United States Clinical Oncology Next Generation Sequencing Market Size, Share, and COVID-19 Impact Analysis, By Technology (Whole Exome Sequencing, Targeted Sequencing & Resequencing, and Whole Genome Sequencing), By Workflow (Sequencing, Data Analysis, and Pre-Sequencing), By Application (Companion Diagnostics, Screening, and Others), By End-User (Laboratories, Hospital, and Clinics), and US Clinical Oncology Next Generation Sequencing Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUSA Clinical Oncology Next Generation Sequencing Market Insights Forecasts to 2035

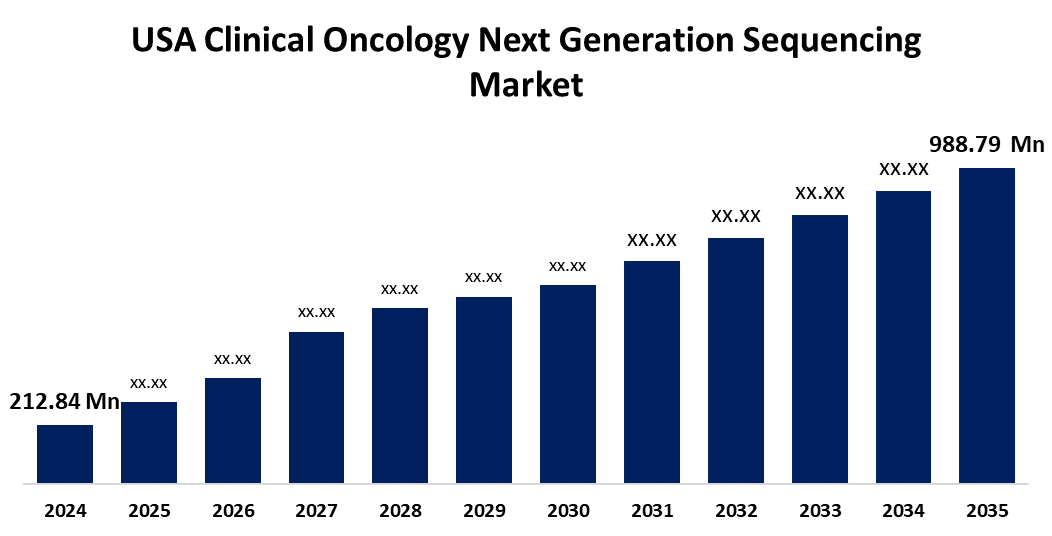

- The US Clinical Oncology Next Generation Sequencing Market Size Was Estimated at USD 212.84 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 14.98% from 2025 to 2035

- The USA Clinical Oncology Next Generation Sequencing Market Size is expected to reach USD 988.79 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the US Clinical Oncology Next Generation Sequencing Market is anticipated to reach USD 988.79 Million by 2035, growing at a CAGR of 14.98% from 2025 to 2035. The market growth is attributed to the growing prevalence of cancer, the adaptability of next-generation sequencing, and growing investments by the US government in the healthcare and research sectors.

Market Overview

The US clinical oncology next-generation sequencing market utilizes next-generation sequencing (NGS) technologies to analyze cancer-associated genetic mutations, enabling precision medicine, targeted therapies, and personalized treatment plans, enabling comprehensive tumor profiling. Oncology is a term that describes the study of cancer and its treatment. It includes surgery, chemotherapy, medications, and radiotherapy. Next-generation sequencing is a novel method of high-throughput screening that includes identifying the sequence of DNA and RNA to study the variations and mutations that occur in genes associated with diseases. The growing trend of artificial intelligence and its integration with NGS sequencing in the oncology sector propels the market growth. AI algorithms help identify patients for individualized treatment by detecting mutations that are medically relevant and predicting therapeutic response. Increased industrial integration can result from integration into NGS workflows, which can also strengthen precision oncology programs and improve clinical efficacy.

Several government initiatives drive the market growth. For instance, the Centers for Disease Control and Prevention and the Association of Public Health Laboratories have launched the Next Generation Sequencing (NGS) Quality Initiative, a quality management system (QMS) designed to address challenges in developing and implementing NGS-based tests. The QMS allows users to create customizable guidance documents, standard operating procedures, forms, and tools. It also provides free tools and resources for clinical and public health laboratory personnel to enhance their quality management workflows. The initiative is based on the Clinical & Laboratory Standards Institute's 12 Quality Systems Essentials.

Report Coverage

This research report categorizes the market for the US clinical oncology next generation sequencing market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US clinical oncology next generation sequencing market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US clinical oncology next generation sequencing market.

