United States Cassava Market Size, Share, and COVID-19 Impact Analysis, By Product (Conventional and Organic), By Application (Animal Feed, Pharmaceutical, Food & Beverage, Paper & Textile, and Others), and United States Cassava Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesUnited States Cassava Market Insights Forecasts to 2035

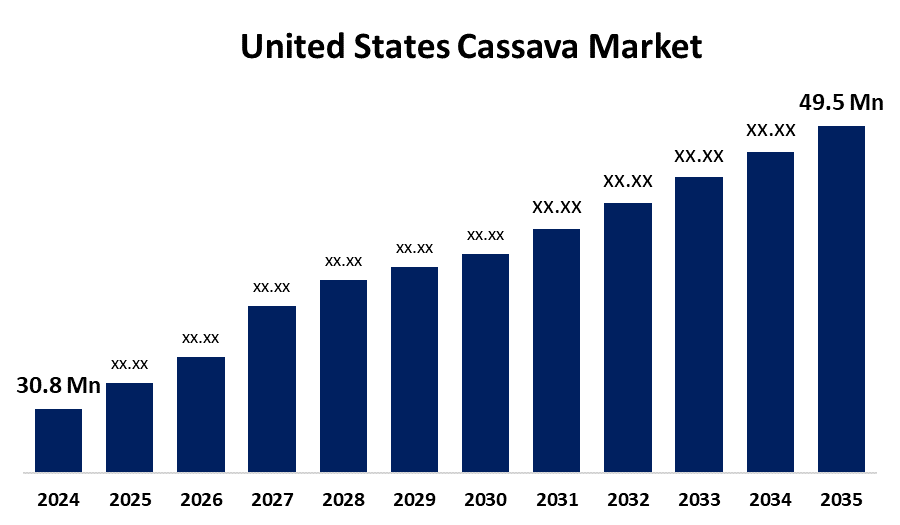

- The US Cassava Market Size Was Estimated at USD 30.8 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.41% from 2025 to 2035

- The US Cassava Market Size is Expected to Reach USD 49.5 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States Cassava Market is anticipated to reach USD 49.5 million by 2035, growing at a CAGR of 4.41% from 2025 to 2035. The expansion of the United States' Cassava market is propelled by the increasing demand for gluten-free products.

Market Overview

The shrubby cassava (Manihot esculenta), commonly known as manioc, yuca, or mandioca, belongs to the Euphorbiaceae spurge family. With the rise of health concerns from consumers, cassava has become a nutritious alternative to wheat and other gluten-containing cereals. The growing demand for cassava-flour-based products such as snacks and noodles for consumers with gluten intolerance or on a gluten-free diet is evidence that more individuals view cassava as a nutritious alternative. Advances in cassava processing technology are also a critical factor for market development. Products made from cassava are now more efficient and of higher quality because of advancements in processing methods. Advances in cassava starch extraction methods are producing higher-quality, higher-yield products, making them more desirable for use in food and industrial applications. New value-added products, including cassava flour and biodegradable packaging materials, have helped to expand the potential market for cassava. The increased interest in plant-based diets and new advancements in product formulations is further supporting the demand for cassava-based ingredients in multiple culinary uses in the United States. The US recognizes the potential for cassava cultivation and processing to improve food security and rural livelihoods, resulting in initiatives that support the crop. Assistance can take several forms, including grants for research and development, infrastructure investment to enhance supply chains, and financial support for manufacturers. These initiatives strengthen regional economies and enable greater manufacturing ability to satisfy consumer demand.

The USDA's National Institute of Food and Agriculture (NIFA) has invested nearly $121 million to advance research in specialty crops, including cassava. This money helps programs that address issues with post-harvest processing, pest control, and production.

Report Coverage

This research report categorizes the market for the United States cassava market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States cassava market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States cassava market.

United States Cassava Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 30.8 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.41% |

| 2035 Value Projection: | USD 49.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 121 |

| Segments covered: | By Product, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Parchem fine and specialty chemicals, Archer Daniels Midland Company, Woodland Foods, American Key Food Products, Ingredion Inc. (Kerr Concentrates), Cargill, Ingredion Inc., Tate and Lyle Plc, Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The growth of the United States cassava market is boosted by growing consumer awareness, health consciousness, and the need to avoid the emergence of chronic diseases, improve longevity, and promote better health. Foods enhanced with health-promoting and disease-preventing qualities are driving the nutritional food industry. New functional foods and beverages have to be introduced to the market by producers due to the shifting eating habits and taste preferences of consumers. Manioc starch is also becoming more and more popular in cereals and snacks. One of the essential elements that producers add to food goods is manioc starch. Among the well-known product categories that contain manioc starch are dairy, baked goods, and snacks. Cereals and snacks are two of the most popular foods that consumers eat.

Restraining Factors

The United States cassava market faces obstacles as the yield and quality of cassava crops are harmed by a number of pests and diseases, such as cassava mosaic disease and cassava mealybug. To overcome these obstacles and sustain output, advanced pest management techniques and disease-resistant plant varieties are required.

Market Segmentation

The United States cassava market share is classified into product and application.

- The conventional segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States cassava market is segmented by product into conventional and organic. Among these, the conventional segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by its affordability and adaptability as a staple food source. The need for accessible and reasonably priced food products is expanding as the population and urbanisation increase. This demand can be effectively met by conventional cassava, which is frequently grown on a bigger scale using tried-and-true farming methods.

- The food & beverage segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the United States cassava market is segmented into animal feed, pharmaceutical, food & beverage, paper & textile, and others. Among these, the food & beverage segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth in this segment is supported demand for new alternative and gluten-free carbohydrates. Health-conscious consumers have potentially started using cassava flour and starch in baked goods and cooking as a natural, gluten-free alternative to wheat flour. Cassava can also be made into other products. Many products can be made from cassava, including baked goods, sauces, snacks, and food products.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States cassava market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Parchem fine and specialty chemicals

- Archer Daniels Midland Company

- Woodland Foods

- American Key Food Products

- Ingredion Inc. (Kerr Concentrates)

- Cargill

- Ingredion Inc.

- Tate and Lyle Plc

- Others

Recent Development

- In April 2024, Shine Bridge Inc., a U.S.-based food processing and manufacturing company, led a coalition to partner with the Nigerian government on large-scale commercial cassava processing. This initiative aims to boost processing capacity and export high-quality cassava flour and starch to the U.S. market, addressing the demand for gluten-free products.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States cassava market based on the following segments:

United States Cassava Market, By Product

- Conventional

- Organic

United States Cassava Market, By Application

- Animal Feed

- Pharmaceutical

- Food & Beverage

- Paper & Textile

- Others

Need help to buy this report?