United States Chocolate Market Size, Share, and COVID-19 Impact Analysis, By Product (Traditional and Artificial), By Distribution Channel (Supermarket & Hypermarket, Convenience Store, and Online), and United States Chocolate Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesUnited States Chocolate Market Size Insights Forecasts to 2035

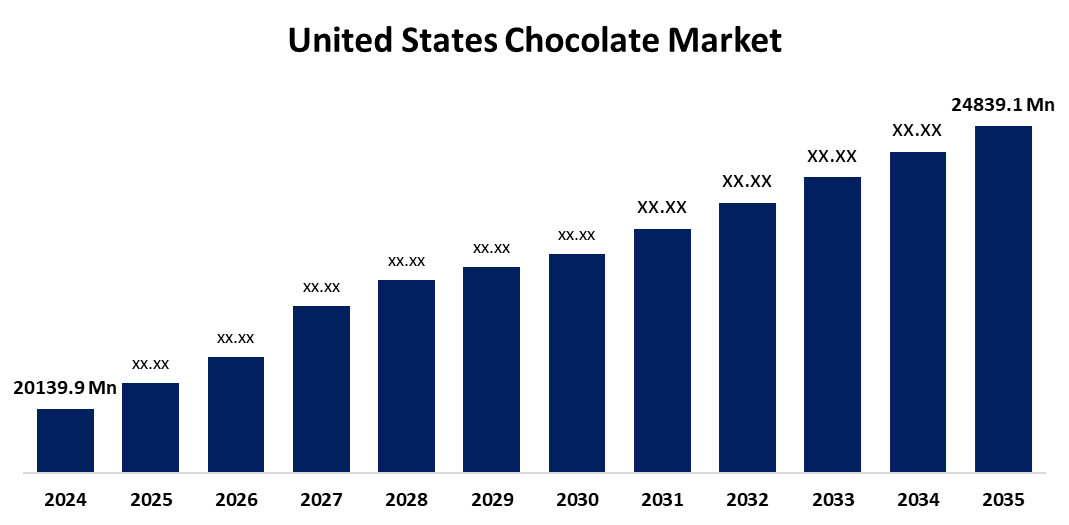

- The US Chocolate Market Size Was Estimated at USD 20139.9 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 1.92% from 2025 to 2035

- The US Chocolate Market Size is Expected to Reach USD 24839.1 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the United States Chocolate Market Size is anticipated to reach USD 24839.1 million by 2035, growing at a CAGR of 1.92% from 2025 to 2035. The expansion of the United States chocolate market is propelled by consumer awareness of the advantages of eating premium chocolate for one's health.

Market Overview

Chocolate is a food product manufactured from ground and roasted cacao beans that is frequently sweetened and flavoured. It is frequently eaten as candy, added to drinks, or used as a flavouring in other sweet dishes. Increased consumer desire for artisanal and premium chocolate products, increased health awareness, which leads to an increased interest in healthier dark, organic chocolates, and the seasonal and festive demand causing sales surges during holiday periods, are the major drivers for this sector. The principal ingredients used to make chocolate in the United States include cocoa beans, sugar, milk, cocoa butter, and lecithin as an emulsifier. Nuts, fruits, and other sugars, with flavourings often from vanilla or vanillin, are other examples of ingredients. The quality, origin of these ingredients, and the production process greatly affect the flavour and texture of the final product.

The U.S. Department of Agriculture (USDA) has made improving the cocoa supply chain a top focus. Through the Cocoa for Peace program, a partnership with the U.S. Agency for International Development (USAID), the USDA hopes to boost cocoa production in Colombia. This program increases Colombian farmers' ability to satisfy international quality standards and increases exports to markets such as the United States by providing them with resources, training, and technical assistance.

Report Coverage

This research report categorizes the market for the United States chocolate market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States chocolate market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States chocolate market.

United States Chocolate Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 20139.9 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 1.92% |

| 2035 Value Projection: | USD 24839.1 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 198 |

| Tables, Charts & Figures: | 125 |

| Segments covered: | By Product, By Distribution Channel and COVID-19 Impact Analysis |

| Companies covered:: | The Hershey Co, Mondelez International Inc Class A, Mars, Incorporated, Lindt & Sprüngli, See’s Candies, Barry Callebaut, Chocoladefabriken Lindt & Sprüngli AG, Nestle, Ferrero Group, and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The growth of the United States chocolate market is boosted by its capacity to reduce heart disease, together with its many applications beyond chocolate cake and chocolate milk. Chocolate, along with quality chocolate products, is one of the most widely recognized food items. Moderate consumption of chocolate has increased serotonin, a neurotransmitter that calms the brain and acts as a natural antidepressant, as well as promotes the removal of toxins that enhance disposition. There are all sorts of shapes, sizes, and wrapping on chocolates for the best fit to an event. The chocolate industry, valued in billions of dollars, continues to expand, especially when there are new products being developed and marketed.

Restraining Factors

The United States chocolate market faces obstacles like fluctuating commodity prices of cocoa and interruptions with supply, due to natural and man-made factors, including crop diseases, climate change, and unrest in cocoa-producing regions. In addition, with a greater awareness around health issues relating to sugar consumption, more consumers are looking for options that may have impacted the traditional chocolate market.

Market Segmentation

The United States chocolate market share is classified into product and distribution channel.

- The traditional segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States chocolate market is segmented by product into traditional and artificial. Among these, the traditional segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by the demand for milk chocolate, which is based on its quality, and with the largest share of the traditional sector coming from the milk chocolate segment. Cocoa is more commonly utilized and is readily available, which is far broader than carob and the raw product from which artificial chocolate is made. Milk chocolate contains flavonoids, which are antioxidants that fight free radicals in the body and help in blood flow.

- The online segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the United States chocolate market is segmented into supermarket & hypermarket, convenience store, and online. Among these, the online segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled because it has become popular over the last couple of years as more individuals use the internet. The key factors causing this shift to use online distribution channels are the increasing volume of individuals using the internet, the diversity of brands available, and shopping from home.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States chocolate market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- The Hershey Co

- Mondelez International Inc Class A

- Mars, Incorporated

- Lindt & Sprüngli

- See’s Candies

- Barry Callebaut

- Chocoladefabriken Lindt & Sprüngli AG

- Nestle

- Ferrero Group

- Others

Recent Development

- In October 2023, Mondelez International repositioned the Toblerone chocolate brand as a premium chocolate with its "Never Square" campaign. The campaign draws inspiration from luxury brands, positioning Toblerone as a unique and high-quality chocolate. To support the new brand positioning, Toblerone is introducing innovative formats and gifting options, including Toblerone Truffles with a velvety smooth truffle center and a unique diamond shape. The brand is also expanding its Tiny Toblerone packs to U.S. retailers, making the chocolate more accessible. These smaller sizes and shareable packs align with the company's goal of providing a variety of portion sizes and mindful snacking options.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States chocolate market based on the following segments:

United States Chocolate Market, By Product

- Traditional

- Artificial

United States Chocolate Market, By Distribution Channel

- Supermarket & Hypermarket

- Convenience Store

- Online

Need help to buy this report?