United States Cannula Market Size, Share, and COVID-19 Impact Analysis, By Product (Cardiac, Dermatology, Nasal, and Others), By Type (Neonatal Cannulae, Straight Cannulae, Winged Cannulae, Wing with Port, and Winged with Stop Cork), and United States Cannula Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited States Cannula Market Size Insights Forecasts to 2035

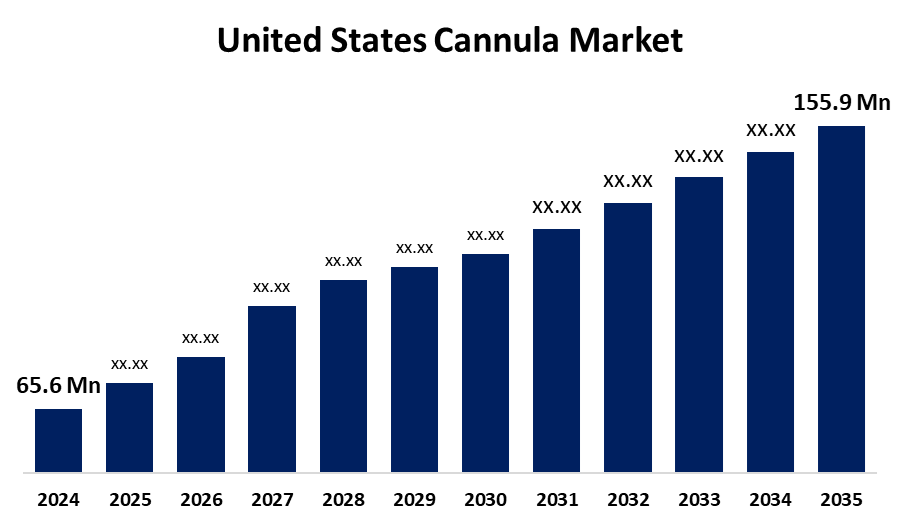

- The US Cannula Market Size Was Estimated at USD 65.6 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.19% from 2025 to 2035

- The US Cannula Market Size is Expected to Reach USD 155.9 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the United States Cannula Market Size is anticipated to reach USD 155.9 million by 2035, growing at a CAGR of 8.19% from 2025 to 2035. The expansion of the United States cannula market is propelled by advances in healthcare infrastructure, a rise in the number of individuals undergoing surgery, and a surge in the number of minimally invasive treatments are some examples of these factors.

Market Overview

A cannula is a tiny, flexible, hollow tube that is used in medicine to enter ducts, veins, arteries, or cavities in the body. The trend towards minimally invasive procedures is becoming more commonplace. Minimally invasive and endoscopic procedures for the treatment of cardiovascular conditions are quickly becoming the procedure of choice for several reasons, including aesthetic results, decreased surgical trauma, fewer incisions, lower risk of infection, fewer wounds, less blood loss, and lower pain. In 2023, the United States had a channel share of greater than 35% of the cannula market. As cardiovascular diseases occur more frequently and hospitalization and mortality rates increase, cardiac cannulas for the delivery of intravenous drugs have increased.

The U.S. federal government supports the medical device sector, which includes cannula producers, with a robust innovation and regulatory ecosystem. The FDA's Centre for Devices and Radiological Health (CDRH) offers initiatives such as the Breakthrough Devices Program, Safer Technologies Program, Pre-Submission meetings, and the Total Product Life Cycle Advisory Program (TAP), which expedite regulatory pathways, offer early feedback, and give priority to review for novel devices.

Report Coverage

This research report categorizes the market for the US cannula market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the USA cannula market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States cannula market.

United States Cannula Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 65.6 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 8.19% |

| 2035 Value Projection: | USD 155.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 149 |

| Tables, Charts & Figures: | 128 |

| Segments covered: | By Product, By Type and COVID-19 Impact Analysis |

| Companies covered:: | Edwards Lifesciences Corp, Boston Scientific Corp, Becton Dickinson & Co, Medtronic, Edward Lifesciences, Smiths Medical, LivaNovaca, Flexicare Medical, Medin Medical Innovations, and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States cannula market is boosted by the minimally invasive procedures that involve incisions which are smaller than a conventional procedure. Minimally invasive surgery can result in less scarring, less pain, quicker recovery, reduced risk of infection, and less trauma. Minimally invasive surgeries are now widely used in numerous medical specialties, including orthopaedic, cardiovascular, gastroenterology, and plastic surgery, due to surgical technological advances in robotic surgery, laparoscopic surgery, endoscopy, and substance therapies. Long-term oxygen therapy (LTOT) is necessary for patients with COPD, especially as the disease progresses, to maintain adequate oxygen levels in their blood.

Restraining Factors

The United States cannula market faces obstacles like the long-term use of a nasal cannula may also loose fitting or poorly fitted nasal cannula, which can lead to discomfort or pressure sore formation. Long-term mishandling of a nasal cannula at higher oxygen concentrations may also lead to oxygen toxicity, but this is infrequent.

Market Segmentation

The United States cannula market share is classified into product and type.

- The cardiac segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States cannula market is segmented by product into cardiac, dermatology, nasal, and others. Among these, the cardiac segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by the growing number of cardiovascular diseases. The number of cardiovascular diseases is increasing for several reasons, including a shift to a sedentary lifestyle, processed foods, and a lack of physical activity. Another major contributor to the increasing number of cardiovascular diseases is attributed to the aging population, which now has a larger portion of elderly individuals than in the past.

- The straight cannulae segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the type, the United States cannula market is segmented into neonatal cannulae, straight cannulae, winged cannulae, wing with Port, and Winged with Stop Cork. Among these, the straight cannulae segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by the advantages of the product design. The second advantage has been the extremely sharp needle feature that allows easy entry of straight cannulae. Cannulae like this are used in cardiac procedures to avoid any accidents and cut down on unnecessary delays, which can potentially interrupt the procedure entirely.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. cannula market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Edwards Lifesciences Corp

- Boston Scientific Corp

- Becton Dickinson & Co

- Medtronic

- Edward Lifesciences

- Smiths Medical

- LivaNovaca

- Flexicare Medical

- Medin Medical Innovations

- Others

Recent Development

- In May 2023, Intuitive Surgical announced that it had received FDA approval for the da Vinci SP surgical system for simple prostatectomy. The system comprises three, wristed, multi-jointed instruments and one fully wristed 3D HD camera. The instruments and camera are integrated via a single cannula.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States cannula market based on the following segments:

United States Cannula Market, By Product

- Cardiac

- Dermatology

- Nasal

- Others

United States Cannula Market, By Type

- Neonatal Cannulae

- Straight Cannulae

- Winged Cannulae

- Wing with Port

- Winged with Stop Cork

Need help to buy this report?