United States Commercial Boiler Market Size, Share, and COVID-19 Impact Analysis, By Fuel (Natural Gas, Coal, Oil, and Others), By Technology (Condensing, Non-Condensing), By End-user (Educational Institutions, Healthcare Sector, Offices, Hospitality, and Others), and United States Commercial Boiler Market Insights, Industry Trend, Forecasts to 2035

Industry: Advanced MaterialsUnited States Commercial Boiler Market Insights Forecasts to 2035

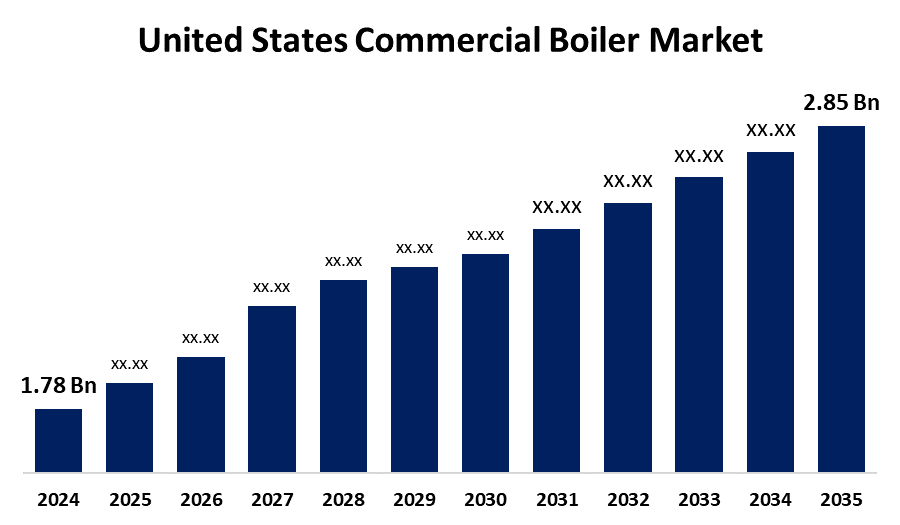

- The USA Commercial Boiler Market Size was estimated at USD 1.78 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.37% from 2025 to 2035

- The U.S. Commercial Boiler Market Size is Expected to Reach USD 2.85 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the USA commercial boiler market is anticipated to reach USD 2.85 billion by 2035, growing at a CAGR of 4.37% from 2025 to 2035. The United States commercial boiler market is growing due to several factors, such as the increased demand for energy-efficient products and stringent environmental laws, with advancements in technology, such as automated intelligence and condensing boilers, also propelling market growth. Growing operating expenses are forcing companies to invest in more efficient boilers. Tighter pollution regulations and ecological concerns are spurring the uptake of low-emission and ultra-low NOx boilers. Demands for confident heating in multilarge-volume commercial buildings like hotels, schools, and plants are another top driver.

Market Overview

The U.S. commercial boiler market refers to the demand for boilers installed in non-residential properties such as offices, hospitals, schools, and industrial premises to supply heat and hot water. Commercial boilers are generally bigger than domestic boilers, with the ability to deal with greater heat output and satisfy commercial environments. The industry is being driven by developments in boiler technology, such as the application of smart technologies and digital controls for enhanced efficiency and less energy use, it also includes urbanization, rising energy efficiency demand, renewable energy technologies, greater corporate sustainability attention, and greater demand for commercial building heating and hot water solutions. The market offers appreciable expansion potential driven by increased demand for energy-efficient heating systems and more stringent environmental regulations, including a heightened emphasis on minimizing carbon emissions and the expansion of biomass boilers for green energy solutions. The United States government initiatives aimed at enhancing energy efficiency and lowering emissions involved establishing energy efficiency standards for boilers and promoting the use of cutting-edge technologies such as condensing technology and heat pumps.

Report Coverage

This research report categorizes the market for the United States commercial boiler market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States' commercial boiler market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States commercial boiler market.

