United States Commercial Cooking Equipment Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Broilers, Grills and Griddles, Cook Chill Systems, Refrigerators, Ovens, Dishwashers, and Others), By End-User (Full-Service Restaurants, Quick Service Restaurants, Catering, Railway Dining, Resorts & Hotels, Hospitals, and Others), and United States Commercial Cooking Equipment Market Insights, Industry Trend, Forecasts to 2035

Industry: Machinery & EquipmentUnited States Commercial Cooking Equipment Market Insights Forecasts to 2035

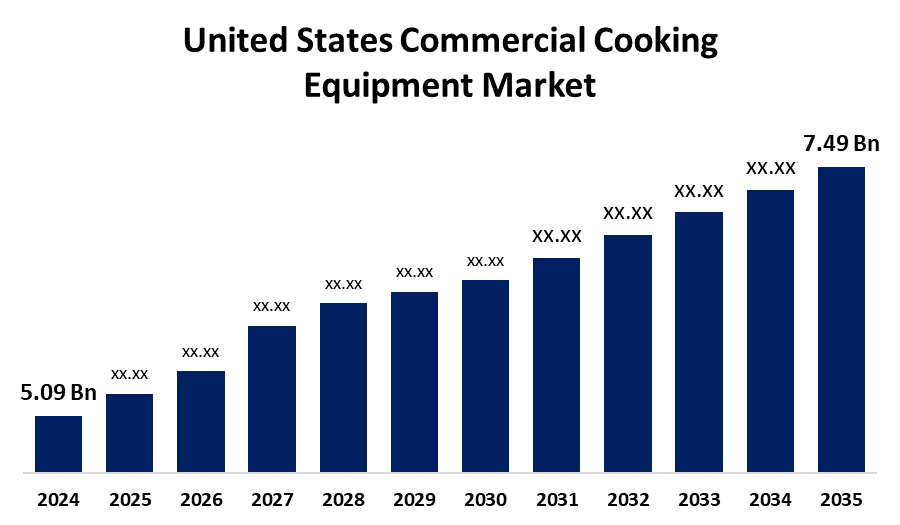

- The United States Commercial Cooking Equipment Market Size was estimated at USD 5.09 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.57% from 2025 to 2035

- The United States Commercial Cooking Equipment Market Size is Expected to Reach USD 7.49 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States commercial cooking equipment market is anticipated to reach USD 7.49 billion by 2035, growing at a CAGR of 3.57% from 2025 to 2035. The USA commercial cooking equipment market is fueled by the expansion of the foodservice industry, increasing demand for out-of-home food, and growing use of energy-saving and intelligent appliances. Moreover, advances in technology, the necessity to save on labor costs through automation, and the growing intake of fast food are also major drivers.

Market Overview

The market refers to the tools, such as steamers, ovens, fryers, ranges, and their use in foodservice companies, including caterers, restaurants, and hotels, with its growing demand and contribution to the commercial cooking equipment sector. Due to factors such as the growing number of food service establishments, rising disposable income, the growing number of young people, and the demand for quick, easy, and high-quality meal options, the market is experiencing rapid expansion. It offers new technologies like automation, IoT, and artificial intelligence (AI) are also emerging in the sector, increasing operational efficiency and reducing operating costs. Governments and different organizations provide grants for financing the construction of commercial kitchens and incubators, especially for small enterprises and local food systems. The above efforts aid in the construction of infrastructure for local food producers and businesspeople and help to spur the growth and development of the food service industry.

Report Coverage

This research report categorizes the market for the United States commercial cooking equipment Market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the USA commercial cooking equipment market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States commercial cooking equipment market.