United States Clinical Oncology Next Generation Sequencing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 212.84 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 14.98% |

| 2035 Value Projection: | USD 988.79 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 185 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Technology, By Workflow, By End-User and COVID-19 Impact Analysis |

| Companies covered:: | Perkin Elmer, Agilent Technologies, Thermo Fisher Scientific, Myriad Genetics, Macrogen, Inc., Pacific Bioscience and others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The wide use of next-generation sequencing (NGS) technologies to examine circulating tumor DNA or biomarkers from blood or bodily fluids, liquid biopsies, is a ground-breaking method for cancer monitoring and diagnosis, driving the market growth. These technologies offer a more precise understanding of tumor heterogeneity and evolution by detecting genetic alterations in ctDNA with great sensitivity. Liquid biopsies' non-invasiveness creates new avenues for cancer patient care by facilitating dynamic treatment modifications and early tumor recurrence identification, both of which improve patient outcomes. New sequencing platforms have been introduced as a result of research and development investments; performance, throughput, and scalability are the main areas of focus. NGS technologies help analyze and interpret data, and collaborations between government organizations, business partners, and academic institutions have accelerated NGS-based cancer research. Therefore, ideal applications of this technology accelerate the market expansion.

Restraining Factors

The high implementation costs, regulatory and compliance issues, complex data management and interpretation, restricted reimbursement procedures, and competition from centralized sequence facilities restrict the growth of the market.

Market Segmentation

The USA clinical oncology next generation sequencing market share is classified into technology, workflow, application, and end-user.

- The targeted sequencing & resequencing segment held the largest share of 70.11% in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US clinical oncology next generation sequencing market is segmented by technology into whole exome sequencing, targeted sequencing & resequencing, and whole genome sequencing. Among these, the targeted sequencing & resequencing centrifuges segment held the largest share of 70.11% in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental expansion is attributed to the reduced sequencing cost, which mostly focuses on the genomic region of interest, efficiency, and enhancing the identification of the genetic variants.

- The sequencing segment accounted for the largest share of 54.13% in 2024 and is predicted to grow at a significant CAGR during the forecast period.

The US clinical oncology next generation sequencing market is segmented by workflow into sequencing, data analysis, and pre-sequencing. Among these, the sequencing segment accounted for the largest share of 54.13% in 2024 and is predicted to grow at a significant CAGR during the forecast period. This sector growth is attributed to the detection of abnormalities overall on the genome, interrogating several targets at the same time, providing a details picture of the genetic makeup, and improved resolution.

- The screening segment accounted for the largest share of 74.33% in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US clinical oncology next generation sequencing market is segmented by application into companion diagnostics, screening, and others. Among these, the screening segment accounted for the largest share of 74.33% in 2024 and is expected to grow at a significant CAGR during the forecast period. The sector growth is attributed to its speed, precision, and sensitivity, widely used in cancer screening, assessing several genes in a single assay, and removing the need for multiple tests to detect causative alterations.

- The laboratories segment accounted for the largest share of 61.15% in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The US clinical oncology next generation sequencing market is segmented by end-user into laboratories, hospital, and clinics. Among these, the laboratories segment accounted for the largest share of 61.15% in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This is driven by the increased focus on research and, rising use of NGS technologies in the laboratories for cancer detection.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US clinical oncology next-generation sequencing market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Perkin Elmer

- Agilent Technologies

- Thermo Fisher Scientific

- Myriad Genetics

- Macrogen, Inc.

- Pacific Bioscience

- Others

Recent Developments:

- In February 2025, Roche introduced its proprietary sequencing by expansion (SBX) technology, a breakthrough in next-generation sequencing. SBX chemistry and an innovative sensor module provide ultra-rapid, high-throughput sequencing for various applications. This technology enhances understanding of genetics, genomics, and cell biology, and is crucial for decoding complex diseases like cancer, immune disorders, and neurodegenerative conditions.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the US clinical oncology next-generation sequencing market based on the below-mentioned segments:

US Clinical Oncology Next Generation Sequencing Market, By Technology

- Whole Exome Sequencing

- Targeted Sequencing & Resequencing

- Whole Genome Sequencing

US Clinical Oncology Next Generation Sequencing Market, By Workflow

- Sequencing, Data Analysis

- Pre-Sequencing

US Clinical Oncology Next Generation Sequencing Market, By Application

- Companion Diagnostics

- Screening

- Others

US Clinical Oncology Next Generation Sequencing Market, By End-User

- Laboratories

- Hospital

- Clinics

Need help to buy this report?