United States Cannabis Testing Market Size, Share, and COVID-19 Impact Analysis, By Technology (Chromatography, Spectroscopy), By Service Type (Potency Testing, Terpene Profiling, Heavy Metal Testing, Pesticide Screening, Microscopy Testing), By End-use (Cannabis Drug Manufacturers, Cannabis Cultivators/Growers, Others), and United States Cannabis Testing Market Insights Forecasts to 2033

Industry: HealthcareUnited States Cannabis Testing Market Insights Forecasts to 2033

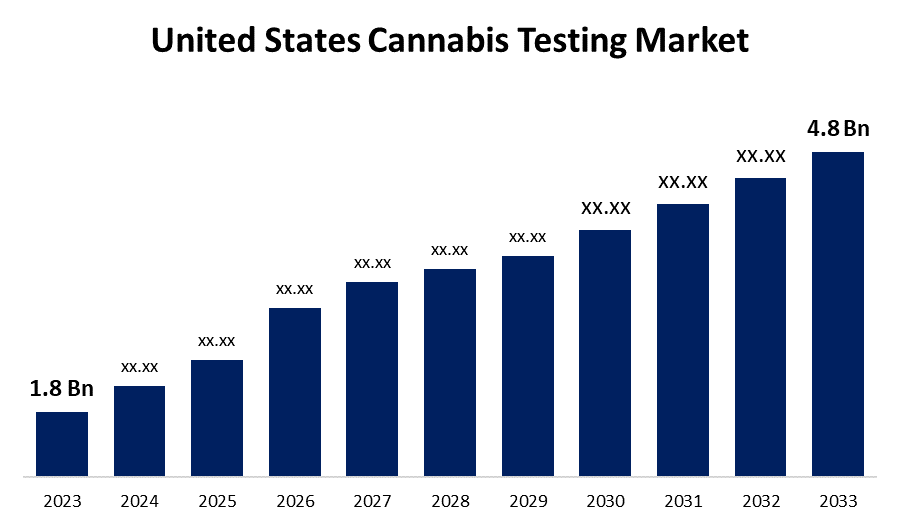

- The United States Cannabis Testing Market Size was valued at USD 1.8 Billion in 2023.

- The Market Size is Growing at a CAGR of 10.3% from 2023 to 2033.

- The United States Cannabis Testing Market Size is Expected to Reach USD 4.8 Billion by 2033.

Get more details on this report -

The United States Cannabis Testing Market Size is expected to reach USD 4.8 Billion by 2033, at a CAGR of 10.3% during the forecast period 2023 to 2033.

Market Overview

Cannabis testing involves identifying active components and key chemical constituents in a marijuana specimen. This screening also includes the detection of fungus and bacteria, both of which can cause disease if not treated. Cannabinoids and terpenes are the primary active ingredients in marijuana that have therapeutic properties. The specimen has a high concentration of an effective component. Cannabis screening is done with analytical techniques such as gas chromatography, liquid chromatography, and spectrometry; professional laboratories in the area offer marijuana testing services. The presence of pesticide residues in a specimen indicates cleanliness and effectiveness. Cannabinoids and terpenes are the primary active ingredients in marijuana that have therapeutic properties. The sample has a high concentration of a therapeutic component. Cannabis testing is the examination of an individual sample of cannabis to determine THC, CBD, and terpene levels, as well as contaminants and impurities such as residual solvents, mold, disease, pests, or pesticide residues. Each state and municipality can set its own standards and regulations for what should be tested and printed on cannabis labels. Individual growers may also choose more stringent standards, including having their samples tested for CBC and CBG levels. This testing can only be done by certified chemists and lab technicians. Previously, cannabis cultivation and sales were prohibited for several years.

Report Coverage

This research report categorizes the market for United States cannabis testing market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States cannabis testing market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the United States cannabis testing market.

