United States Colonoscopes Market Size, Share, and COVID-19 Impact Analysis, By Type (Video Colonoscopes and Fiber Optic Colonoscopes), By Procedure Type (Diagnostic and Therapeutic), and United States Colonoscopes Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited States Colonoscopes Market Insights Forecasts to 2035

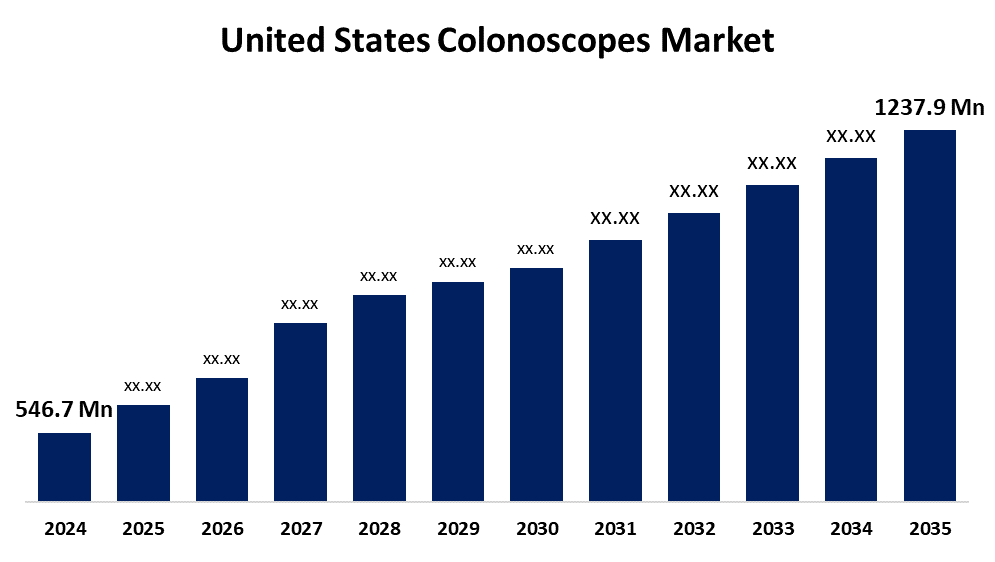

- The US Colonoscopes Market Size Was Estimated at USD 546.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.71% from 2025 to 2035

- The US Colonoscopes Market Size is Expected to Reach USD 1237.9 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the United States Colonoscopes Market Size is Anticipated to Reach USD 1237.9 Million by 2035, Growing at a CAGR of 7.71% from 2025 to 2035. The expansion of the United States Colonoscopes market is propelled by the growing prevalence of colorectal disorders, such as colorectal cancer and inflammatory bowel disease (IBD).

Market Overview

A colonoscope is a medical instrument used during colonoscopy procedures to view within the colon and rectum. Due to the increased awareness of the illness, healthcare professionals are encouraging routine screenings, which is causing the need for advanced colonoscopy techniques and equipment to increase. The use of colonoscopes has increased significantly due to the use of education programs by health organizations, and the increased awareness in the individual about the importance of colorectal cancer screenings. The increased demand for procedures such as colonoscopy represents a large opportunity for growth, as the demand for procedures that are less invasive increases. The benefits of minimally invasive procedures, such as colonoscopy, which include decreased patient comfort, quick recovery, and shorter hospital stay, have increased the popularity of these types of procedures. Colonoscopy and other minimally invasive procedures have now become a routine part of many hospital medical procedures. Patients and healthcare professionals are increasingly aware of the benefits of using more advanced, less invasive technology instead of traditional open surgery and are demanding these technologies.

The U.S. government has recently launched a number of programs to boost the market for colonoscopies, with an emphasis on advancing early detection of colorectal cancer, integrating cutting-edge technologies, and enhancing screening accessibility. By including colonoscopy performance in their Accountable Care Organisation and Medicare Advantage Star programs, the Centers for Medicare & Medicaid Services has enhanced patient access to these procedures by providing incentives for healthcare providers to meet quality screening standards.

Report Coverage

This research report categorizes the market for the United States colonoscopes market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States colonoscopes market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States colonoscopes market.

United States Colonoscopes Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 546.7 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 7.71% |

| 2035 Value Projection: | USD 1237.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 160 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Procedure Type, By Type and COVID-19 Impact Analysis. |

| Companies covered:: | Olympus Corporation, FUJIFILM Holdings Corporation, Medtronic plc, Boston Scientific Corporation, PENTAX Medical, KARL STORZ SE & Co. KG, Hoya Corporation, Smart Medical Systems Ltd and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States colonoscopes market is boosted by improved screening and diagnostic technologies are required due to the growing geriatric population and the rising incidence of colorectal cancer. Technological developments like AI-assisted detection, narrow-band imaging, and high-definition imaging are increasing the precision of diagnoses and the effectiveness of procedures. Regular screenings are being encouraged by government programs and advantageous reimbursement rules, which are increasing market demand even further. Furthermore, developments like disposable colonoscopes and the move towards less invasive procedures are improving patient comfort and lowering the risk of infection.

Restraining Factors

The United States colonoscopes market faces obstacles like the cost of purchasing, maintaining, and performing colonoscopies can be steep, especially in areas with limited healthcare budgets. Patients may even be ineligible due to excessive costs.

Market Segmentation

The United States colonoscopes market share is classified into type and procedure type.

- The video colonoscopes segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States colonoscopes market is segmented by type into video colonoscopes and fiber optic colonoscopes. Among these, the video colonoscopes segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by their ability to produce high-definition images. Even with traditional colonoscopes, gastroenterologists who use video colonoscopes are immensely more powerful in diagnostics. Video colonoscopes produce deep, real-time video imaging of the colon and rectum with a level of clarity that no other instrument affords a gastroenterologist tasked with looking for polyps or signs of colorectal cancer.

- The diagnostic segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the procedure type, the United States colonoscopes market is segmented into diagnostic and therapeutic. Among these, the diagnostic segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by the dramatic increase in colorectal cancer, with death. Because cancer is on the list of top diseases contributing to death, chances of survival involve early diagnosis. Colonoscopy is a best practice in screening and diagnosing conditions such as polyps, inflammatory bowel diseases, and colorectal cancer, and the colonoscope's mark state is reliant on this position in providing thorough diagnostic procedures, making them in high demand.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States colonoscopes market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Olympus Corporation

- FUJIFILM Holdings Corporation

- Medtronic plc

- Boston Scientific Corporation

- PENTAX Medical

- KARL STORZ SE & Co. KG

- Hoya Corporation

- Smart Medical Systems Ltd.

- Others

Recent Development

- In December 2023, Medtronic expanded its partnership with Cosmo Intelligent Medical Devices, investing USD 100 million to enhance the GI Genius platform, an AI-driven system assisting in identifying potential lesions during colonoscopies.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States colonoscopes market based on the following segments:

United States Colonoscopes Market, By Type

- Video Colonoscopes

- Fiber Optic Colonoscopes

United States Colonoscopes Market, By Procedure Type

- Diagnostic

- Therapeutic

Need help to buy this report?