United States Cellulose Acetate Market Size, Share, and COVID-19 Impact Analysis, By Product (Plastic and Fiber), By Application (LCD & Photographic Films, Tapes & Labels, Cigarette Filters, Textiles & Apparels, and Others), and US Cellulose Acetate Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsUSA Cellulose Acetate Market Insights Forecasts to 2035

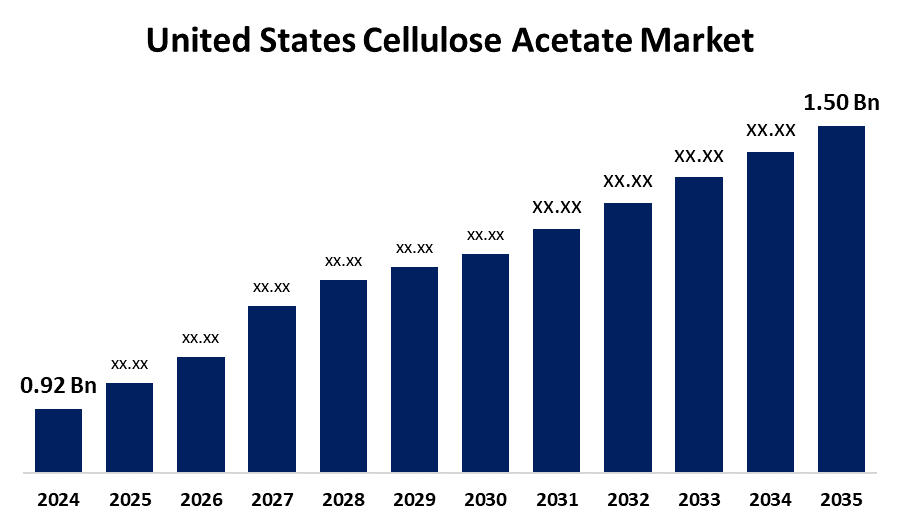

- The US Cellulose Acetate Market Size was Estimated at USD 0.92 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.54% from 2025 to 2035

- The USA Cellulose Acetate Market Size is Expected to reach USD 1.50 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The US Cellulose Acetate Market Size is anticipated to reach USD 1.50 Billion by 2035, growing at a CAGR of 4.54% from 2025 to 2035. This market growth is attributed to the increasing use of cellulose acetate in various industries, including pharmaceuticals, textiles, apparel, and packaging.

Market Overview

The United States cellulose acetate market involves the production, distribution, and utilization of cellulose acetate, a polymer used in various sectors. A byproduct of cellulose, cellulose acetate is made from wood or cotton pulp. It is made from the acetylation of the plant material cellulose and is nontoxic, nonirritating, and biodegradable. It is used to wrap freshly made and baked items in food packaging. Cellulose acetate is utilized in various applications due to its organic origin, eco-friendliness, and biodegradability in diverse environmental conditions. The FDA's classification of it as "generally recognized as safe" has spurred the food packaging sector to create substitutes. The growing demand for cellulose acetate in fabrics, cigarette filters, eyeglass frames, and photographic films is driving the growth of the cellulose acetate market. The market is expanding as a result of rising environmental awareness and the use of biodegradable products. Cellulose acetate is being used extensively in drug delivery systems in the pharmaceutical and medical sectors. Innovations, research into new uses, and technological breakthroughs all contribute to the market's expansion. Improvements in production techniques and the rising demand for eco-friendly items have a positive impact on the industry.

Report Coverage

This research report categorizes the market for the US cellulose acetate market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US cellulose acetate market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US cellulose acetate market.

United States Cellulose Acetate Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 0.92 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 4.54% |

| 2035 Value Projection: | USD 1.50 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 244 |

| Tables, Charts & Figures: | 99 |

| Segments covered: | By Product and By Application |

| Companies covered:: | Celanese Corp Class A, Daicel Corp, Rotuba, Sappi Ltd ADR, Cerdia International, Mitsubishi Chemical Group Corp, Eastman Chemical Co, Rayonier Advanced Materials Inc., and Others |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

Growing usage of cellulose acetate in several industries drives the market growth:

The market for cellulose acetate is expanding because it is widely used in textiles and cigarette filters. Smoking is made more enjoyable by its porous structure, which efficiently captures dangerous particles. It is frequently used in luxury apparel due to its high luster, drape, and adaptability. Cellulose acetate is used in the textile industry to manufacture a variety of textiles, such as rayon and acetate satin. It is anticipated that the need for cellulose acetate in these applications would rise as the tobacco and textile industries grow internationally. Its appeal in photographic films and eyeglass frames is also propelling expansion in the USA since it provides high-quality images along with alternatives that are flexible, long-lasting, and lightweight.

Rising awareness of the benefits of eco-friendly products:

The market for cellulose acetate is expanding as a result of the increased demand for environmentally friendly products. In contrast to conventional polymers, cellulose acetate is biodegradable, which lessens its negative effects on the environment and solves the problem of plastic pollution. Consumer products, packaging, and textile industries have expressed interest in this. Increased demand for cellulose acetate positions it as a preferred choice for sustainable product development and propels market expansion as customers place a higher priority on sustainability and governments impose more stringent environmental restrictions. Cellulose acetate is increasingly being used in sustainable product development as the need for sustainable materials increases.

Restraining Factors

The variable raw material costs, regulatory obstacles, dwindling demand in conventional applications, the presence of alternatives such as bio-based plastics, and tobacco industry regulations may limit the growth of the market.

Market Segmentation

The USA Cellulose Acetate Market share is classified into product and application.

- The fiber segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US cellulose acetate market is segmented by product into plastic and fiber. Among these, the fiber segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental expansion is attributed to the biodegradable, long-lasting colors, widely used in the textiles and apparel industries, owing to their good quality, presence of pores in fiber, which maintains the air and enhances the breathability, softness, and improves the dyeability property.

- The cigarette filters segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US cellulose acetate market is segmented by application into LCD & photographic films, tapes & labels, cigarette filters, textiles & apparels, and others. Among these, the cigarette filters segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The sector's growth is ascribed to the porous material used in cigarette filters, providing a safer and more efficient alternative to traditional filters. Its high wet strength and low ignition propensity make it a popular choice among leading tobacco companies.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US cellulose acetate market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Celanese Corp Class A

- Daicel Corp

- Rotuba

- Sappi Ltd ADR

- Cerdia International

- Mitsubishi Chemical Group Corp

- Eastman Chemical Co

- Rayonier Advanced Materials Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the US cellulose acetate market based on the below-mentioned segments:

US Cellulose Acetate Market, By Product

- Plastic

- Fiber

US Cellulose Acetate Market, By Application

- LCD & Photographic Films

- Tapes & Labels

- Cigarette Filters

- Textiles & Apparels

- Others

Need help to buy this report?