United States Colostrum Market Size, Share, and COVID-19 Impact Analysis, By Nature (Organic and Conventional), By Source (Cow, Buffalo, and Goat), and United States Colostrum Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesUnited States Colostrum Market Insights Forecasts to 2035

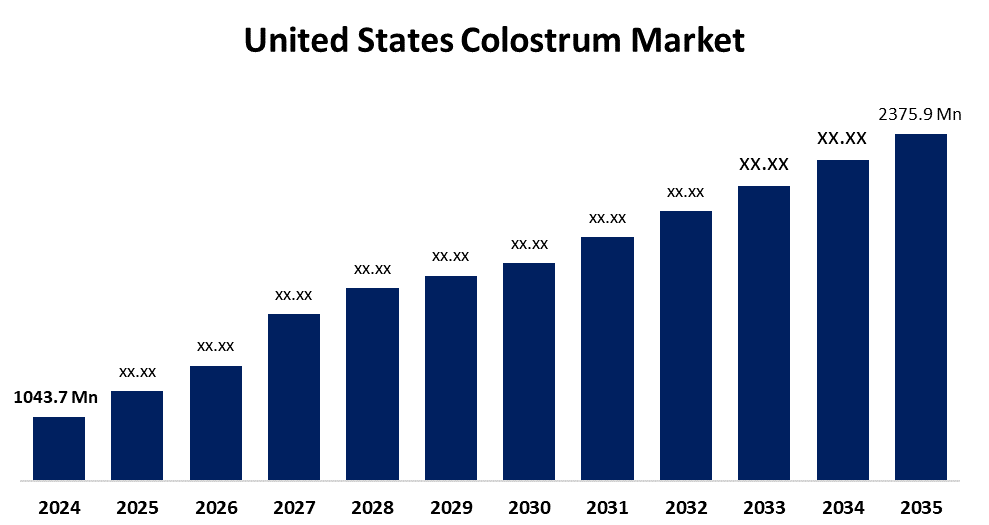

- The US Colostrum Market Size Was Estimated at USD 1043.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.76% from 2025 to 2035

- The US Colostrum Market Size is Expected to Reach USD 2375.9 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States Colostrum Market is anticipated to reach USD 2375.9 million by 2035, growing at a CAGR of 7.76% from 2025 to 2035. The expansion of the United States colostrum market is propelled by increasing consumer interest in preventive wellness and natural health solutions.

Market Overview

The colostrum is the first milk produced by mammals in the final weeks of pregnancy and the initial days of delivery. Awareness of colostrum's immune-boosting properties has driven the demand for colostrum-based products. Colostrum contains immunoglobulins, antibodies, and growth factors, all of which serve to bolster the immune system. In addition to any immune and immunological benefits, colostrum is viewed positively regarding gut health as it is known to repair the intestinal wall, as well as facilitate a healthy microbiome. The immune, gut, and gut health benefits of colostrum are desirable, especially for individuals seeking gut improvement or individuals with gut health issues such as leaky gut syndrome. Immunoglobulins, as well as other bioactive components of colostrum, support the development of a newborn's immune system, as well as intestinal development and growth. These benefits align with the growing trend of providing extra beneficial additives to baby-feeding products. Marketing related to colostrum will concentrate on the ability to facilitate immunity, assist with inflammation, and support gut health, which researchers, consumers, and parents have all expressed interest in functional foods and immune health.

The United States' Food and Drug Administration has been actively involved in ensuring the safety of dairy products, including bovine colostrum. In May 2024, the FDA bolstered consumer trust in bovine-based supplements by examining 297 retail dairy samples across 17 states for infections. Pasteurisation also effectively neutralises pathogens like H5N1 in milk and dairy products, including colostrum, according to a study by the FDA and USDA, ensuring the consumers health.

Report Coverage

This research report categorizes the market for the United States colostrum market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States colostrum market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States colostrum market.

United States Colostrum Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1043.7 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.76% |

| 2035 Value Projection: | USD 2375.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 225 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Nature, By Source |

| Companies covered:: | NOW Foods, Sterling Technology, APS BioGroup, Manna Pro Products LLC, La Belle, Inc., Immuno-Dynamics, PuraLife LLC, Farbest Brands, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States colostrum market is boosted because colostrum is abundant in bioactive materials such as immunoglobulins, lactoferrin, growth factors, and antimicrobial peptides. Each of these components can support gut health, build the immune system, and assist in preventing infection. Bovine colostrum has been proven to enhance intestinal barrier function and decrease the risk of infection, enhancing immune function in humans. Colostrum is strongly promoted as beneficial for boosting the immune system by healthcare professionals and wellness officials. Growth in adoption is accelerated, and recommendations foster consumer knowledge from trusted sources. Because milk has been known to boost immunity and contribute to tissue healing, colostrum is routinely recommended for patients recovering from sickness or surgery.

Restraining Factors

The United States colostrum market faces obstacles due to its limited seasonal availability and perishable nature; colostrum causes supply fluctuations. Due to specialised processing and strict quality controls, high production costs lead to higher product prices, which restrict accessibility.

Market Segmentation

The United States colostrum market share is classified into nature and source.

- The conventional segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States colostrum market is segmented by nature into organic and conventional. Among these, the conventional segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven because it is sourced from cows typically raised using conventional farm practices, which may include pesticide, hormone, and antibiotic use. Conventional colostrum forms are geared towards consumers who may prefer to buy a product that is generally lower cost and are less concerned with organic or sustainable practices.

- The cow segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the source, the United States colostrum market is segmented into cow, buffalo, and goat. Among these, the cow segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled because it is more favored than other forms because of the multiple aspects of cow colostrum, which rely on its nutrition, bioavailability, absorption, immune support, and gut-friendly nature. Cow colostrum is packed with nutrients, growth factors, antibodies, and immune support molecules, making it one of the most health-supporting substances.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States colostrum market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- NOW Foods

- Sterling Technology

- APS BioGroup

- Manna Pro Products LLC

- La Belle, Inc.

- Immuno-Dynamics

- PuraLife LLC

- Farbest Brands

- Others

Recent Development

- In November 2022, PanTheryx introduced a new form line tailored for healthcare practitioners, known as Life’s First Naturals PRO ColostrumOne Extra Strength. This innovative line is specifically crafted to bolster immune and digestive health in both adults and children. The supplement is engineered using high-grade bovine colostrum and proprietary technology to enhance immune bioactives.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States colostrum market based on the following segments:

United States Colostrum Market, By Nature

- Organic

- Conventional

United States Colostrum Market, By Source

- Cow

- Buffalo

- Goat

Need help to buy this report?