United States Catamaran Market Size, Share, and COVID-19 Impact Analysis, By Product (Sailing Catamarans and Power Catamarans), By Size (Small, Medium, and Large), and United States Catamaran Market Insights, Industry Trend, Forecasts to 2035

Industry: Automotive & TransportationUnited States Catamaran Market Size Insights Forecasts to 2035

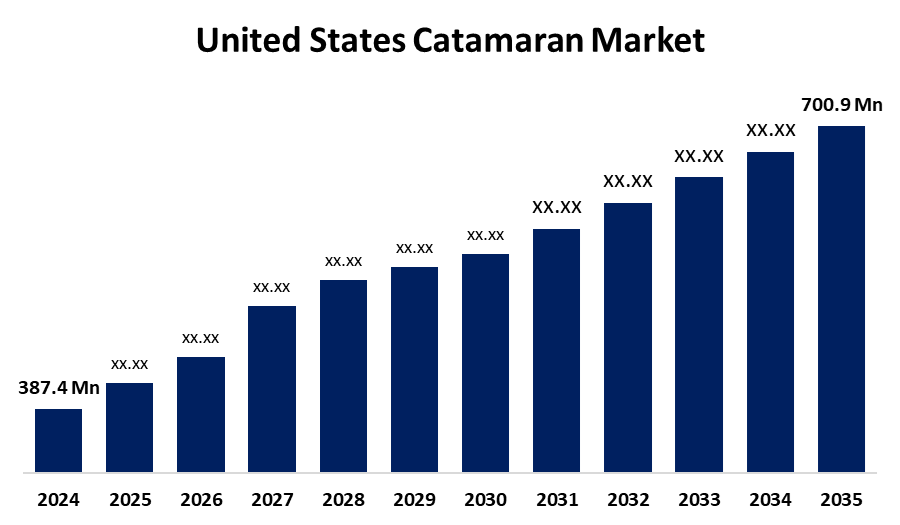

- The US Catamaran Market Size Was Estimated at USD 387.4 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.54% from 2025 to 2035

- The US Catamaran Market Size is Expected to Reach USD 700.9 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the United States Catamaran Market Size is anticipated to reach USD 700.9 million by 2035, growing at a CAGR of 5.54% from 2025 to 2035. The expansion of the United States catamaran market is driven by the rise in cruising and racing events, as well as the increasing disposable wealth of its inhabitants.

Market Overview

A catamaran is a particular kind of boat that is identified by having two equal-sized parallel hulls joined by a deck or other structure. Catamarans are incredibly comfortable. They have more capacity than monohulls, and even the living space and cockpit between the hulls may accommodate different needs, which is essential for long-distance sailing. The booming marine tourism market, combined with the increasing cruise ship market, along with consumers wanting high-end luxury holidays, is growing fast. The catamaran market is also experiencing growth as consumers want personalised details and custom-built boats. Consumers want custom interiors, sophisticated navigation systems, and, whether electric or hybrid, environmentally sustainable advances to their cruising lifestyle. The manufacturers are designing modular concepts allowing consumers to choose utilities and layouts that are unique to their preferences. Customisation is common in the premium luxury sector, where wealthy consumers are looking for a vessel that is high-value, high-performing, and distinctive. This trend is not only a competitive advantage for the businesses providing catamarans, but it also increases the overall and ultimate enjoyment for the consumer.

The U.S. federal government, through agencies like as the Department of Transportation and the Maritime Administration (MARAD), has actively supported catamaran manufacture by funding small shipyard modernisation through the Small Shipyard Grant Program.

Report Coverage

This research report categorizes the market for the United States catamaran market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States catamaran market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States catamaran market.

United States Catamaran Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 387.4 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.54% |

| 2035 Value Projection: | USD 700.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 136 |

| Tables, Charts & Figures: | 127 |

| Segments covered: | By Product, By Size and COVID-19 Impact Analysis |

| Companies covered:: | Derecktor Shipyards, Chesapeake Shipbuilding, Hobie Cat Company, PDQ Yachts, ArrowCat Marine, Specmar Inc., Corinthian Yachts, Leopard Catamarans, and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States catamaran market is boosted due to greater awareness of both mental and physical well-being. Consumers in the US have recently boosted their expenditure on outdoor leisure. A major contributor to increased sales of watercrafts, including charters, fishing catamarans, sailing yachts, portable catamarans, etc., is increased spending on outdoor recreational activities, including fishing, boating, and cruising. The estimated participant percentage of US citizens who actively engage in water sports, including canoeing, kayaking, and remarks, etc., is approximately 15%.

Restraining Factors

The United States catamaran market faces obstacles like the high cost of construction and maintenance, which could limit its reach to a bigger audience. Construction costs become expensive with the use of modern materials and technologies like hydrofoils and unique hull shapes.

Market Segmentation

The United States catamaran market share is classified into product and size.

- The sailing segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States catamaran market is segmented by product into sailing catamarans and power catamarans. Among these, the sailing segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven because it is perfect for a long-distance cruise and is frequently utilised by sailors or individuals who enjoy sailing. Sailboats may reach speeds of 9 to 10 knots with the right engine and propeller, and they are seaworthy, which means they provide comfort at sea. Sail handling on sailing catamarans is now simpler because of new designs and advancements in technology.

- The medium segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the size, the United States catamaran market is segmented into small, medium, and large. Among these, the medium segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. In terms of performance, space, and cost, the segment's rise is driven by features like fully equipped cabins, independent living areas, and minimal docking requirements.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States catamaran market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Derecktor Shipyards

- Chesapeake Shipbuilding

- Hobie Cat Company

- PDQ Yachts

- ArrowCat Marine

- Specmar Inc.

- Corinthian Yachts

- Leopard Catamarans

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States catamaran market based on the following segments:

United States Catamaran Market, By Product

- Sailing Catamarans

- Power Catamarans

United States Catamaran Market, By Size

- Small

- Medium

- Large

Need help to buy this report?