United States Compounding Pharmacies Market Size, Share, and COVID-19 Impact Analysis, By Product (Oral, Liquid Preparations, Liquid Preparations, Rectal, Parenteral, Ophthalmic, Nasal, Otic), By Compounding Type (PIA, PDA), By Sterility (Sterile, Non-Sterile), By Application (Adult, Geriatric, Pediatric, Veterinary), and United States Compounding Pharmacies Market Insights Forecasts to 2033

Industry: HealthcareUnited States Compounding Pharmacies Market Insights Forecasts to 2033

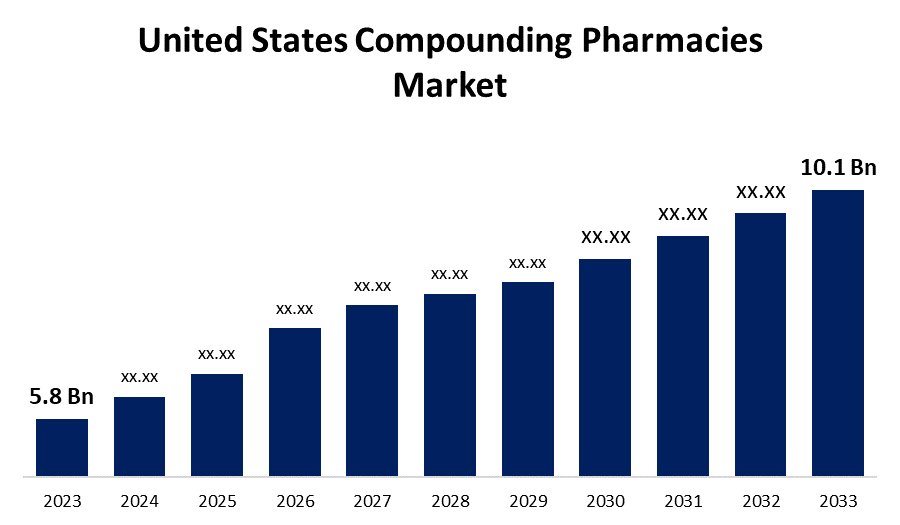

- The United States Compounding Pharmacies Market Size was valued at USD 5.8 Billion in 2023.

- The Market Size is Growing at a CAGR of 5.7% from 2023 to 2033.

- The United States Compounding Pharmacies Market Size is Expected to Reach USD 10.1 Billion by 2033.

Get more details on this report -

The United States Compounding Pharmacies Market Size is expected to reach USD 10.1 Billion by 2033, at a CAGR of 5.7% during the forecast period 2023 to 2033.

Market Overview

A compounded drug may be required for a patient who cannot be treated with an FDA-approved drug, such as one who is allergic to dyes and requires a medication without them, or for an elderly or child who is unable to swallow a tablet or capsule and requires a medication in liquid dosage form. When an FDA-approved drug is not required to treat a patient, doctors in hospitals, clinics, and other healthcare settings may prescribe compounded medications. One of the primary drivers of market expansion is the growing importance of compounding in improving medication adherence. Patients may struggle to adhere to their medications for a variety of reasons, including swallowing issues, taste preferences, or allergies to certain ingredients in commercially available medications. Compounding pharmacies specialize in creating personalized medications based on individual patient needs, addressing adherence barriers by offering customized dosage forms, flavors, and allergen-free formulations to improve patient acceptance and compliance, resulting in increased demand for their services. The surge in investments by key market players in R&D to innovate and customize formulations to effectively treat various diseases is expected to drive growth in the United States compounding pharmacies market.

Report Coverage

This research report categorizes the market for United States compounding pharmacies market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States compounding pharmacies market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the United States compounding pharmacies market.

United States Compounding Pharmacies Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | 5.8 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.7% |

| 2033 Value Projection: | USD 10.1 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Product, By Compounding Type, By Sterility, By Application |

| Companies covered:: | Athenex Pharma Solutions (Athenex Inc.), B Braun Melsungen AG, Clinigen Group PLC, Dougherty’s Pharmacy Inc, Fagron, Fresenius Kabi, ImprimisRx (Harrow Health, Inc.), Institutional Pharmacy Solutions, ITC Compounding Pharmacy, Lorraine’s Pharmacy, McGuff Company Inc (McGuff Compounding Pharmacy Services), Nephron Pharmaceuticals Corporation, Pencol Compounding Pharmacy, QuVa Pharma, Rx3 Compounding Pharmacy, Triangle Compounding Pharmacies, Wedgewood Village Pharmacy, and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact,Challenges,Growth, Analysis. |

Get more details on this report -

Driving Factors

The rising prevalence of cancer among the US population is significantly boosting market growth. The rising incidence of cancer in the United States is expected to significantly boost the growth of the compounding pharmacies market in the coming years. Drug shortages have resulted from longer lead times, a lack of adequate raw materials, increased drug failure, and delayed production, all of which have contributed to the growth of the US compounding market. Furthermore, the growing geriatric population base in the United States, combined with improved longevity, is accelerating market growth significantly. The growing acceptance of compounding pharmacies, combined with favorable government reimbursement policies, is driving the growth of the US compounding pharmacies market. Furthermore, increasing technological advancements are driving the growth of effective compounding pharmacies. The presence of leading market players, combined with a strong healthcare infrastructure in the United States, is driving growth in the compounding pharmacies market.

