United States Cashew Market Size, Share, and COVID-19 Impact Analysis, By Form (Paste, Whole, Powder, Roasted, and Splits), By Application (Snacks & Bars, Dairy Products, Cereals, Cosmetic Products, Bakery Products, Confectioneries, Desserts, Beverages, and Others), By Distribution Channel (Retailers, Online Stores, Supermarkets, and Others), and US Cashew Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesUSA Cashew Market Insights Forecasts to 2035

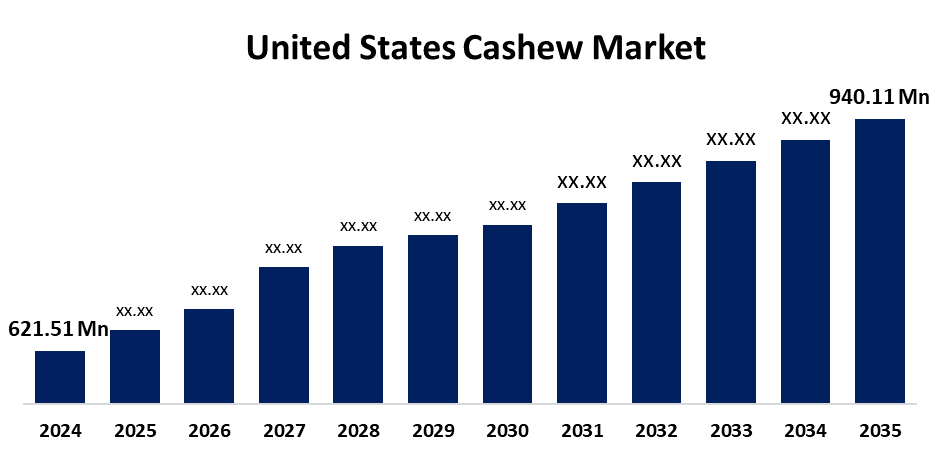

- The US Cashew Market Size was estimated at USD 621.51 Million in 2024

- The Market Size is expected to grow at a CAGR of around 3.83% from 2025 to 2035

- The USA Cashew Market Size is expected to reach USD 940.11 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The US Cashew Market Size is anticipated to reach USD 940.11 Million by 2035, growing at a CAGR of 3.83% from 2025 to 2035. The market is rapidly expanding due to rising health awareness, nutritional benefits, vegan and plant-based diet trends, and the growing demand for convenience and nutrition-rich snacks.

Market Overview

The United States cashew market involves the production, distribution, and consumption of cashews or cashew nuts in food industries, nutritional benefits, and dairy products. The cashew nut and cashew apple are produced by the cashew, a tropical evergreen tree. The dwarf cashew, which can reach a height of 6 meters, yields more and matures earlier, making it more profitable. In the food processing industry, cashews are used extensively in baked goods, confections, snacks, and culinary preparations. Market demand is supported by the expansion of the food processing industry, which is fueled by urbanization, shifting consumer preferences, and the need for convenience foods. Because of their high protein, vitamin K, fat, and oil content, cashew nuts are a popular edible nut. The shell is taken off, they are roasted before eating, and the cashew oil is used to make plastic. In addition to lowering blood cholesterol, cashews also lower the risk of cardiovascular disease, prevent gallstones and cancer, and promote healthy brain function. As consumers adopt healthier diets, the market for cashew nuts is expanding quickly.

Report Coverage

This research report categorizes the market for the US cashew market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US cashew market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US cashew market.

United States Cashew Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 621.51 million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 3.83% |

| 2035 Value Projection: | USD 940.11 million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 271 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Form, By Application and By Distribution Channel |

| Companies covered:: | DVK Group, Nutsco Inc., Alphonsa Cashew Industries, Bismi Cashew Company, Prime Nuts FZE, Qlam International Limited, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Consumers' growing awareness of nutrition and health is driving up demand for cashews in the US. These nuts support heart health, weight control, and cholesterol reduction because they are high in protein, healthy fats, vitamins, minerals, and antioxidants. The market is expanding due to consumers' increasing desire for nutrient-dense snacks and healthy eating practices. The popularity of cashews is also being increased by health-focused campaigns run by public health organizations and private businesses. The market for cashews is also benefiting from the trend toward veganism and plant-based diets. Cashews can be used in a variety of plant-based recipes, such as vegan cheeses and cashew milk, which are dairy substitutes. Cashew demand is rising as more people switch to plant-based diets for moral, environmental, and health reasons.

Restraining Factors

The rising raw material costs, delays in supply, regulatory obstacles, presence of alternative nuts like almonds, walnuts, and peanuts, and environmental concerns may impede the growth of the market.

Market Segmentation

The USA cashew market share is classified into form, application, and distribution channel.

- The whole segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US cashew market is segmented by form into paste, whole, powder, roasted, and splits. Among these, the whole segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is attributed to the richness in proteins, which contain essential minerals like zinc and magnesium, improve cardiac health, control weight, maintain bone health, and antioxidants.

- The confectioneries segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US cashew market is segmented by application into snacks & bars, dairy products, cereals, cosmetic products, bakery products, confectioneries, desserts, beverages, and others. Among these, the confectioneries segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is driven by the growing use of cashews in confectioneries such as energy bars, chocolates, and candies.

- The online stores segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US cashew market is segmented by distribution channel into retailers, online stores, supermarkets, and others. Among these, the online stores segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The sector growth is attributed to consumer convenience, offering discounts, and a personalized experience.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US cashew market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- DVK Group

- Nutsco Inc.

- Alphonsa Cashew Industries

- Bismi Cashew Company

- Prime Nuts FZE

- Qlam International Limited

- Others

Recent Developments:

- In December 2024, Octonuts California, a plant-based snack manufacturer, introduced cashew snacks and butters in churro-inspired and strawberry flavors, as well as gochujang and creme brule snack packages.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the US cashew market based on the below-mentioned segments:

US Cashew Market, By Form

- Paste

- Whole

- Powder

- Roasted

- Splits

US Cashew Market, By Application

- Snacks & Bars

- Dairy Products

- Cereals

- Cosmetic Products

- Bakery Products

- Confectioneries

- Desserts

- Beverages

- Others

US Cashew Market, By Distribution Channel

- Retailers

- Online Stores

- Supermarkets

- Others

Need help to buy this report?