United States Commercial Dishwashers Market Size, Share, and COVID-19 Impact Analysis, By Type (Hood Type, Under Counter, Rack Type, and Others), and End-User (Hotels, Restaurants, Catering Units, Cafes and Bakeries, and Others), and United States Commercial Dishwashers Market Insights, Industry Trend, Forecasts to 2035

Industry: Machinery & EquipmentUnited States Commercial Dishwashers Market Insights Forecasts to 2035

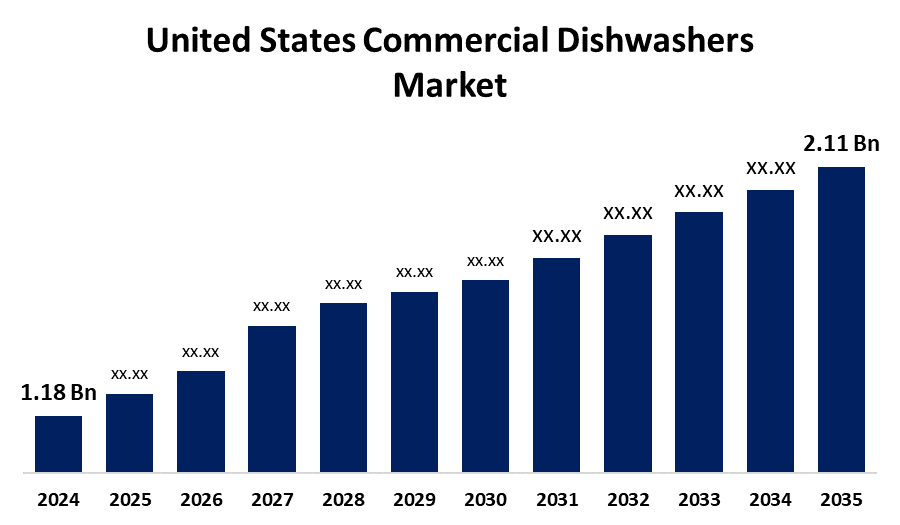

- The USA Commercial Dishwashers Market Size was estimated at USD 1.18 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.43% from 2025 to 2035

- The U.S. Commercial Dishwashers Market Size is Expected to Reach USD 2.11 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States commercial dishwashers market is anticipated to reach USD 2.11 billion by 2035, growing at a CAGR of 5.43% from 2025 to 2035. The US commercial dishwashers market is increasing because of many reasons, such as the increased requirement for high-capacity, rugged dishwashers in the hospitality, foodservice, and healthcare industries. Increased demand for efficient cleaning equipment and the movement toward automation are increasing the adoption rate of commercial dishwashers due to their better performance compared to residential dishwashers in less time and higher reliability.

Market Overview

The United States commercial dishwasher market involves the demand for dishwashing machines utilized by commercial entities such as hotels, restaurants, and catering businesses. The market is dominated by the demand for powerful dishwashers with large capacities to clean large numbers of dishes, glassware, and cutlery in a quick and efficient process. The growth in the foodservice industry, growing use of ENERGY STAR-certified models, and technological improvement in dishwashers are driving market demand and growth for resource-saving dishwashing technologies, by driving eating-in and take-away consumption and heightened concern for sustainability and hygiene standards. The US commercial dishwasher market is robust based on robust demand by numerous businesses, concern for efficiency and sustainability, and a massive market size. The United States government promotes energy efficiency in the commercial dishwasher industry through the likes of ENERGY STAR and policy-making that promotes energy conservation programs. These will be effective in curbing energy and water consumption and ultimately lower costs for businesses while guaranteeing environmental sustainability.

Report Coverage

This research report categorizes the market for the United States commercial dishwashers market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the USA commercial dishwashers market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.S. commercial dishwashers market.

United States Commercial Dishwashers Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.18 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.43% |

| 2035 Value Projection: | USD 2.11 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 101 |

| Segments covered: | By Type and COVID-19 Impact Analysis |

| Companies covered:: | MEIKO International, Hobart, Jackson WWS, Miele, Thermador, Fagor America, Electrolux AB, Whirlpool Professional Appliances, Insinger Machine Company, CMA Dishmachines., and others key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The United States commercial dishwashers market is growing with a rising need for high-capacity dishwashers to accommodate enormous loads of cutlery and dishes effectively in high-volume facilities, particularly crowded places. In healthcare and hospitality industries, the rising demand for effective cleaning equipment, along with the automation trend, is pushing the use of commercial dishwashers, which are more reliable and quicker in operation than household models. Apart from this, the increase in the number of restaurants, cafes, and small-scale food industries, along with the increase in Westernized lifestyles, impacts the market. Companies are constantly coming up with ways of improving commercial dishwashers in terms of how efficient and how well they perform, making them even more attractive to companies. With the growing focus on being sustainable, companies are more and more incorporating energy-saving dishwashers as a way of reducing running costs.

Restraining Factors

The key constraint in the United States commercial dishwasher market is the excessive initial cost of acquiring these machines compared to residential models. The cost can act as a limitation for certain businesses, particularly small businesses or those with narrow budgets. Further, the necessity for frequent repairs and maintenance can affect the market since companies will have to incorporate these continuous costs. Regulations are also very rigid, including those of the U.S. Department of Energy (DOE) and the Environmental Protection Agency (EPA), which can influence the technology selection and design choices of companies.

Market Segmentation

The United States commercial dishwashers market share is classified into type and end user.

- The hood type segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States commercial dishwashers market is segmented by type into hood type, under counter, rack type, and others. Among these, the hood type segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because these dishwashers have several benefits over counter dishwashers, including loading and unloading racks during machine operation, which simplifies washing and reduces labor costs. Their construction also eliminates bending and lifting, which improves the kitchen staff's ergonomics. Furthermore, the intense output and efficient cleaning capacity of hood-type machines are well suited to the rigorous demands of commercial kitchens.

- The restaurants segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States commercial dishwashers market is segmented by end-user into hotels, restaurants, catering units, cafes and bakeries, and others. Among these, the restaurants segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is brought about by Restaurants, particularly those handling high volumes of patrons, requiring effective and efficient dishwashing facilities to deal with high volumes of dirty dishes and cutlery daily. Further, the demand to meet stringent food safety and sanitation guidelines, and the growing culture of going out to eat or ordering food delivery.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States commercial dishwashers market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- MEIKO International

- Hobart

- Jackson WWS

- Miele

- Thermador

- Fagor America

- Electrolux AB

- Whirlpool Professional Appliances

- Insinger Machine Company

- CMA Dishmachines.

- Others

Recent Developments:

- In June 2021, Hobart announced last month the addition of the new AMTL Two Level Door Type Commercial Dishwasher to its complete line of dishwashers. Engineered to deliver the legendary Hobart Clean, the AMTL dish machine offers two wash chambers to maximize dish room throughout and efficiency while delivering superior wash performance.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States commercial dishwashers market based on the below-mentioned segments:

U.S. Commercial Dishwashers Market, By Type

- Hood Type

- Under Counter

- Rack Type

- Others

U.S. Commercial Dishwashers Market, By End-User

- Hotels

- Restaurants

- Catering Units

- Cafes and Bakeries

- Others

Need help to buy this report?