Restraining Factors

The major factors that hamper growth in the United States compounding pharmacies market include increased product warnings in sterile compounding, which has resulted in a decrease in sales of compounded injectable drugs, which is also expected to slow market growth. The agency stated that interaction with the rubber stopper in some lots of these syringes may reduce drug potency if filled in syringes and not used right away.

Market Segment

- In 2023, the oral segment accounted for the largest revenue share over the forecast period.

Based on the product, the United States compounding pharmacies market is segmented into oral, liquid preparations, liquid preparations, rectal, parenteral, ophthalmic, nasal, and otic. Among these, the oral segment has the largest revenue share over the forecast period. The rising prevalence of various chronic diseases, combined with an increased preference for oral medications owing to their ease of use and storage, has fueled the growth of this segment. Some of the most popular traditional forms of oral medications include tablets, capsules, powder, and granules. The increasing demand for personalized medications among different age groups is expected to drive market growth during forecast period.

- In 2023, the pharmaceutical ingredient alteration (PIA) segment accounted for the largest revenue share over the forecast period.

Based on the compounding type, the United States compounding pharmacies market is segmented into pharmaceutical ingredient alteration (PIA) and pharmaceutical dosage alteration (PDA). Among these, the pharmaceutical ingredient alteration (PIA) segment has the largest revenue share over the forecast period. PIA entails modifying the composition or concentration of active ingredients in medications, often to tailor them to individual patients. The PDA segment dominated the market, accounting for the largest share. PDA is an important aspect of compounding pharmacies; the dominance of a specific segment in the market can shift depending on factors such as regional preferences, patient demands, and market dynamics.

- In 2023, the non-sterile segment accounted for the largest revenue share over the forecast period.

Based on the sterility, the United States compounding pharmacies market is segmented into sterile and non-sterile. Among these, the non-sterile segment has the largest revenue share over the forecast period. Non-sterile compounded medications consist of solutions, suspensions, ointments, creams, powders, suppositories, capsules, and tablets. The main advantage of non-sterile compounding medication is the ability to change the route of administration based on patient preference.

- In 2023, the adult segment accounted for the largest revenue share over the forecast period.

Based on the application, the United States compounding pharmacies market is segmented into adult, geriatric, pediatric, and veterinary. Among these, the adult segment has the largest revenue share over the forecast period owing to their sedentary lifestyle and food habits. Furthermore, adults prefer compounded nutritional supplements to avoid taking multiple medications because a single medication is designed to meet all of their nutritional requirements. This helps to grow the United States compounding pharmacies market during the forecast period.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States compounding pharmacies market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Athenex Pharma Solutions (Athenex Inc.)

- B Braun Melsungen AG

- Clinigen Group PLC

- Dougherty’s Pharmacy Inc

- Fagron

- Fresenius Kabi

- ImprimisRx (Harrow Health, Inc.)

- Institutional Pharmacy Solutions

- ITC Compounding Pharmacy

- Lorraine’s Pharmacy

- McGuff Company Inc (McGuff Compounding Pharmacy Services)

- Nephron Pharmaceuticals Corporation

- Pencol Compounding Pharmacy

- QuVa Pharma

- Rx3 Compounding Pharmacy

- Triangle Compounding Pharmacies

- Wedgewood Village Pharmacy

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2022, Nephron Pharmaceuticals Corporation introduced a new syringe presentation, the Cyclic Olefin Copolymer syringe (COC), through its Nephron 503B Outsourcing Facility operation. The company is preparing to launch 8.4% Sodium Bicarbonate Injection in a COC syringe. This strategy will allow the company to expand its product portfolio as the compounding pharmacies market grows.

- In May 2020, Wedgewood Pharmacy has announced an acquisition with Zoo and Wildlife Specializations to acquire a 503B outsourcing facility and a state-licensed pharmacy. This strategy expanded the company's product portfolio, driving market growth.

Market Segment

This study forecasts country revenue from 2022 to 2033. Spherical Insights has segmented the United States compounding pharmacies market based on the below-mentioned segments:

United States Compounding Pharmacies Market, By Product

- Oral

- Liquid Preparations

- Liquid Preparations

- Rectal

- Parenteral

- Ophthalmic

- Nasal

- Otic

United States Compounding Pharmacies Market, By Compounding Type

- PIA

- PDA

United States Compounding Pharmacies Market, By Sterility

- Sterile

- Non-Sterile

United States Compounding Pharmacies Market, By Application

- Adult

- Geriatric

- Pediatric

- Veterinary

Need help to buy this report?