United States Commercial Drones Market Size, Share, and COVID-19 Impact Analysis, By Type (Fixed wing drones, Rotary blade drones, and Hybrid drones), By Application (Agriculture & Environment, Media & Entertainment, Energy, Government, Construction & Archaeology, Others), and United States Commercial Drones Market Insights, Industry Trend, Forecasts to 2035

Industry: Advanced MaterialsUnited States Commercial Drones Market Insights Forecasts to 2035

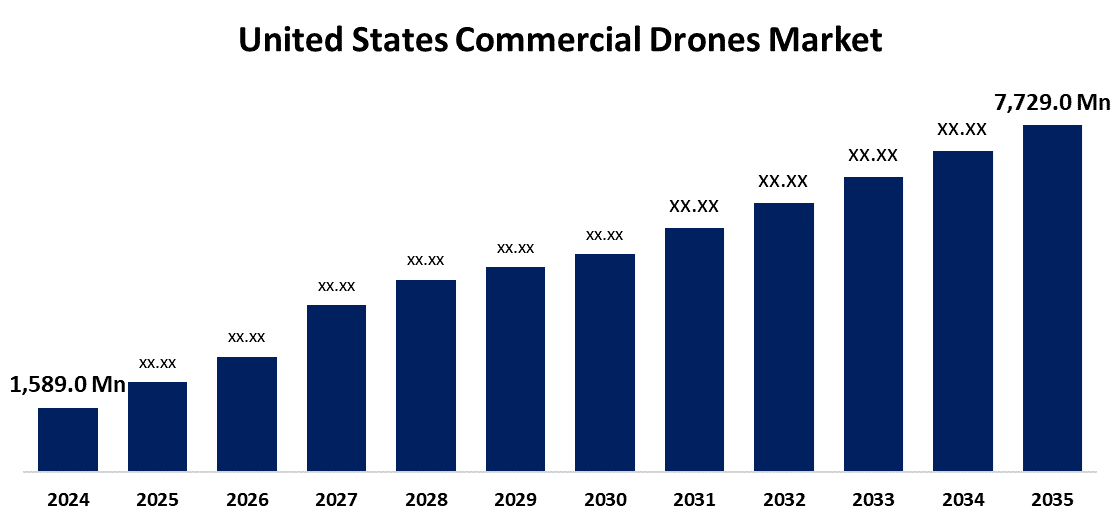

- The United States Commercial Drones Market Size Was Estimated at USD 1,589.0 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 15.47% from 2025 to 2035

- The USA Commercial Drones Market Size is Expected to Reach USD 7,729.0 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States Commercial Drones Market Size is anticipated to reach USD 7,729.0 million by 2035, growing at a CAGR of 15.47% from 2025 to 2035. Technological innovation, expanded applications, and enabling regulations fuel the U.S. commercial drone industry. Its main sectors are agriculture, logistics, energy, media, and construction. AI, extended flight times, and high-end sensors such as lidar and cameras now characterize drones, making them more useful. They are utilized for applications including crop monitoring, deliveries, inspection of infrastructure, surveillance, and aerial media. Increasing investments and FAA regulations also fuel further growth and adoption of the market.

Market Overview

The U.S. commercial drone market refers to the utilization of unmanned aerial systems (UAS) across industries like agriculture, aerial photography, infrastructure inspection, surveying, and emergency response. Technology advances such as longer battery life, better cameras, and increased payload capacity have been driving the increasing versatility of drones. The strengths of drones are cost-effectiveness and improved operational productivity. For instance, in farming, drones support crop health tracking, allowing timely interventions and limiting labor requirements. The market further offers robust possibilities through the potential of artificial intelligence (AI) and machine learning (ML) that facilitate wiser, self-governing drone operations as well as analytics. These breakthroughs are predicted to drive the adoption of drones among more sectors more quickly. In addition, supportive government policy, the Federal Aviation Administration's (FAA) Part 107, sets clear guidelines for operations and the standard for safety. These policies engender trust between users and businesses, which leads to increased market expansion and the position of drones in commercial applications.

Report Coverage

This research report categorizes the market for the USA commercial drones market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States' commercial drone market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States commercial drone market.

United States Commercial Drones Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1,589.0 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 15.47% |

| 2035 Value Projection: | USD 7,729.0 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Skydio, AeroVironment, Amazon Prime Air, Anduril Industries, Vantage Robotics, Teal Drones, Volansi., 3D Robotics (3DR), Aevex Aerospace, Swift Engineering, Rotor Technologies and others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The commercial drones market in the U.S. is expanding at a rapid rate due to a high demand from sectors like transportation, agriculture, media, and construction. Commercial drones help in crop monitoring and fertilizing more efficiently, saving time and money. They are also employed by the media to shoot aerial photographs and are being tested for fast, cheap delivery. Drones are being used more and more in infrastructure inspection, disaster response, real estate, and law enforcement. Advances in sensor technology, AI, and battery life are making drones smarter, more autonomous, and more efficient for a wide range of professional uses, fueling further market growth.

Restraining Factors

The US commercial drones market is subject to several constraints, even though it is growing fast. Regulatory issues in the form of complicated FAA approval processes and limitations on Beyond Visual Line of Sight (BVLOS) operations delay deployments. Data privacy and airspace safety concerns also confine large-scale adoption. High upfront costs, short battery lives, and reliance on expert operators also slow expansion. Supply chain disruptions and civilians' surveillance concerns also affect market acceptance and growth.

Market Segmentation

The United States commercial drones market share is classified into type and application.

- The rotary blade drones segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States commercial drones market is segmented by type into fixed-wing drones, rotary blade drones, and hybrid drones. Among these, the rotary blade drones segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. These drones are valued for their versatility and ability to hover, making them ideal for tasks requiring precision and stability. Commonly used in inspection, photography, surveillance, filming, and surveying, they offer reliable performance in applications that demand accurate positioning and control in challenging or confined environments.

- The media & entertainment segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States commercial drone market is segmented by application into agriculture & environment, media & entertainment, energy, government, construction & archaeology, and others. Among these, the media & entertainment segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to the versatility, ease of use, and ability of drones to capture high-quality, dynamic aerial shots. They are widely used in films, TV, advertising, real estate marketing, news coverage, and social media, offering unique visual perspectives that enhance content across media, marketing, and reporting industries.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States commercial drones market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Skydio

- AeroVironment

- Amazon Prime Air

- Anduril Industries

- Vantage Robotics

- Teal Drones

- Volansi.

- 3D Robotics (3DR)

- Aevex Aerospace

- Swift Engineering

- Rotor Technologies

- Others

Recent Developments:

- In May 2025, SiFly Launched NDAA-Compliant Long-Endurance Drones to Expand Industrial and Public Safety Capabilities. The Q250, SiFly’s heavy-lift drone, is capable of transporting payloads of up to 200 pounds with an endurance of 100 minutes potentially replacing expensive helicopter operations.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States commercial drones market based on the below-mentioned segments:

U.S. Commercial Drones Market, By Type

- Fixed-wing drones

- Rotary blade drones

- Hybrid drones

U.S. Commercial Drones Market, By Application

- Agriculture & Environment

- Media & Entertainment

- Energy

- Government

- Construction & Archaeology

- Others

Need help to buy this report?