conductive Polymers Market Insights, Industry Trend, Forecasts to 2035.

Industry: Chemicals & MaterialsUnited States Conductive Polymers Market Insights Forecasts to 2035

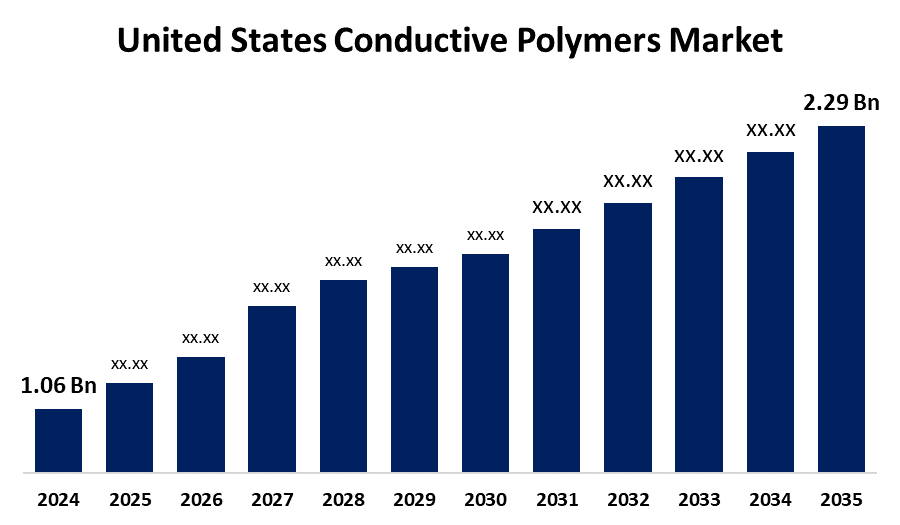

- The United States Conductive Polymers Market Size was estimated at USD 1.06 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.25% from 2025 To 2035

- The United States Conductive Polymers Market Size is Expected to Reach USD 2.29 Billion By 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United States Conductive Polymers Market Size is Anticipated to reach USD 2.29 Billion By 2035, Growing at a CAGR of 7.25% from 2025 To 2035. The U.S. conductive polymers market is growing due to rising demand in electronics, electric vehicles, and renewable energy. These polymers offer lightweight, flexible, and energy-efficient properties. Government support for sustainable technologies and innovation in bio-based and 3D-printed polymers further fuels expansion. Their versatility across industries makes them integral to next-generation electronic applications.

Market Overview

The USA conductive polymers market refers to the industry focused on the production, development, and application of polymers that can conduct electricity while retaining the mechanical properties of plastics. These materials combine electrical conductivity with flexibility, lightweight structure, and corrosion resistance, making them suitable for use in a wide range of applications, including electronics, energy storage, sensors, and electromagnetic shielding. The market growth is largely driven by rising demand in the consumer electronics sector, expanding use in electric vehicles (EVs), and increasing reliance on renewable energy systems that require efficient energy storage and transfer solutions. Conductive polymers offer strengths such as design flexibility, reduced manufacturing costs, and compatibility with miniaturized and flexible electronics. Various opportunities are lying in the development of bio-based and recyclable conductive polymers, as well as innovations in additive manufacturing like 3D printing. The medical and aerospace industries are also exploring new uses due to the material’s lightweight and customizable properties. Furthermore, U.S. government initiatives promoting clean energy, electric mobility, and sustainable materials, through grants, subsidies, and research funding, are accelerating innovation and adoption.

Report Coverage

This research report categorizes the market for the United States conductive polymers market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the U.S. conductive polymers market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the USA conductive polymers market.

United States Conductive Polymers Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.06 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.25% |

| 2035 Value Projection: | USD 2.29 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 185 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | American Polymers Corporation, SABIC Innovative Plastics US, Agfa-Gevaert NV USA, Celanese Corporation, PolyOne Corporation, Lubrizol Corporation, AIK Technology Inc., ElectriPlast Corp, Parker Hannifin, RTP Company, Addivant USA, Ensinger Inc., Arkema Inc., DuPont, 3M, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing demand from the electronics, automotive, and energy sectors due to their excellent electrical conductivity, flexibility, and lightweight characteristics, making them ideal for use in batteries, capacitors, sensors, and displays. The growing adoption of electric vehicles (EVs) and renewable energy systems also boosts the need for conductive materials that can enhance performance while reducing weight and environmental impact. Additionally, the rise of wearable technologies and miniaturized medical devices expands the application scope of conductive polymers. Government initiatives promoting clean energy and technological innovation support its market growth. The trend toward bio-based and recyclable materials further drives the market, positioning conductive polymers as a key solution for sustainable innovation.

Restraining Factors

The high production costs and limited conductivity compared to traditional metals, complex manufacturing processes, and low mechanical strength in some polymer types hinder broader adoption. Additionally, limited awareness and technical expertise in handling advanced polymer systems further slow market growth, especially in small and medium-scale industries.

Market Segmentation

The United States conductive polymers market share is classified into type and application.

- The acrylonitrile butadiene styrene segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The USA conductive polymers market is segmented by type into acrylonitrile butadiene styrene, polycarbonates, and polyphenylene polymer-based resins. Among these, the acrylonitrile butadiene styrene segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to its excellent balance of strength, impact resistance, and ease of processing. ABS is widely used in electronics and automotive parts for its cost-effectiveness and good electrical insulating properties, making it the preferred choice over polycarbonates and polyphenylene polymers in many applications.

- The capacitors segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The U.S. conductive polymers market is segmented by application into capacitors, anti-static packaging, and batteries. Among these, the capacitors segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to the growing demand for miniaturized, high-performance electronic devices. Conductive polymers enhance capacitor efficiency with better conductivity and flexibility. Their crucial role in consumer electronics, automotive, and renewable energy sectors drives higher adoption compared to anti-static packaging and batteries.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States conductive polymers market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- American Polymers Corporation

- SABIC Innovative Plastics US

- Agfa-Gevaert NV USA

- Celanese Corporation

- PolyOne Corporation

- Lubrizol Corporation

- AIK Technology Inc.

- ElectriPlast Corp

- Parker Hannifin

- RTP Company

- Addivant USA

- Ensinger Inc.

- Arkema Inc.

- DuPont

- 3M

- Others

Recent Developments:

- In February 2025, SABIC introduced its new conductive NORYL GTX™ LMX310 resin, designed for inline paintable automotive applications. This unfilled, conductive polyphenylene ether (PPE) blend offers enhanced dimensional stability, absorbing 85% less moisture than traditional PA-based materials, reducing warpage by up to 90%. It also provides high heat resistance, enabling Class A color matching and eliminating the need for additional offline painting processes.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the U.S., regional, and country levels from 2020 to 2035. Spherical Insights has segmented the USA conductive polymers market based on the below-mentioned segments

United States Conductive Polymers Market, By Type

- Acrylonitrile Butadiene Styrene

- Polycarbonates

- Polyphenylene Polymer-Based Resins

United States Conductive Polymers Market, By Application

- Capacitors

- Anti-Static Packaging

- Batteries

Need help to buy this report?