United States Concrete Market Size, Share, and COVID-19 Impact Analysis, By Application (Structural Components, Pavements, Roadways, and Bridges), By End Use (Residential, Commercial, Industrial, and Infrastructural), and United States Concrete Market Insights, Industry Trend, Forecasts to 2035

Industry: Construction & ManufacturingUnited States Concrete Market Insights Forecasts to 2035

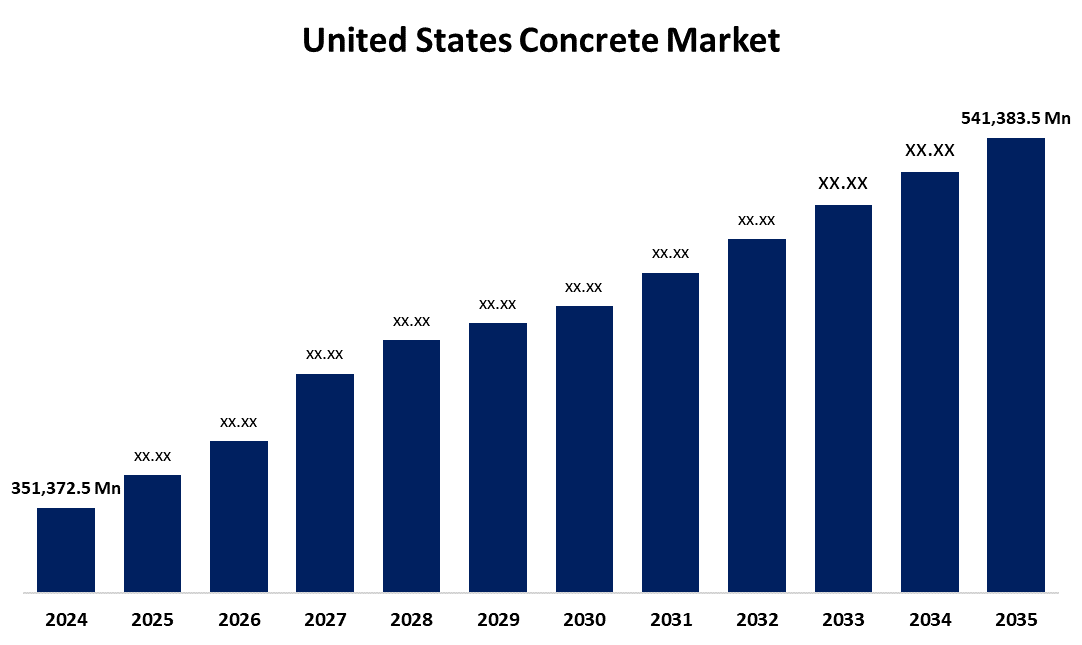

- The US Concrete Market Size Was Estimated at USD 351,372.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.01% from 2025 to 2035

- The US Concrete Market Size is Expected to Reach USD 541,383.5 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States Concrete Market Size is anticipated to reach USD 541,383.5 Million by 2035, Growing at a CAGR of 4.01% from 2025 to 2035. The expansion of the United States' concrete market is propelled by the rapid pace of urbanization and industrialization in the US.

Market Overview

Concrete, a common and widely used building product, has three major ingredients: Cement, a rock aggregate (the term aggregate usually includes both gravel and sand), and Water. When combined, these ingredients form a pliable and workable slurry that can then be designed to hydrate and form a hard, strong material over time. Concrete is flexible and is required when performing any kind of construction. One definition of concrete is the basic mixture of multiple aggregates like crushed stone, gravel, or sand, along with a binding agent (likely Portland cement). Concrete has both a tough and durable nature that will withstand very harsh environmental conditions. Concrete as a whole has and will continue to be a pivotal building material because of its strength, usability, and durability. Various types of concrete, all with their characteristics to meet the needs of the growing construction market, have been developed, including precast concrete (which is appropriate for larger structures), fibreglass concrete, and polymer concrete. Advances in technique and concrete quality have allowed more efficient concrete products to become available, due to advancements in production variables and construction techniques. Delivery of concrete products has demonstrated improved performance and consistency as a result of better production techniques, more automation in the production process, and the specifications of present-day construction to the present-day requirements of designers. Dealing with the price volatility of raw materials, regulatory hurdles, and influencing external economic factors are just some of the challenges facing the US concrete market. The price volatility of cement, the main ingredient in producing concrete, can impact profit margins and industry stability. The U.S. utility infrastructure market is sizable, as projects range from building renewable energy facilities to enhancing municipal water delivery systems.

The U.S. concrete market for utility infrastructure projects is significantly impacted by government funding programs and legislation. The federal, state, and local government sector drives demand for concrete by investing in utility infrastructure products, communications infrastructure products, and infrastructure projects.

Report Coverage

This research report categorizes the market for the United States concrete market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States' concrete market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States concrete market.

United States Concrete Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 351,372.5 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.01% |

| 2035 Value Projection: | USD 541,383.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 189 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Application, By End Use and COVID-19 Impact Analysis |

| Companies covered:: | Wells Concrete, Dayton Superior Corporation, Granite Construction, Oldcastle Materials, Vulcan Materials Company, Quikrete, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

Mergers and acquisitions are important factors in determining the competitive landscape of the concrete industry and are driving the growth of the concrete business in the United States. More and more companies are merging, thus expanding their footprint and consolidating their supply chain. The markets in which we operate are influenced primarily by regulatory environments - in particular building codes and environmental regulations which promote sustainable materials and practices.

Restraining Factors

The United States concrete market faces obstacles because of the intricacy of its formulation, the requirement for specialised ingredients, and the incorporation of cutting-edge technology. products like self-healing concrete, translucent concrete, and dry concrete frequently have higher initial costs.

Market Segmentation

The United States concrete market share is classified into application and end use.

- The structural components segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States concrete market is segmented by application into structural components, pavements, roadways, and bridges. Among these, the structural components segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by the US's infrastructure construction projects' exponential growth. Bridges, highways, tunnels, airports, and public buildings are all being built with significant financial support from both public and private sector organisations. These projects all call for strong, load-bearing materials. For these uses, concrete is still the preferred material due to its high compressive strength, adaptability, and durability. As a result, demand has remained steady.

- The residential segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the end use, the United States concrete market is segmented into residential, commercial, industrial, and infrastructural. Among these, the residential segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by the increasing need for new housing and infrastructure spurred by increased urbanisation and population levels. Concrete consumption has risen due to new apartment, villa, and residential complex construction in the US. Government programs promoting affordable housing and urban revitalization also promote large housing development projects that require resilient and cost-effective construction materials such as concrete.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States concrete market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Wells Concrete

- Dayton Superior Corporation

- Granite Construction

- Oldcastle Materials

- Vulcan Materials Company

- Quikrete

- Others

Recent Development

- In November 2023, Sika invested in Texas for the second time in as many years. Sika continues to make investments in the production of polymers at its Sealy facility in the US state of Texas. Sika ViscoCrete is a high-performance, resource-efficient concrete additive composed of polymers, which are chemical building blocks. The increasing demand for its concrete additive in the USA and Canada prompted the company to begin research.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States Concrete market based on the following segments:

United States Concrete Market, By Application

- Structural Components

- Pavements

- Roadways

- Bridges

United States Concrete Market, By End Use

- Residential

- Commercial

- Industrial

- Infrastructural

Need help to buy this report?