United States Commercial Cooking Equipment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 5.09 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.57% |

| 2035 Value Projection: | USD 7.49 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 123 |

| Segments covered: | By Product Type, By End-User and COVID-19 Impact Analysis |

| Companies covered:: | The Middleby Corporation, AB Electrolux, John Bean Technologies Corp, GEA Group Aktiengesellschaft, Duke Manufacturing Company, Hobart Corp., Cambro, Hoshizaki America, Frymaster LLC, Alto-Shaam, Inc., and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The US market for commercial cooking equipment is being led by the growth of the food service market, and specifically, the rise of quick-service restaurants such as McDonald's, Starbucks, and Subway, and fast-food chains, and the growing demand for energy-efficient, technologically sophisticated cooking appliances for food preparation solutions, including high-technology features and Internet of Things (IoT) functionalities. The hotel and resort industry also plays a huge role in driving the demand for commercial cooking equipment, looking for long-lasting, efficient, and energy-saving equipment to minimize running expenses and conform to environmental requirements. Also, consumers with increasing disposable income are likely to eat out, a high proportion of youth in the US also drive demand for quick-service and fast-food eating, and the expanding market's growth with high-capacity restaurants to fulfil their fast-paced, high-volume needs. Stringent regulation by the regulatory bodies emphasizes sanitation and hygiene, which is also fueling market growth.

Restraining Factors

The USA market for commercial cooking equipment is subject to restraints concerning high initial investments and specialized training to maintain high-technology or special equipment, as well as frequent maintenance to support proper functioning and safety, which can be an added expense and effort for companies. The multifaceted regulation and the possible seasonal fluctuations in demand for certain equipment can affect market growth and uptake. The food service industry is regulated in several ways, which may affect the kind and choice of equipment that can be utilized.

Market Segmentation

The United States commercial cooking equipment market share is classified into product type and end-user.

- The ovens segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States commercial cooking equipment market is segmented by product type into broilers, grills and griddles, cook chill systems, refrigerators, ovens, dishwashers, and others. Among these, the ovens segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to their adaptability and basic application in a variety of cooking techniques such as baking, roasting, and grilling. This is trailed by cooktops and ranges, which are also preferred for immediate heat cooking methods. This flexibility, in addition to the desire for standardized food quality and operational efficiency in professional kitchens, makes ovens desirable.

- The quick service restaurants segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The USA commercial cooking equipment market is segmented by end-user into full-service restaurants, quick service restaurants, catering, railway dining, resorts & hotels, hospitals, and others. Among these, the quick service restaurants segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to such factors as the widespread fast growth of quick-service restaurants across the world, innovations, rising need for effective cooking equipment, and enhanced consumer demand for quick-service meals. QSRs also heavily invest in high-end kitchen appliances to enhance operational effectiveness, minimize waiting times, and ensure standard food quality.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States commercial cooking equipment market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- The Middleby Corporation

- AB Electrolux

- John Bean Technologies Corp

- GEA Group Aktiengesellschaft

- Duke Manufacturing Company

- Hobart Corp.

- Cambro

- Hoshizaki America

- Frymaster LLC

- Alto-Shaam, Inc.

- Others

Recent Developments:

- In February 2025, Middleby Announces Intent to Separate Food Processing Business into a Standalone Public Company, Creating Independent Innovative Leaders in the Kitchen Equipment and Food Processing Industries. This separation creates two independent and innovative leaders: The Middleby Corporation (Middleby RemainCo) and Middleby Food Processing. Middleby intends to execute the separation through a tax-free spin-off, which is expected to be completed by early 2026.

- In September 2024, Electrolux Group introduced three new small appliances in its Frigidaire brand to make consumers’ lives easier. Customers can shop for a large-capacity countertop air fryer, multi-function combo oven, and sleek semi-automatic espresso maker from a brand they trust. All three are available online on Frigidaire.com, Amazon, and Walmart.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States commercial cooking equipment market based on the below-mentioned segments:

U.S. Commercial Cooking Equipment Market, By Product Type

- Broilers

- Grills and Griddles

- Cook Chill Systems

- Refrigerators

- Ovens

- Dishwashers

- Others

U.S. Commercial Cooking Equipment Market, By End-User

- Full-Service Restaurants

- Quick Service Restaurants

- Catering

- Railway Dining

- Resorts & Hotel

- Hospitals

- Others

Need help to buy this report?