United States Car Rental Market Size, Share, and COVID-19 Impact Analysis, By Vehicle Type (Luxury Cars, Executive Cars, Economy Cars, SUVs, and MUVs), By Application (Local Usage, Airport Transport, Outstation, and Others), By Booking Mode (Online and Offline/Direct), and U.S. Car Rental Market Insights, Industry Trend, Forecasts to 2033.

Industry: Consumer GoodsUnited States Car Rental Market Insights Forecasts to 2033

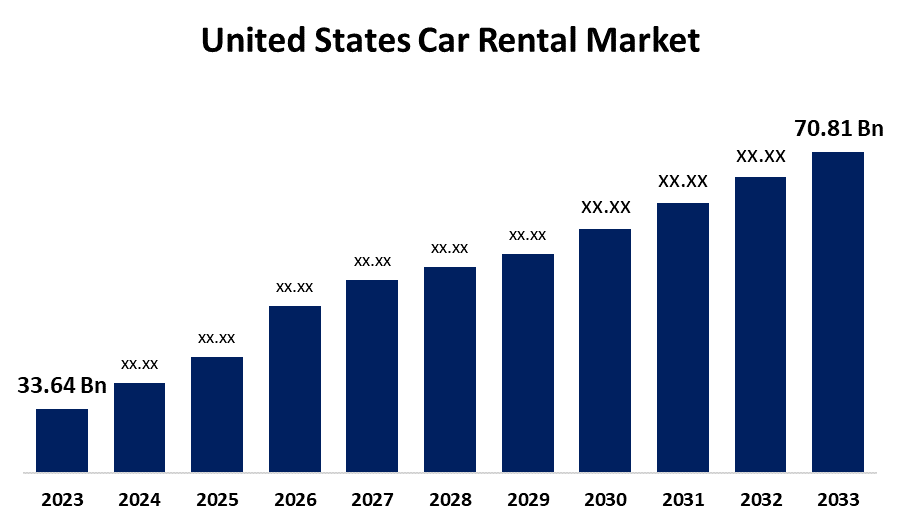

- The United States Car Rental Market Size Was Estimated at USD 33.64 Billion in 2023.

- The Market Size is Growing at a CAGR of 7.73% from 2023 to 2033

- The USA Car Rental Market Size is Expected to Reach USD 70.81 Billion by 2033

Get more details on this report -

The United States Car Rental Market Size is Expected to reach USD 70.81 Billion By 2033, Growing at a CAGR of 7.73% from 2023 to 2033

Market Overview

This sector of the economy, which serves both business and leisure tourists, is referred to as the United States car rental market. This market comprises services from local suppliers, large rental firms, and online platforms that make car reservations easier. The demand for travel associated with tourism is rising, which would increase market demand. The demand for rental cars has increased as more people travel for business, pleasure, and vacation. Additionally, government officials see the potential for boosting discretionary income, so they concentrate on encouraging people to spend more on travel and mobility to spur economic growth. Customers even pay for car rentals for business meetings and vacations. In addition, the Drive Electric Orlando Rental Pilot, which aids consumer adoption of EVs in rental fleets, was partially funded by the U.S. Department of Energy. The government's promotion of clean mobility options is resulting in a rise in the use of electric rental cars and rules that prioritize sustainability.

Report Coverage

This research report categorizes the market for the U.S. car rental market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US car rental market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the USA car rental market.

United States Car Rental Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 33.64 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.73% |

| 2033 Value Projection: | USD 70.81 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Vehicle Type, By Application, By Booking Mode and COVID-19 Impact Analysis |

| Companies covered:: | Enterprise Holdings, Inc., The Hertz Corporation, Avis Budget Group, Sixt, Midway Car Rental, Dollar, Europcar, Fox Rent a Car, Turo, Getaround, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The expanding usage of mobile applications and internet platforms is driving growth in the U.S. car rental business. Also, to improve client happiness and experience, automobile rental companies are integrating digital solutions into their rentals. Additionally, the number of car rental choices has increased due to growing environmental consciousness, especially carpooling, which drastically lowers the number of vehicles on the road. Furthermore, the market is expanding due to rising insurance, parking, and depreciation expenses, urban consumers particularly younger groups and business travelers prioritize flexibility over ownership to save money and avoid commitment.

