United States Cold Chain Logistics Market Size, Share, and COVID-19 Impact Analysis, By Service Type (Refrigerated Storage and Refrigerated Transport), By End User (Meat and Seafood, Fruits & Vegetables, Bakery & Confectionery, Dairy & Frozen Products, Pharmaceuticals, and Others), and United States Cold Chain Logistics Market Insights, Industry Trend, Forecasts to 2033.

Industry: Information & TechnologyThe United States Cold Chain Logistics Market Insights Forecasts to 2033

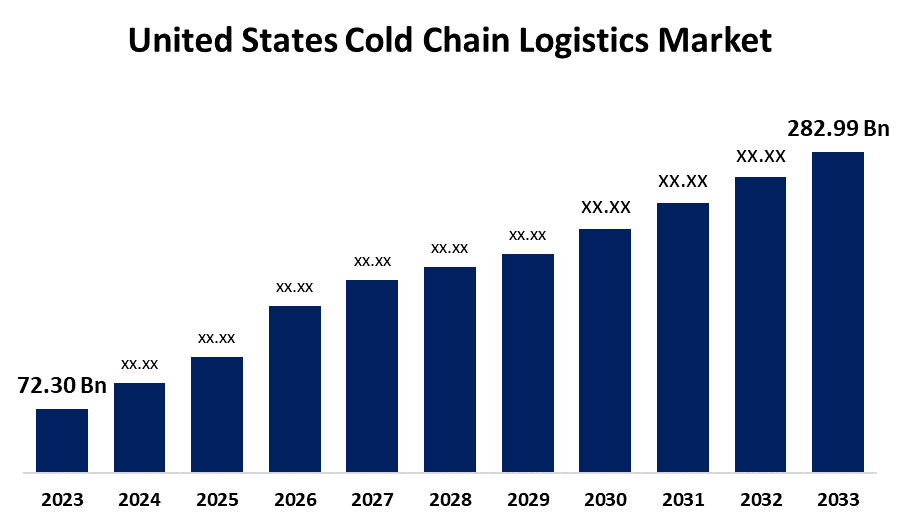

- The U.S. Cold Chain Logistics Market Size was Valued at USD 72.30 Billion in 2023

- The United States Cold Chain Logistics Market Size is Growing at a CAGR of 14.62% from 2023 to 2033

- The USA Cold Chain Logistics Market Size is Expected to Reach USD 282.99 Billion by 2033

Get more details on this report -

The USA Cold Chain Logistics Market Size is anticipated to exceed USD 282.99 Billion by 2033, growing at a CAGR of 14.62% from 2023 to 2033. The U.S. cold chain logistics market is growing rapidly, driven by rising demand for perishable goods, advanced technology adoption, and expanding pharmaceutical needs, ensuring safe and efficient temperature-controlled supply chains.

Market Overview

The United States cold chain logistics market refers to the handling, storage, and transportation of temperature-sensitive goods e.g., perishable foodstuffs, pharmaceuticals, and chemicals within a temperature-controlled supply chain. The system maintains product quality and safety by keeping constant temperatures along the supply chain from production to end delivery. Moreover, the U.S. cold chain logistics industry is driven by increasing demand for perishable foods, pharmaceutical industry growth, and growth in e-commerce grocery services. Growing consumer demand for fresh and organic foods, enhanced food safety regulations, and advancements in refrigeration and real-time monitoring also greatly fuel market growth. Furthermore, In October 2023, Wabash and Fernweh, a private investment company with expertise in the industrial technology space, have formed a 49:51 joint venture that will drive Wabash's growth and expansion of an end-to-end digital platform that makes the overall experience better for dealers, customers, and suppliers by the ease, speed, and convenience of an interconnected partner ecosystem. Ayna.AI will be the implementation partner for the joint venture as it goes on a journey to scale up in the next few years.

Report Coverage

This research report categorizes the market for the US cold chain logistics market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US cold chain logistics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the USA cold chain logistics market.

United States Cold Chain Logistics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 72.30 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 14.62% |

| 2033 Value Projection: | USD 282.99 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Service Type, By End User |

| Companies covered:: | Lineage Logistics Holding, LLC, United States Cold Storage, Penske, Americold Logistics, Inc., Carrier, NFI Industries, Tippmann Group, United Parcel Service of America, Inc., Wabash National Corporation, Burris Logistics, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

A potential area of market growth in U.S. cold chain logistics, less observed by others, is the rising demand for cold chain solutions in plant-based and lab-grown foods. As alternative protein markets expand, these products require specialized temperature control to maintain texture, taste, and safety, opening new logistics opportunities beyond traditional sectors.

Restraining Factors

The U.S. cold chain logistics market faces restraints from high operational costs, energy consumption concerns, infrastructure limitations in rural areas, and strict regulatory compliance, making expansion and maintenance challenging for providers.

Market Segmentation

The United States cold chain logistics market share is classified into service type and end user.

- The storage segment accounted for the largest share of the US cold chain logistics market in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

On the basis of service type, the United States cold chain logistics market is divided into refrigerated storage and refrigerated transport. Among these, the storage segment accounted for the largest share of the United States cold chain logistics market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. This supremacy is driven by the growing need for temperature-controlled warehousing in different industries, especially food and pharmaceuticals. The growth of cold storage facilities around key transportation centers and ports, combined with the adoption of cutting-edge technologies such as automated storage and retrieval systems (ASRS) and advanced cold chain monitoring systems, has further entrenched the leadership of refrigerated storage in the market.

- The meat and seafood segment accounted for a substantial share of the U.S. cold chain logistics market in 2023 and is anticipated to grow at a rapid pace during the projected period.

On the basis of end user, the U.S. cold chain logistics market is divided into meat and seafood, fruits and vegetables, bakery and confectionery, dairy and frozen products, pharmaceuticals, and others. Among these, the meats, fish, and poultry segment accounted for a substantial share of the U.S. cold chain logistics market in 2023 and is anticipated to grow at a rapid pace during the projected period. This prominence is driven by the rising consumption of these products and the critical need for stringent temperature control during transportation to prevent spoilage and ensure food safety. The perishable nature of these items necessitates efficient cold chain solutions, making this segment a key contributor to the market's growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the USA cold chain logistics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Lineage Logistics Holding, LLC

- United States Cold Storage

- Penske

- Americold Logistics, Inc.

- Carrier

- NFI Industries

- Tippmann Group

- United Parcel Service of America, Inc.

- Wabash National Corporation

- Burris Logistics

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In October 2023, Lineage Logistics, one of the world's most prominent temperature-controlled industrial REITs and integrated solutions companies announced it has acquired eight facilities from Burris Logistics, one of the premier temperature-controlled food distribution companies. Terms of the deal were not disclosed.

Market Segment

This study forecasts revenue at the USA, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the US cold chain logistics market based on the below-mentioned segments

United States Cold Chain Logistics Market, By Service Type

- Refrigerated Storage

- Refrigerated Transport

United States Cold Chain Logistics Market, By End User

- Meat and Seafood

- Fruits and Vegetables

- Bakery and Confectionery

- Dairy and Frozen Products

- Pharmaceuticals

- Others

Need help to buy this report?