United States Chillers Market Size, Share, and COVID-19 Impact Analysis, By Product (Water-Cooled and Air-Cooled), By Application (Industrial, Commercial, and Residential), and United States Chillers Market Insights, Industry Trend, Forecasts to 2035

Industry: Advanced MaterialsUnited States Chillers Market Size Insights Forecasts to 2035

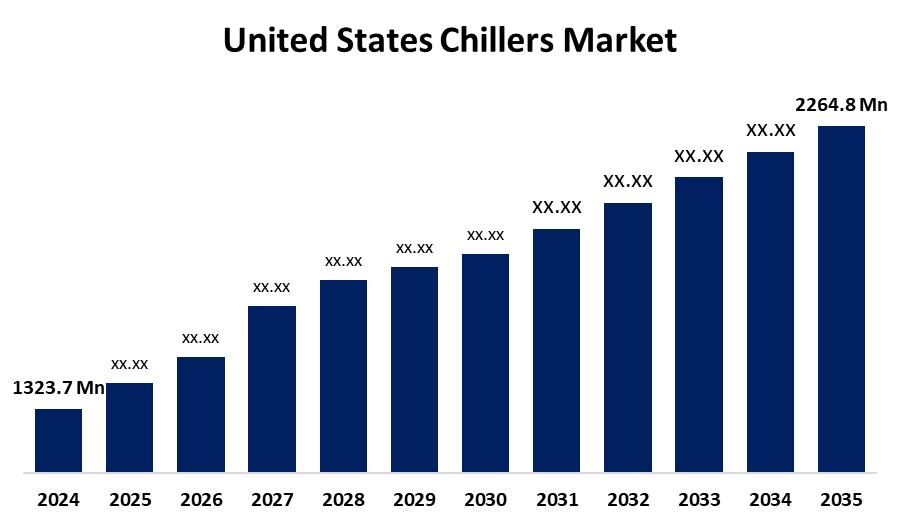

- The US Chillers Market Size Was Estimated at USD 1323.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5% from 2025 to 2035

- The US Chillers Market Size is Expected to Reach USD 2264.8 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the United States Chillers Market Size is anticipated to reach USD 2264.8 million by 2035, growing at a CAGR of 5% from 2025 to 2035. The expansion of the United States chillers market is propelled by the growing demand in the commercial and industrial sectors for space cooling solutions that are both economical and energy-efficient.

Market Overview

A chiller is a mechanical refrigeration device that uses an adsorption, absorption, or vapor-compression cycle to extract heat from a liquid coolant, usually water or a glycol mixture. Several factors have influenced the cooling requirements of various industries, which have fuelled the growth of chillers in the US market. By controlling temperature, chillers are essential for preserving product integrity and comfortable surroundings in commercial, industrial, and residential applications, and demand for them has increased. The increased focus on environmental sustainability and energy efficiency is one important factor driving this increase in demand. As laws have tightened and interest in climate change has increased, modern energy-efficient chillers are very desirable, which forces businesses and consumers to consider more environmentally conscious cooling options. The market with chillers is changing with the use of more sophisticated cooling system applications, along with how they are manufactured and distributed.

The U.S. government actively supports the modernisation and decarbonisation of chillers through a number of coordinated programs. All water-cooled and air-cooled electric chillers purchased by federal agencies must adhere to stringent efficiency standards set by the Department of Energy's Federal Energy Management Program (FEMP), which is reinforced by guidance that was revised in September 2022 to encourage energy and cost savings throughout federal buildings.

Report Coverage

This research report categorizes the market for the United States chillers market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States chillers market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States chillers market.

United States Chillers Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1323.7 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5% |

| 2035 Value Projection: | USD 2264.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 136 |

| Tables, Charts & Figures: | 126 |

| Segments covered: | By Product, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Rite-Temp, General Air Products, Fluid Chillers, Carrier Global Corp Ordinary Shares, Honeywell International Inc, Air Products & Chemicals Inc, Trane, Cold Shot Chillers, Tandem Chillers, and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The growth of the United States chillers market is boosted by the fact that air conditioning systems require cooling technology to chill air, and many of the air conditioning systems rely on chillers. The growth of air conditioning systems is likely to parallel the demand for air conditioning systems in the face of increasing temperatures and urbanisation. Chillers are used in a number of settings, including cars, commercial and residential buildings, and industrial sites. In those locations, chillers are used to cool the air to make the indoor temperature more pleasant, while also removing humidity and improving air quality. It is expected that the growth of the building sector, in particular, will stimulate the demand for air conditioners and chillers.

Restraining Factors

The United States chillers market faces obstacles, like it is expensive to purchase and install, especially the high-efficiency versions that incorporate advanced materials and technology. The high initial cost of chillers may restrict demand in certain markets and be a considerable deterrent for small businesses or building owners with strict budgets.

Market Segmentation

The United States chillers market share is classified into product and application.

- The water-cooled segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States chillers market is segmented by product into water-cooled and air-cooled. Among these, the water-cooled segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven because it has a great option for indoor applications since they have a broad cooling capacity that runs from 10–4,000 tonnes therefore, water-cooled chillers are an excellent option for indoor use since they provide a broad cooling capacity running from 10–4,000 tonnes, and they are an ideal option for all major industrial applications that require high cooling loads.

- The commercial segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the United States chillers market is segmented into industrial, commercial, and residential. Among these, the commercial segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled as it is essential in commercial structures because they provide essential cooling. A lot of heat originates from a number of external and internal cooling loads that must be balanced off. Heat from external loads, such as the sun, wind, and ambient temperatures, and internal loads, such as perspiration, lights, and heat from electrical or mechanical equipment, are sources of heat gain.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States chillers market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Rite-Temp

- General Air Products

- Fluid Chillers

- Carrier Global Corp Ordinary Shares

- Honeywell International Inc

- Air Products & Chemicals Inc

- Trane

- Cold Shot Chillers

- Tandem Chillers

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States chillers market based on the following segments:

United States Chillers Market, By Product

- Water-Cooled

- Air-Cooled

United States Chillers Market, By Application

- Industrial

- Commercial

- Residential

Need help to buy this report?