United States Composites Market Size, Share, and COVID-19 Impact Analysis, By Product (Carbon Fiber, Glass Fiber, and Others), By Manufacturing Process (Layup, Filament, Injection Molding, Pultrusion, Compression molding, RTM, and Others), and United States Composites Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsUnited States Composites Market Insights Forecasts to 2035

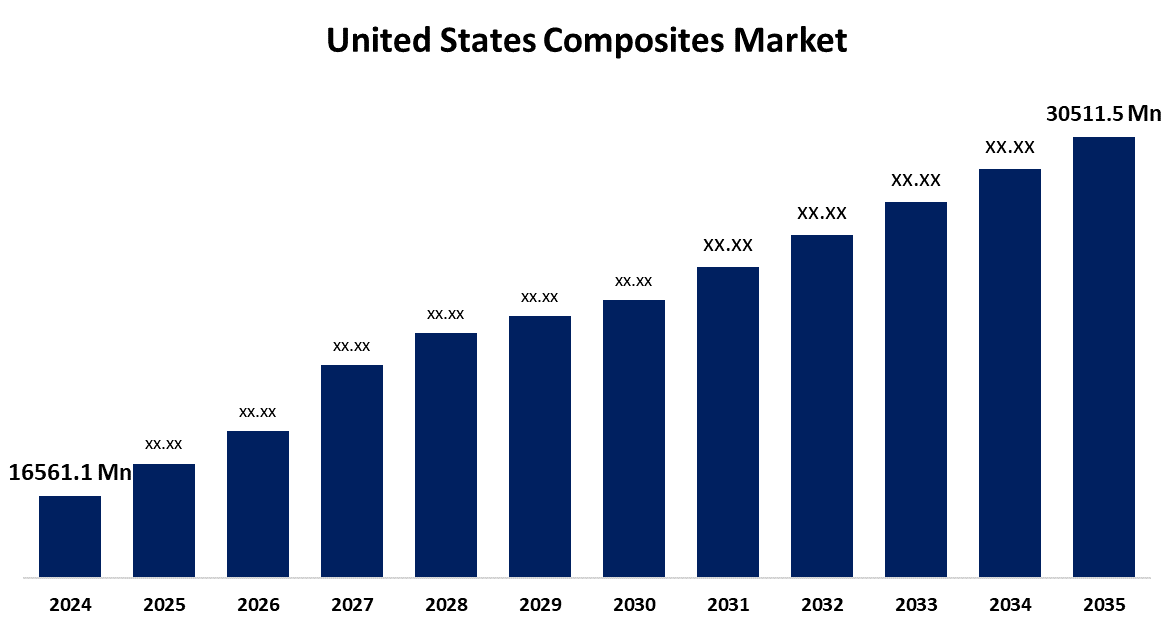

- The US Composites Market Size Was Estimated at USD 16561.1 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.71% from 2025 to 2035

- The US Composites Market Size is Expected to Reach USD 30511.5 Million by 2035

Get more details on this report -

According to a Research Report published by Spherical Insights & Consulting, the United States Composites Market Size is Anticipated to Reach USD 30511.5 Million by 2035, Growing at a CAGR of 5.71% from 2025 to 2035. The expansion of the United States' composites market is propelled by the requirement for lightweight components in the transportation and automotive industries.

Market Overview

Composites are materials created by fusing two or more distinct substances to produce a new material with better qualities than the constituent parts. One of the foremost drivers of the composites market in the United States is the increasing requirement for lightweight materials in the automotive industry. The composites market will benefit from aerospace and defence capacity produced by the expansion of commercial space aircraft manufacturing capabilities for space exploration missions by Northrop Grumman Corporation, Space Exploration Technologies Corp, and Virgin Galactic, along with the increase in air passenger traffic. The composites market will also benefit from the anticipated growth of composites for the aerospace and defence sectors due to the presence of the largest airplane manufacturer in the country, The Boeing Company, and the rapid advancement of the aerospace and defence sectors. The defence industry is expected to experience the same increase in demand as it ramps up innovations and technologies. The composites market growth should increase gradually as the OEMs take advantage of the existing environmental legislation to replace parts with composites in vehicles.

The U.S. Department of Energy (DOE), which has initiated several major funding initiatives, has been at the forefront. In order to improve performance and manufacturability, it announced in February 2023 a $30 million project to develop composite materials and additive manufacturing for large wind turbines, particularly offshore.

Report Coverage

This research report categorizes the market for the United States composites market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States composites market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States composites market.

United States Composites Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 16561.1 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 5.71% |

| 2035 Value Projection: | USD 30511.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 160 |

| Tables, Charts & Figures: | 150 |

| Segments covered: | By Product, By Manufacturing Process and COVID-19 Impact Analysis. |

| Companies covered:: | CoorsTek, Carpenter Technology Corp, Zimmer Biomet Holdings Inc, Dentsply Sirona Inc, Stryker Corp, Johnson & Johnson, Baxter International, Medtronic, Evonik Industries AG, Carpenter Technology Corporation and Others. |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States composites market is boosted by the lay-up process for composite manufacture was time-consuming and limited in design geometry. These days, special manufacturing procedures that do not require labour can make composites because of Digital Composite Manufacturing (DCM). DCM allows composites to be locally customised in three dimensions to achieve the desired strength, density, and flexibility required by the project. Designers are now empowered to design composites with the flexibility of 3D printing and the performance of composites. So, composites will likely benefit from this.

Restraining Factors

The United States composites market faces obstacles like the cost of carbon fibre products being more expensive than other structural construction materials used for similar purposes, but, because of weight, initially lower-cost materials such as steel and aluminium typically require more work.

Market Segmentation

The United States composites market share is classified into product and manufacturing process.

- The glass fiber segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States composites market is segmented by product into carbon fiber, glass fiber, and others. Among these, the glass fiber segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by the fact that they are being used across many industries, including construction, wind energy, electrical, electronics, automotive, and transportation. Recent advancements to enhance strength and durability with composites are causing them to be increasingly adopted in pipe manufacturing.

- The layup segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the manufacturing process, the United States composites market is segmented into layup, filament, injection molding, pultrusion, compression molding, RTM, and others. Among these, the layup segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled as there is increased production of boats, wind turbine blades, and architectural mouldings. A cost-effective wet layup method allows for composite products of various sizes and shapes to be produced for applications such as storage tanks and marine prototypes.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States composites market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Momentive

- Weyerhaeuser Co

- PPG Industries Inc

- Owens-Corning Inc

- Cytec Industries

- Hexcel Corp

- DuPont de Nemours Inc

- Huntsman Corp

- Woodsward Inc.

- Others

Recent Development

- In April 2024, Owens Corning announced their definitive agreement to acquire all outstanding shares of Masonite for $133.00 per share in cash. The deal represents a premium of about 38% to Masonite’s closing share price and about 46% to Masonite’s 20-day volume-weighted average price. The transaction value is around $3.9 billion, implying a purchase multiple of approximately 8.6x 2023E adjusted EBITDA2 or 6.8x when including synergies of $125 million.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States composites market based on the following segments:

United States Composites Market, By Product

- Carbon Fiber

- Glass Fiber

- Others

United States Composites Market, By Manufacturing Process

- Layup

- Filament

- Injection Molding

- Pultrusion

- Compression molding

- RTM

- Others

Need help to buy this report?