Restraining Factors

The market for car rental in the United States is hampered by issues like high operating costs, volatile fuel prices, the cost of vehicle maintenance, and regulatory obstacles are some of the challenges facing the US car rental market. Furthermore, industry expansion and profitability are impacted by economic downturns, insurance complexity, and competition from ride-sharing services.

Market Segmentation

The U.S. car rental market share is classified into vehicle type, application, and booking mode.

- The economy cars segment accounted for the largest market share of 30.24% in 2023 and is estimated to grow at a significant CAGR during the projected period.

Based on the vehicle type, the U.S. car rental market is classified into luxury cars, executive cars, economy cars, SUVs, and MUVs. Among these, the economy cars segment accounted for the largest market share of 30.24% in 2023 and is estimated to grow at a significant CAGR during the projected period. This segment is growing due to the increased customer preference for affordability, particularly during difficult economic times. Additionally, economy cars are also renowned for being fuel-efficient, which fits in nicely with the growing desire from consumers for affordable and environmental transport options. In addition, the growing number of car rental companies and their accessibility in suburban and smaller cities increased the appeal of economy rentals.

- The local usage segment accounted for the highest market share of 42.31% in 2023 and is expected to grow at a significant CAGR during the projected timeframe.

Based on the application, the U.S. car rental market is divided into local usage, airport transport, outstation, and others. Among these, the local usage segment accounted for the highest market share of 42.31% in 2023 and is expected to grow at a significant CAGR during the projected timeframe. The demand for local automobile rentals was driven by the increase in urban populations and the growing need for short-term, convenient mobility solutions. Furthermore, long-term car ownership was frequently no longer necessary due to the growing popularity of rental cars for errands, daily commutes, and sporadic travel. The popularity of local rentals was also influenced by their flexibility, reasonable cost, and enhanced accessibility via digital booking systems.

- The online segment anticipated the largest market share of 65.94% in 2023 and is estimated to grow at a significant CAGR during the forecast period.

Based on the booking mode, the U.S. car rental market is classified into online and offline/direct. Among these, the online segment anticipated the largest market share of 65.94% in 2023 and is estimated to grow at a significant CAGR during the forecast period. This segment is growing due to the ability to browse, compare, and book rentals from any location was made possible by the ease and convenience of Internet platforms. Additionally, the popularity of digital booking channels was increased by the growing use of cell phones and internet connectivity. Online offers of enticing discounts, promos, and tailored suggestions encouraged users to use these sites even more.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. car rental market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Enterprise Holdings, Inc.

- The Hertz Corporation

- Avis Budget Group

- Sixt

- Midway Car Rental

- Dollar

- Europcar

- Fox Rent a Car

- Turo

- Getaround

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2025, SIXT opened its 24th Florida facility, its newest in the United States, at the Seminole Hard Rock Hotel & Casino in Hollywood. Through a collaboration with Hard Rock International and Seminole Gaming, this launch got underway by providing Unity by Hard Rock members with special discounts at SIXT locations around the country. In addition to reciprocal advantages from Royal Caribbean and Celebrity Cruises, the Unity loyalty program offers redeemable points for rewards at Hard Rock locations. SIXT and Hard Rock leaders have voiced their excitement about this partnership.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the U.S. car rental market based on the below-mentioned segments

U.S. Car Rental Market, By Vehicle Type

- Luxury Cars

- Executive Cars

- Economy Cars

- SUVs

- MUVs

U.S. Car Rental Market, By Application

- Local Usage

- Airport Transport

- Outstation

- Others

U.S. Car Rental Market, By Booking Mode

- Online

- Offline/Direct

Need help to buy this report?