United States Cannabis Testing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.8 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 10.3% |

| 2033 Value Projection: | USD 4.8 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Technology, By Service Type, By End-use and COVID-19 Impact Analysis. |

| Companies covered:: | Anresco, SC Labs, Inc, CW Analytical Laboratories, Digipath, Inc, EVIO, Inc, Eurofins Scientific, Pure Analytics LLC, PSI Labs, Green Scientific Labs, Steep Hills, Inc, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Legalization of medical cannabis, combined with the growing number of cannabis testing laboratories. Medical cannabis has proven effective in a variety of medical applications, including reducing chemotherapy-induced nausea, stimulating appetite in AIDS patients, controlling muscular spasms in multiple sclerosis patients, and lowering intraocular pressure in glaucoma patients. Governments are legalizing the use of medical cannabis because of its health benefits. As medical cannabis becomes legal, the demand for analytical testing of cannabis to ensure its safety prior to human consumption has increased during forecast period. According to industry experts, the number of cannabis testing labs is expected to increase at a significant CAGR over the forecast period, owing to rising legalization and adoption of cannabis testing. These trends point to an increase in demand for analytical instrumentation, software, and services for cannabis testing during forecast period.

Restraining Factors

Lack of uniform rules and regulations may hamper the growth of United States cannabis testing market during forecast period. Cannabis has been legalized as a result of its increased medical use. However, the absence of uniform testing standards or stringent rules and regulations has emerged as a major concern.

Market Segment

- In 2023, the spectroscopy segment accounted for the largest revenue share over the forecast period.

Based on the type, the United States cannabis testing market is segmented into chromatography and spectroscopy. Among these, the spectroscopy segment has the largest revenue share over the forecast period. This is owing to the numerous benefits provided by spectroscopy technology, such as real-time analysis, high throughput, and minimal sample preparation requirements. Furthermore, it is more cost effective than its counterpart, which is expected to accelerate the adoption of spectroscopy.

- In 2023, the potency testing segment accounted for the largest revenue share over the forecast period.

Based on the service type, the United States cannabis testing market is segmented into potency testing, terpene profiling, heavy metal testing, pesticide screening, and microscopy testing. Among these, the potency testing segment has the largest revenue share over the forecast period. The market is being driven by the increasing use of effective potency testing techniques such as gas chromatography (GC) and high-performance liquid chromatography (HPLC) for testing samples, as well as the growing demand for examining the potency of various cannabinoids, particularly CBD (Cannabidiol) and tetrahydrocannabinol (THC) in cultivated cannabis.

- In 2023, the cannabis cultivators/growers segment accounted for the largest revenue share over the forecast period.

Based on the end-use, the United States cannabis testing market is segmented into cannabis drug manufacturers, cannabis cultivators/growers, and others. Among these, the cannabis cultivators/growers’ segment has the largest revenue share over the forecast period. Cultivators are signing agreements with testing laboratories and research centers as governments in many countries restrict THC content in cannabis products. Furthermore, these growers must sell different plant varieties based on their CBD and THC content to manufacturers and wholesalers at different prices. These are the dominant factors driving the segmental growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States cannabis testing market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Anresco

- SC Labs, Inc

- CW Analytical Laboratories

- Digipath, Inc

- EVIO, Inc

- Eurofins Scientific

- Pure Analytics LLC

- PSI Labs

- Green Scientific Labs

- Steep Hills, Inc

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In July 2022, Green Scientific Labs Holdings Inc. ("Green Scientific Labs" or the "Company"), a leading multi-state provider of innovative cannabis and hemp testing technologies and methods, has announced the launch of its new laboratory information management system (LIMS) for immediate use across all laboratory operations.

Market Segment

This study forecasts country revenue from 2022 to 2033. Spherical Insights has segmented the United States cannabis testing market based on the below-mentioned segments:

United States Cannabis Testing Market, By Technology

- Chromatography

- Spectroscopy

United States Cannabis Testing Market, By Service Type

- Potency Testing

- Terpene Profiling

- Heavy Metal Testing

- Pesticide Screening

- Microscopy Testing

United States Cannabis Testing Market, By End-Use

- Cannabis Drug Manufacturers

- Cannabis Cultivators/Growers

- Others

Need help to buy this report?