United States Clinical Trials Market Size, Share, and COVID-19 Impact Analysis, By Phase (Phase I, II, III, IV), By Study Design (Interventional Trials, Observational Trials, Expanded Access Trials), and United States Clinical Trials Market Insights, Industry Trend, Forecasts to 2035.

Industry: HealthcareUnited States Clinical Trials Market Insights Forecasts to 2035

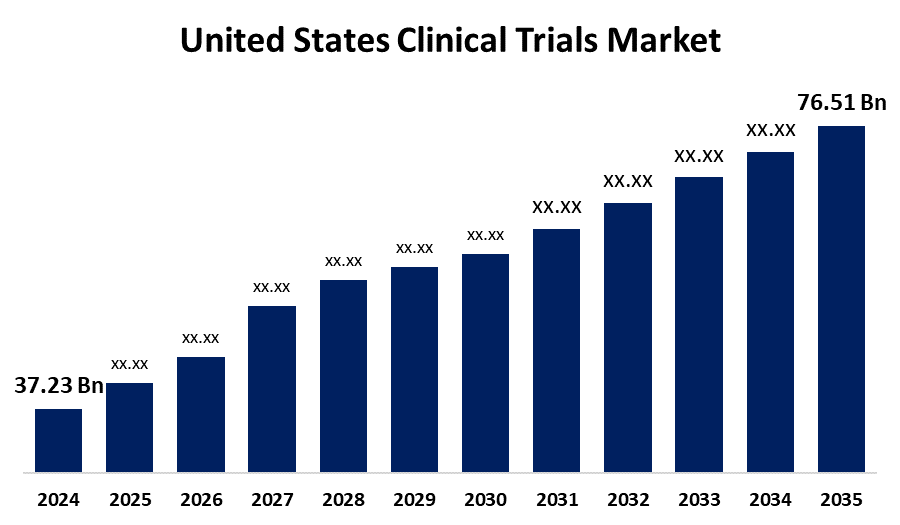

- The United States Clinical Trials Market Size Was Estimated at USD 37.23 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.77% from 2025 to 2035

- The United States Clinical Trials Market Size is Expected to Reach USD 76.51 Billion by 2035

Get more details on this report -

The United States Clinical Trials Market Size is Anticipated to reach USD 76.51 Billion By 2035, Growing at a CAGR of 6.77% from 2025 to 2035. Increased prevalence of chronic diseases, advances in medical research and technology, and the increasing demand for new treatments are among the key drivers driving market growth. Most notable drivers are the focus on personalized treatment, AI-based medication dispensing, and the emergence of decentralized clinical trials, which significantly help in the growth of the United States clinical trial market.

Market Overview

Clinical trial market is the business industry comprising all activities that relate to conducting studies in human subjects to determine the safety and efficacy of new treatments like drugs, biologics, and medical devices. The need for new treatments and development of biotechnology and individualized medicine drive the expansion in the market. Stable growth in the demand for tailored medicine, increased incidence of chronic diseases, and new cutting-edge clinical research technologies are central drivers of the market expansion. The U.S. Food and Drug Administration (FDA) is highly actively engaged in regulation of the process, and the optimum practices are being followed in trial design, patient safeguarding, and ethics. The biomedical research is heavily impacted by digitalization, which is growing the size of the U.S. clinical trials market significantly. Use sophisticated technology, like Electronic Data Capture (EDC) systems, to lessen data collection and improve patient data management. The cost of monitoring is lower, and the time to clinical trials decreases through offering real-time access to data and accelerating review. Additionally, the need for decentralized trials, whereby patients engage remotely, increases by the day. This is transforming trials for it to be more accessible, cost-effective, and quick. As future opportunities, the key market players are particularly looking at the shift towards personalized medicine since the personalized drugs are interested in the drug effects on specific patients for a specific duration, and also to enhance patient engagement by way of social media and other websites, this contributes to the recruitment and retention of the patients. The US market for clinical trials is regulated by the US government, through the Food and Drug Administration (FDA), the National Institutes of Health (NIH), and the Department of Health and Human Services (HHS), to protect the safety of patients, protect human subjects, and enable effective development of new therapies. The FDA mandates registration of clinical trials on ClinicalTrials.gov in conjunction with the NIH. The FDA regulates GCP for the purpose of ensuring that clinical trials are designed, conducted, analyzed, and reported so as to safeguard human subjects and produce valid data.

Report Coverage

This research report categorizes the market for the United States clinical trial market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States clinical trial market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States clinical trial market.

