United States Chitosan Market Size, Shareand COVID-19 Impact Analysis, , By Grade (Industrial Grade, Food Grade, and Pharmaceutical Grade), By Source (Shrimp, Crab, Squid, Krill, and Others), and United States Chitosan Market Insights, Industry Trend, Forecasts to 2035

Industry: Specialty & Fine ChemicalsUnited States Chitosan Market Size Insights Forecasts to 2035

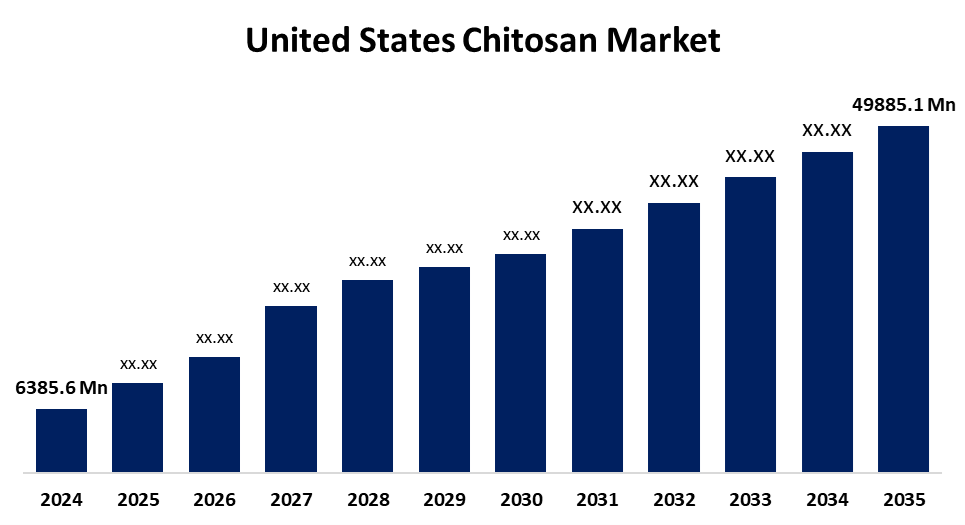

- The US Chitosan Market Size Was Estimated at USD 6385.6 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 20.55% from 2025 to 2035

- The US Chitosan Market Size is Expected to Reach USD 49885.1 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the United States Chitosan Market Size is anticipated to reach USD 49885.1 million by 2035, growing at a CAGR of 20.55% from 2025 to 2035. The expansion of the United States chitosan market is propelled by the rising demand for goods made from natural sources and their widespread use in pharmaceutical, cosmetic, and wastewater treatment applications.

Market Overview

Chitosan is a naturally occurring linear polymer that is created when chitin, the second most prevalent natural polymer after cellulose, is deacetylated. Due to its various applications in industries that value sustainable materials, chitosan is experiencing growth in the US market. Chitosan, which is derived from the shells of crustaceans such as prawns, crabs, and lobsters, is biodegradable, non-toxic, and biocompatible, all of which give it suitability for use in packaging, textiles, water treatment, and even chemical substitutes. In 2025, Milliken & Company acquired Tidal Vision, a company focused on chitosan that employs over 200 individuals and operates in five states in the US. Their strategic investment aims to develop high-performance, sustainable material solutions and accelerate the use of biodegradable chemicals. These partnerships emphasise the role of chitosan as a key ingredient to creating more sustainable and environmentally-conscious industrial ecosystems in every area of the US, while demonstrating the increasing demand for bio-based products. Chitosan is disrupting the US health care sector due to its powerful antimicrobial, wound healing, and biocompatible characteristics, and it is opening a promising future for the US chitosan market.

The United States actively promotes chitosan through innovation, research, and regulation initiatives. Coatings, seed treatments, and plant growth applications can now avoid expensive pesticide registration due to the EPA's November 2022 addition of chitosan to its minimum-risk pesticide exemption list under FIFRA.

Report Coverage

This research report categorizes the market for the United States chitosan market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States chitosan market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States chitosan market.

United States Chitosan Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 6385.6 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 20.55% |

| 2035 Value Projection: | USD 49885.1 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 198 |

| Tables, Charts & Figures: | 127 |

| Segments covered: | By Grade, By Source and COVID-19 Impact Analysis |

| Companies covered:: | LyondellBasell Advanced Polymers Inc Pref Share, FMC Corp, Panvo Organics Pvt. Ltd., Meron Biopolymers, United Chitotechnologies Inc., Chitobine, ChitoLytic, Tidal Vision, Biostar-CH, Inc, and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The growth of the United States chitosan market is boosted by the increasing demand for sustainable bio-based polymers in numerous sectors such as water treatment, biomedicine, cosmetics, and food and beverages. In light of increasing environmental sustainability standards and awareness, industries are looking for viable substitutes for efficient synthetic materials based on accepted environmental practices. Chitosan, derived from chitin, which is a naturally occurring biopolymer, offers a viable alternative for the industry due to its biodegradable, non-toxic, and biocompatible properties. Chitin is located in the shells of crustaceans, including crabs, prawns, and lobsters. The replacement of conventional chemical flocculants with bio-based flocculants made of chitosan is becoming increasingly common in the water treatment sector to remove contaminants from wastewater, including oils and heavy metals.

Restraining Factors

The United States chitosan market faces obstacles, like the uncertainty of the supply chain and the volatility of raw materials supply. The primary raw material supply for chitosan is crustacean shells, which rely on the fishing and seafood processing industries, including crabs, prawns, and lobsters.

Market Segmentation

The United States chitosan market share is classified into grade and source.

- The industrial grade segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States chitosan market is segmented by grade into industrial grade, food grade, and pharmaceutical grade. Among these, the industrial grade segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven due to its broad range of applications, low cost, and versatility in industries with high demand. It is applicable for municipal, agricultural, and industrial purposes since it is nearly always applied in water and wastewater treatment with natural flocculants used to remove oils, suspended solids, and heavy metals. Demand is further supplemented with applications in agriculture, textiles, and cosmetics as a seed coating and carrier for biodegradable pesticides.

- The shrimp segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the source, the United States chitosan market is segmented into shrimp, crab, squid, krill, and others. Among these, the shrimp segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by due to its low cost, the chitin level it contains, and being readily available. Shrimp shells, the major waste from the seafood industry, provide a readily available and sustainable resource for the production of chitosan. Bulk applications are further facilitated by an efficient supply chain and established processing capabilities.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States chitosan market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- LyondellBasell Advanced Polymers Inc Pref Share

- FMC Corp

- Panvo Organics Pvt. Ltd.

- Meron Biopolymers

- United Chitotechnologies Inc.

- Chitobine

- ChitoLytic

- Tidal Vision

- Biostar-CH, Inc

- Others

Recent Development

- In November 2022, Chitogen Inc., a U.S.-based medical manufacturing company, signed a letter of intent with Tru Shrimp to purchase commercial quantities of chitosan produced from the ground-up exoskeleton of its farm-raised shrimp. This move was made to build a large-scale shrimp farm in South Dakota, U.S.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States chitosan market based on the following segments:

United States Chitosan Market, By Grade

- Industrial Grade

- Food Grade

- Pharmaceutical Grade

United States Chitosan Market, By Source

- Shrimp

- Crab

- Squid

- Krill

- Others

Need help to buy this report?