United States Cobalt Market Size, Share, and COVID-19 Impact Analysis, By Product (Cobalt Sulfate, Cobalt Oxide, and Cobalt Metal), By End-use (EV, Industrial Metals, Superalloys, Industrial Chemicals, and Others), and United States Cobalt Market Insights, Industry Trend, Forecasts to 2035

Industry: Advanced MaterialsUnited States Cobalt Market Size Insights Forecasts to 2035

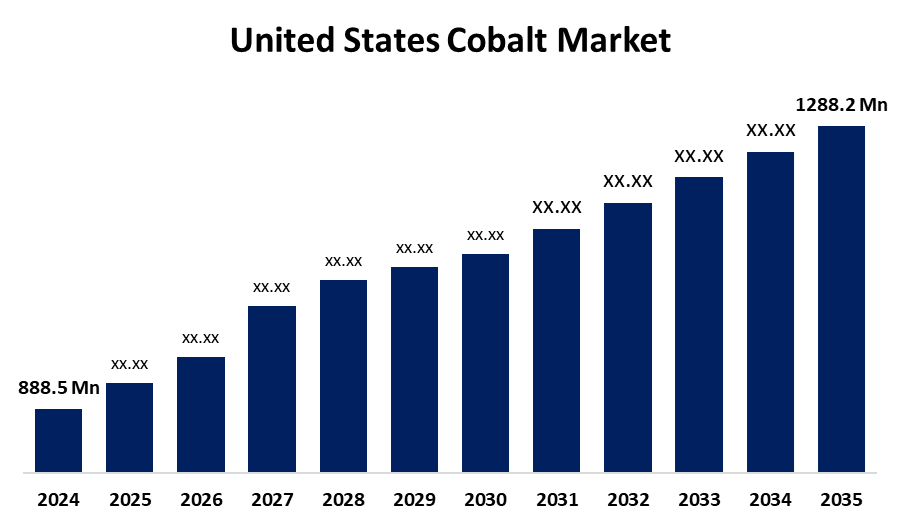

- The US Cobalt Market Size Was Estimated at USD 888.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.43% from 2025 to 2035

- The US Cobalt Market Size is Expected to Reach USD 1288.2 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the United States Cobalt Market Size is anticipated to reach USD 1288.2 million by 2035, growing at a CAGR of 3.43% from 2025 to 2035. The expansion of the United States' cobalt market is propelled by the growing number of electric vehicles (EVs).

Market Overview

Cobalt (Co), a metallic chemical element, is a naturally ferromagnetic, hard, and shiny silvery-blue transition metal. The current reign of lithium-nickel-manganese-cobalt-oxide (NMC) batteries in EVs, with a cathode that includes 10–20% cobalt, represents the most popular battery chemistry for EVs. Cobalt makes up a sizable amount of all Li-ion batteries and greatly increases the range and longevity of EV batteries. Li-ion batteries are used in power tools and e-bikes in addition to EVs and PHEVs. With many cars and a fair number of commercial and defence aeroplanes being produced, the U.S. is one of the major markets and is expected to have a positive impact on the expansion of the industry due to the increasing focus on building out the EV supply chain, such as the Inflation Reduction Act (IRA). Superalloys based on cobalt are used in chemical processing, power generation, and aeroplanes, with an increase in aeroplane manufacturing ensuring there is demand for any refurbished or new superalloys. Boeing announced in March 2023 that it would increase production of the 787 to 10 per month by 2026, and that will increase production of MAX aeroplanes to 50 per month.

The United States government employs a number of well-coordinated initiatives to enhance cobalt production and supply resiliency. To explore and increase cobalt extraction in Idaho and evaluate a domestic cobalt refinery, Jervois Mining USA received $15 million from the Department of Defence under the Defence Production Act (DPA).

Report Coverage

This research report categorizes the market for the United States cobalt market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States cobalt market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States cobalt market.

United States Cobalt Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 888.5 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.43% |

| 2035 Value Projection: | USD 1288.2 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 187 |

| Tables, Charts & Figures: | 117 |

| Segments covered: | By Product, By End-use and COVID-19 Impact Analysis |

| Companies covered:: | Freeport-McMoran Inc, Umicore, Glencore, Sumitomo Metal Mining Co., Ltd., Jervois Mining USA, Electra Battery Materials, Lundin Mining, Redwood Materials, and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The growth of the United States cobalt market is boosted by the growing need for electric vehicles (EVs), where cobalt plays a crucial role in lithium-ion batteries by improving stability and energy density. Government subsidies and incentives, as well as a movement towards more environmentally friendly modes of transportation, are driving this spike in EV usage. The demand for cobalt is further increased by developments in renewable energy storage technologies and the growth of the electronics sector.

Restraining Factors

The United States cobalt market faces obstacles like the ongoing decline in prices, and the current oversupply, not least from excessive mining activity, has extended the oversupply issue into 2024-25. In many cases, the desire for cobalt in cathodes has declined as more and more batteries have turned towards cobalt-free chemistries like LFP.

Market Segmentation

The United States cobalt market share is classified into product and end-use.

- The cobalt sulfate segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States cobalt market is segmented by product into cobalt sulfate, cobalt oxide, and cobalt metal. Among these, the cobalt sulfate segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven as ir is used across many sectors, including agriculture, dyeing, batteries, and catalysts. It has a vital role in the making of lithium batteries found in countless electronic devices, including laptop computers, cell phones, and electric vehicles, as it increases the endurance and functionality of these batteries.

- The EV segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the end-use, the United States cobalt market is segmented into EV, industrial metals, superalloys, industrial chemicals, and others. Among these, the EV segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by battery manufacturing, which is driven by increased focus on EV manufacturing, which will rise in importance. For example, GM and Samsung SDI announced in April 2023 that they will invest USD 3 billion into a new EV battery plant located in the U.S.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States cobalt market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Freeport-McMoran Inc

- Umicore

- Glencore

- Sumitomo Metal Mining Co., Ltd.

- Jervois Mining USA

- Electra Battery Materials

- Lundin Mining

- Redwood Materials

- Others

Recent Development

- In September 2024, US Strategic Metals (USSM) partnered with Glencore and Chilean Cobalt Corp. (C3) to explore downstream cobalt/copper processing in Missouri, aiming to build integrated U.S.-based processing capacity tied to C3’s Chilean supply.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States cobalt market based on the following segments:

United States Cobalt Market, By Product

- Cobalt Sulfate

- Cobalt Oxide

- Cobalt Metal

United States Cobalt Market, By End-use

- EV

- Industrial Metals

- Superalloys

- Industrial Chemicals

- Others

Need help to buy this report?