United States Clinical Trials Market Report Coverage

| Report Coverage | Details |

|---|---|

| No. of Pages: | 188 |

| Tables, Charts & Figures: | 90 |

Get more details on this report -

Driving Factors

The primary driving factor for market growth is shift towards personalized medicine. It is expected that more drugs will clear each step of the clinical trial process when pharmacogenetics is employed. The shift towards personalized medicine will boost the pipeline of pharmaceuticals by augmenting the use of pharmacogenetics at clinical trial levels. Another factor fuelling the growth of the market is the increasing aging population results in more cases of non-communicable diseases (NCDs), the evolution of precision medicine, and the adoption of decentralized trial models; hence, the U.S. clinical trials market has witnessed tremendous change during the forecast period. Secondly, digitalization of biomedical research helps in making the clinical trials process simpler, thereby challenging the sponsors to spend more on the clinical trial process as chances of successful clinical trials are greater through the adoption of newer technologies. Further, combination trials and collaboration in clinical trials are expected to grow, which would further drive the United States clinical trials market. Due to the expensive nature of drug development, biopharma firms are now forming alliances with one another in a bid to boost the resources and share the risk of the high cost. Demands by patients for new treatments, and indeed especially in areas like cancer, rare disease, and chronic disease, are a very strong driver for clinical trials. In addition to that, the application of wearable devices such as smartwatches and health trackers is increasingly being applied in clinical trials since they enable monitoring of patients' health in real time. That would imply that the devices would be capable of supporting continuous, non-invasive data gathering that enables researchers to track vital signs, activity, and other health measurements outside the clinic, hence expanding the market.

Restraining Factors

The primary restraining factor for the market is that clinical trials are costly in the U.S, as a huge cost is involved in the recruitment of volunteers, regulatory requirements, data collection, and infrastructure. Hence, increased costs appear to be a bigger challenge for larger pharma giants rather than the smaller biotech companies. Such costs tend to push timelines back, scope down, and in certain instances fail to make it feasible to initiate such studies, not a very profitable therapeutic target, like rare diseases. Another factor, such as limited exposure to diverse patient groups, is attributed to the majority of the clinical trials run in the U.S. suffer from not being diverse enough, representing the populations they want to cover. Furthermore, financial and budgetary restrictions have been a hindering factor for market growth because big pharmaceutical organizations tend to have huge budgets, while small organizations struggle with how to raise capital to cover all that a full-scale trial represents. Budget limitations cause limitations on the number of sites, patients on board, and duration of research, all affecting the quality and outcomes of the trial.

Market Segmentation

The United States clinical trial market share is classified into phases and study designs.

- The phase III segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States clinical trial market is segmented by phase into phase I, II, III, and IV. Among these, the phase III segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth in this segment is due to a series of phase III trials, the most costly and with a high number of subject. These trials are in big patient populations, aimed at proving efficacy and monitoring side effects, and are crucial to final FDA clearance. Greater investments by pharma companies and advances in biotechnology are driving trial initiations. Moreover, increasing patient recruitment challenges and requirements for real-world evidence are driving innovations in trial design and execution, again driving this segment's revenue growth.

- The interventional trials segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States clinical trial market is segmented by study designs into interventional trials, observational trials, and expanded access trials. Among these, the interventional trials segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. Increased need for cutting-edge therapies for oncology, rare conditions, and targeted medicine is driving the use of interventional studies, thus propelling market expansion. Regulatory encouragement and technical developments in trial technologies also play a role in expanding the segment. Interventional design refers to a systematic method applied to assess the safety and effectiveness of medical interventions, devices, or treatments.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States clinical trial market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Fortrea Inc.

- Charles River Laboratories

- IQVIA

- PAREXEL International Corporation

- AstraZeneca

- Eli Lilly and Company

- Syneos Health

- Medpace

- Pfizer

- Wuxi AppTec Inc.

- Caidya

- Others

Recent Developments:

- In July 2024, the FOXG1 Research Foundation (FRF) and Charles River Laboratories International, Inc. collaborated, which emphasizes the patient advocacy group's model for independently advancing drug research to the clinical stage. The collaboration will enable Charles River to manufacture material for FRF's Phase I–II adeno-associated viral (AAV) vector-based gene therapy clinical trials at its plasmid DNA and viral vector centers of excellence (CoE) and provide FRF with its extensive cell and gene therapy experience.

- In June 2024, IQVIA has launched One Home for SitesTM, a unified technology platform that provides clinical research sites with a unified dashboard to manage tasks on all of their trials and single sign-on access. The challenge of managing many different software programs and logins, which limits staff potential to deliver patient care and manage trials, is eliminated. Sites can handle more trials and optimize productivity by simplifying operations with One Home's consolidation of numerous clinical apps onto a single platform.

- In March 2024, Thermo Fisher Scientific Inc., the global leader in scientific services, announced the opening of a new clinical registry for generalized pustular psoriasis (GPP) through CorEvitas. The 10th syndicated illness registry from CorEvitas, this one is now accepting enrollments and fills a gap in the literature by providing real-world evidence (RWE) about the clinical and patient-reported outcomes of GPP patients.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States Clinical Trials Market based on the below-mentioned segments

United States Clinical Trials Market, By Phase

- Phase I

- Phase II

- Phase III

- Phase IV

United States Clinical Trials Market, By Study Design

- Interventional Trials

- Observational Trials

- Expanded Access Trials

Need help to buy this report?