United States Commercial Boiler Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.78 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.37% |

| 2035 Value Projection: | USD 2.85 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 215 |

| Tables, Charts & Figures: | 124 |

| Segments covered: | By Fuel, By Technology, By End-user and COVID-19 Impact Analysis |

| Companies covered:: | Babcock & Wilcox, Bosch Thermotechnology, Cleaver-Brooks Company, Fulton Companies, Viessmann, Lennox International, Ariston, SPX Corporation (WM Technologies), Superior Boiler, A. O. Smith Corporation, and others key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

There are several driving factors of the U.S. commercial boiler market, among which are Urbanization, hot water and heating requirements in commercial buildings, attention to energy efficiency and sustainability concerns, environmental considerations, and industrial expansion and infrastructure investment. The application of commercial boilers for commercial offices, schools, hospitals, hotels, etc., demands heating and hot water for a range of applications, motivating the demand for efficient and guaranteed boiler systems. Companies are increasingly focusing on energy efficiency to lower operating expenses, and the adoption of sustainable strategies in business buildings is driving the use of energy-efficient boiler technologies. The government codes and regulations prompt the use of new, green boiler technologies and fuel types. Investments in manufacturing plants and industrial plants add to the need for efficient and reliable boiler systems. Long-time boiler makers and start-ups compete on market share by developing new technologies, improving energy efficiency, and establishing strategic alliances. The healthcare industry is a major force, with high demand for hot water and steam for sterilizing, cleaning, and space heating.

Restraining Factors

The market for commercial boilers in the U.S. is limited by high initial costs, stringent environmental regulations, and a growing need for energy efficiency. Facility commercial boiler systems can be expensive, especially if the facility is larger or has certain characteristics, such as high-efficiency models. Certain firms, especially smaller ones, may find this initial cost to be a deterrent. The market is being driven towards more efficient boiler technologies by sustainability and stringent environmental requirements. The market dominance of boilers is being challenged in certain applications by alternative heating and cooling technologies, which are also becoming more popular.

Market Segmentation

The United States commercial boiler market share is classified into fuel, technology, and end-user.

- The natural gas segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States commercial boiler market is segmented by fuel into natural gas, coal, oil, and others. Among these, the natural gas segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The expansion is due to its high availability with a well-developed infrastructure, low price compared to other fuel sources, and environmental advantages such as having lower emissions than other fossil fuels like coal and oil. aligning with rising environmental regulations and sustainability objectives.

- The condensing segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States commercial boiler market is segmented by technology into condensing, non-condensing. Among these, the condensing segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of their continuous improvements with cost-effective designs, superior energy efficiency, and lower carbon emissions compared to non-condensing boilers. They recover heat from exhaust gases, which significantly boosts their efficiency, and produce fewer carbon dioxide (CO2) emissions, aligning with environmental regulations and sustainability goals.

- The healthcare sector segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States commercial boiler market is segmented by end-user into educational institutions, healthcare sector, offices, hospitality, and others. Among these, the healthcare sector segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because hospitals and other healthcare institutions require a high level of consistent hot water and steam for multiple applications, such as cleaning, sterilization, and space heating, that are essential for patient care and the maintenance of hygiene in healthcare institutions, thus resulting in a huge demand for commercial boilers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States commercial boiler market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Babcock & Wilcox

- Bosch Thermotechnology

- Cleaver-Brooks Company

- Fulton Companies

- Viessmann

- Lennox International

- Ariston

- SPX Corporation (WM Technologies)

- Superior Boiler

- A. O. Smith Corporation

- Others

Recent Developments:

- In January 2025, Carrier, a US-based heating solutions provider, introduced a new air-to-water heat pumps for residential, commercial applications, 4-14 kW line of heat pumps with a coefficient of performance of up to 4.90. The system uses propane as the refrigerant and can reportedly reach a leaving water temperature of 75 °C.

- In February 2025, AtmosZero launches electric Boiler 2.0, and New Belgium Brewing is first in line with the mission to electrify steam and become the first to manufacture industrial steam heat pumps in the United States.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the USA commercial boiler market based on the below-mentioned segments:

U.S. Commercial Boiler Market, By Fuel

- Natural Gas

- Coal, Oil

- Others

U.S. Commercial Boiler Market, By Technology

- Condensing

- Non-Condensing

U.S. Commercial Boiler Market, By End-user

- Educational Institutions

- Healthcare Sector

- Offices

- Hospitality

- Others

Need help to buy this report?