United States Catheter Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Cardiovascular Catheters, Intravenous Catheters, Neurovascular Catheters, Urology Catheters, and Specialty Catheters), By End-use (Hospitals Stores, Retail Stores, and Others), and United States Catheter Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited States Catheter Market Size Insights Forecasts to 2035

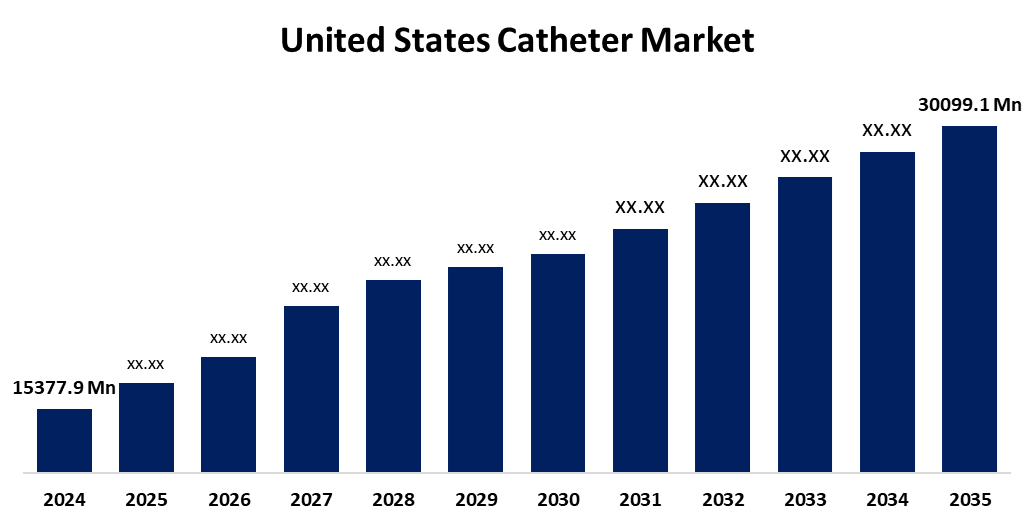

- The US Catheter Market Size Was Estimated at USD 15377.9 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.3% from 2025 to 2035

- The US Catheter Market Size is Expected to Reach USD 30099.1 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the United States Catheter Market Size is anticipated to reach USD 30099.1 million by 2035, growing at a CAGR of 6.3% from 2025 to 2035. The expansion of the United States catheter market is propelled by the use of cutting-edge materials in catheters, the growing demand for antimicrobial catheters, and the rise in urological, neurological, and cardiovascular disorders.

Market Overview

A catheter is a thin, flexible tube that is usually composed of medical-grade materials and can be put into the body for a variety of medical uses through cavities, ducts, organs, or veins. Patients require catheterisation for elective cases under general anaesthesia. The use of catheters can also cause central line-associated bloodstream infections (CLABSIs) and catheter-associated urinary tract infections (CAUTIs). Cerenovus, Inc., which is a division of Johnson & Johnson MedTech, announced in February 2024 the introduction of Cereglide 71 intermediate catheter with TruCourse Technology, providing revascularisation in patients who have had an acute ischaemic stroke. While maintaining the production of catheters with materials including Sorbothane, noted for its resistance to iodine, hydrogen peroxide, and alcohol, used at every production stage to prolong catheter life, suggests that shortly, end-user demand will increase shortly with the continued use of advanced materials in the production of catheters. Durathane catheters also allow users to resist and strengthen during usage of the catheters.

Report Coverage

This research report categorizes the market for the United States catheter market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States catheter market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States catheter market.

United States Catheter Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 15377.9 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.3% |

| 2035 Value Projection: | USD 30099.1 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 196 |

| Tables, Charts & Figures: | 128 |

| Segments covered: | By Product Type, By End-use and COVID-19 Impact Analysis |

| Companies covered:: | Cure Medical, Hollister, Edwards Lifesciences Corp, Teleflex Inc, Boston Scientific Corp, Smith Medical, Biotronik, Cerenovus, Biometrics, and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States catheter market is boosted by the rapidly increasing number of women aged 45 to 55 and older, with an estimated million of them entering menopause each year. Influencers and the media are driving increased awareness and education, which lessens stigma and promotes proactive symptom management. Natural, holistic, and customised remedies are becoming more and more popular with consumers. Meanwhile, menopause care is becoming more accessible and customised due to digital innovations like telehealth platforms, symptom-tracking apps, AI-driven wellness tools, and expanded over-the-counter offerings.

Restraining Factors

The United States catheter market faces obstacles because patients' and healthcare professionals' worries about the dangers and adverse consequences of hormone replacement therapy, such as possible connections to cardiovascular problems and breast cancer, prevent its broader use.

Market Segmentation

The United States catheter market share is classified into product type and end-use.

- The cardiovascular catheters segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States catheter market is segmented by product type into cardiovascular catheters, intravenous catheters, neurovascular catheters, urology catheters, and specialty catheters. Among these, the cardiovascular catheters segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by the rising rates of cardiovascular diseases, increasing demand for interventional cardiac procedures, which is bolstered by the increasing use of cardiac catheters, triggering the market growth. The need and demand for cardiac catheters will continue to grow because of the rising occurrence of cardiovascular diseases such as coronary artery disease, congenital heart defects, and cardiac arrhythmias.

- The hospital's stores segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the end-use, the United States catheter market is segmented into hospitals stores, retail stores, and others. Among these, the hospital’s stores segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by it is increasing prevalence, meaning with improved healthcare facilities, and on top of that, increases in neurological, urologic, and cardiovascular diseases, like the acute rise in minimally invasive surgeries.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States catheter market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cure Medical

- Hollister

- Edwards Lifesciences Corp

- Teleflex Inc

- Boston Scientific Corp

- Smith Medical

- Biotronik

- Cerenovus

- Biometrics

- Others

Recent Development

- In September 2023, Biomerics announced a significant expansion of its operations in Brooklyn Park, Minnesota, USA, adding 100,000 square feet to its facility. This would allow the enhancement of the company's engineering Centers of Excellence, focusing on extrusions, laser processing, catheters, steerable, and final assembly operations.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States catheter market based on the following segments:

United States Catheter Market, By Product Type

- Cardiovascular Catheters

- Intravenous Catheters

- Neurovascular Catheters

- Urology Catheters

- Specialty Catheters

United States Catheter Market, By End-use

- Hospital Stores

- Retail Stores

- Others

Need help to buy this report?