United States Carp Market Size, Share, and COVID-19 Impact Analysis, By Species (Grass, Silver, Common, Bighead, Catla, and Others), By Form (Frozen and Canned), and United States Carp Market Insights, Industry Trend, Forecasts to 2035.

Industry: Food & BeveragesUnited States Carp Market Insights Forecasts to 2035

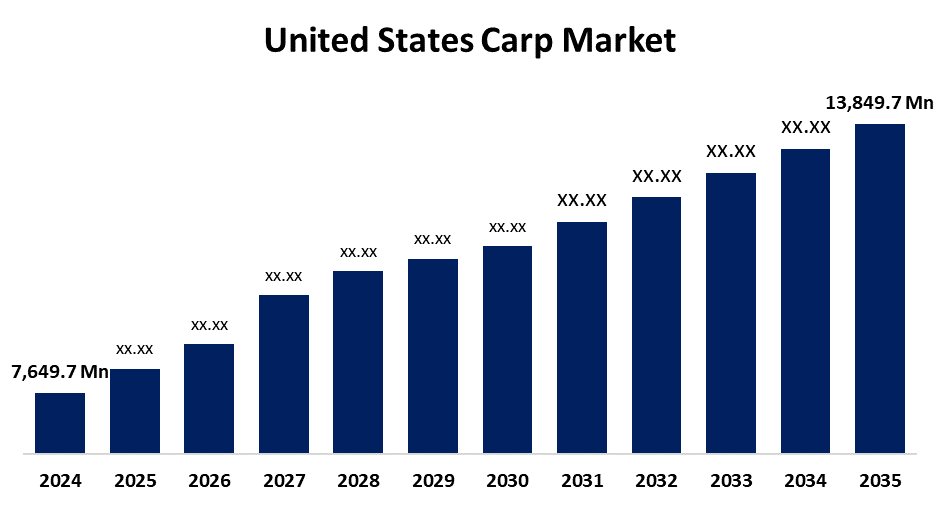

- The US Carp Market Size Was Estimated at USD 7,649.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.54% from 2025 to 2035

- The US Carp Market Size is Expected to Reach USD 13,849.7 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States Carp Market Size is anticipated to reach USD 13,849.7 Million by 2035, growing at a CAGR of 5.54% from 2025 to 2035. The expansion of the United States carp market is propelled by the increasing demand and consumption of fish products.

Market Overview

The term carp refers to several freshwater fish species in the Cyprinidae family, including the common carp (Cyprinus carpio). As carp are considered a non-native species in many waterways, efforts to restrict carp production have been occurring at many state and federal levels. Despite being marketed as a sustainable seafood substitute, carp had few commercial uses at the time because of state and federal concerns about it. Instead of only marketing carp as a whole species, some businesses have begun evaluating value-added products of carp fish, such as fillets, and even fillets to enhance the market viability of carp, while creating an economic incentive for population control. A fish protein demand has been rising due to increased health perspectives about bone health, early skin-old age, and medical evidence for a high incidence of heart-related diseases, but there is also evidence of the nutritional health value of carp, specifically the long-term chronic disease and hormone regulation effects that increase their potential good in this market. The market is also expected to grow throughout the period because of lifestyle changes, the pace of urban living, and consumer preference for healthy food.

The Inflation Reduction Act, the CHIPS and Science Act, and other laws have given the United States the chance to increase carpet production to boost domestic manufacturing and lessen reliance on carpets imported from elsewhere.

Report Coverage

This research report categorizes the market for the United States carp market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States carp market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States carp market.

United States Carp Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 7,649.7 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.54% |

| 2035 Value Projection: | USD 13,849.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 209 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Species, By Form |

| Companies covered:: | Invasive Carp Regional Coordinating Committee, Sorce Freshwater Co., Charles Aquaculture, Midwest Fish Co Op, Carp Solutions, Heartland Processing LLC, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States Carp market is boosted by awareness and understanding of the health benefits of the carp fish. Carp fish contains a relatively good level of the health benefits provided by omega-3 fatty acids, iron, vitamin B12, and protein. Omega-3 fatty acids are known to reduce blood pressure, lipids, heart failure, blood clotting, and muscle infinflammation by decreasing the number of free radicals produced during vigorous exercise. Furthermore, government agencies endorsed many events and campaigns to alleviate and promote the health benefits of consuming carp fish, serving as an impetus for market expansion throughout the forecast period.

Restraining Factors

The United States carp market faces obstacles the market’s increasing demand for alternatives such as salmon, tuna, and other seafood. Prepared seafood is favored by consumers, like fillets and canned foods. Sales and exports continue to increase for tuna and salmon. Carp is not a popular fish to eat because it is invasive and has very bony meat, so consumers purchase little carp.

Market Segmentation

The United States carp market share is classified into species and form.

- The grass segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States carp market is segmented by species into grass, silver, common, bighead, catla, and others. Among these, the grass segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven as health consciousness rises, the market is expected to grow throughout the projected period, led by the growing popularity of grass-fish meals. Also, premium fish products will result in an increased intake, lowering the risk of chronic illnesses. Additionally, the market is expanding due to grass product growth in the US.

- The frozen segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the form, the United States carp market is segmented into frozen and canned. Among these, the frozen segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by the increased demand for processed and packaged seafood in which has allowed increased market growth in recent years. In addition to increasing demand for protein-rich seafood, there is also an increasing demand for frozen carp. Elevations in the working population are also predicted to drive increased demand during the forecast period.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States carp market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Invasive Carp Regional Coordinating Committee

- Sorce Freshwater Co.

- Charles Aquaculture

- Midwest Fish Co Op

- Carp Solutions

- Heartland Processing LLC

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States carp market based on the following segments:

United States Carp Market, By Species

- Grass

- Silver

- Common

- Bighead

- Catla

- Others

United States Carp Market, By Form

- Frozen

- Canned

Need help to buy this report?