The United States Cannabis Market Size, Share, and COVID-19 Impact Analysis, By Source (Hemp and Marijuanas), By Derivatives (CBD and THC), By Cultivation (Indoor Cultivation and Outdoor Cultivation), and United States Cannabis Market Insights, Industry Trend, Forecasts to 2033.

Industry: HealthcareUnited States Cannabis Market Insights Forecasts to 2033

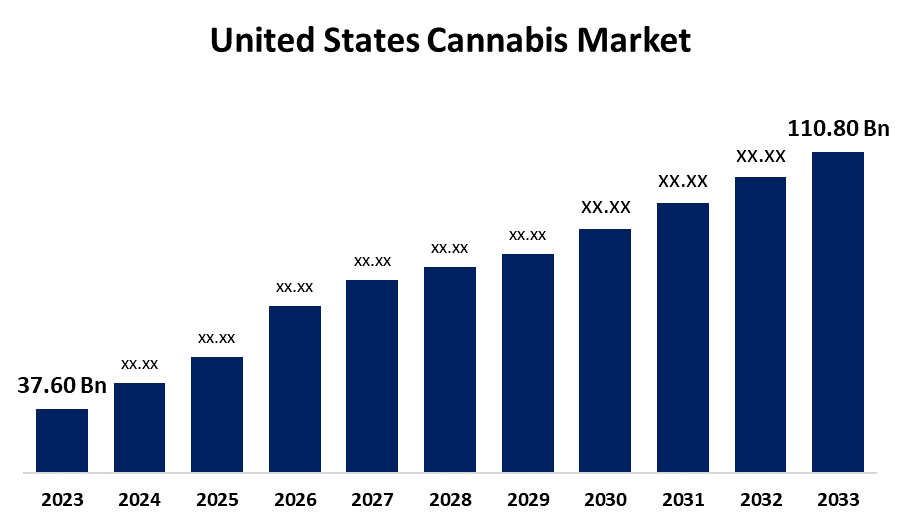

- The U.S. Cannabis Market Size was Valued at USD 37.60 Billion in 2023

- The United States Cannabis Market Size is Growing at a CAGR 11.41% from 2023 to 2033

- The USA Cannabis Market Size is Expected to Reach USD 110.80 Billion by 2033

Get more details on this report -

The USA Cannabis market size is anticipated to exceed USD 110.80 Billion by 2033, growing at a CAGR of 11.41% from 2023 to 2033. The US cannabis industry is growing with legalization, technology, and consumer demand. Federal prohibition and taxation are challenges but not main drivers, whereas THC hegemony, indoor cultivation, and medicinal use fuel growth prospects.

Market Overview

The United States cannabis market is the legal production, cultivation, distribution, and sale of cannabis and cannabis-based products for medical and recreational purposes in the U.S. It encompasses different product segments like flowers, concentrates, edibles, topicals, tinctures, and infused drinks, among others. The market is influenced by state-level legalization, growing consumer acceptance, medical uses, and changing regulatory environments. Moreover, the U.S. cannabis industry is particularly driven by state-splintered laws, federal prohibition tensions, banking limitations, social equity initiatives, and illegal market competition. It is also subject to THC potency trends, tax loads (280E), IP issues, cannabis tourism, and workplace stigma. Furthermore, scientific breakthroughs in cannabinoid conversion distinguish it, making it a very dynamic and changing sector. For instance, in April 2023, CV Sciences, Inc. introduced its +PlusCBD reserve line of additional gummies. The reserve line product line provides a combination of full-spectrum cannabinoids that can be used to bring relief when maximum support is needed. Furthermore, Charlotte's Web, an American firm, entered into a joint venture with AJNA BioSciences PBC, a botanical drug development firm, and British American Tobacco PLC. The acquisition was to acquire FDA approval for full spectrum hemp extract botanical drug.

Report Coverage

This research report categorizes the market for the US cannabis market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the U.S. cannabis market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the USA cannabis market.

United States Cannabis Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 37.60 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 11.41% |

| 2033 Value Projection: | USD 110.80 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 109 |

| Segments covered: | By Source, By Derivatives, By Cultivation |

| Companies covered:: | Tilray Brands, Canopy Growth Corporation, Medical Marijuana, Inc., Aurora Cannabis, CHARLOTTE’S WEB, The Cronos Group, Organigram Holding, Inc, NuLeaf Naturals, LLC, CV Sciences, Inc., Irwin Naturals, Others, |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The USA marijuana industry is distinctively influenced by hyper-local licensing, federal trademark restrictions, cash operations, changing minor cannabinoids (CBN, THCV), and cannabis lounges. State-specific taxation strategies, decarboxylation technologies, celebrity-endorsed brands, and inter-industry tie-ups (beer, wellness) distinguish it further. Medical vs. recreational segmentation, delayed FDA regulatory environments, and laws for public consumption present complexity not found in most sectors, making it extremely volatile and innovation-oriented. Furthermore, in March 2023, +PlusCBD Daily Balance THC-Free Softgels and Gummies are a new product from CV Sciences, Inc. The product is a daily, portable supplement that offers the wellness benefits of CBD.

Restraining Factors

Primary restrictions encompass federal ban, banking limits, excessive taxation, intricate state legislation, black market competition, product safety issues, and licensing obstacles, which all discourage business profitability and market expansion.

Market Segmentation

The U.S. United States cannabis market share is classified into source, derivatives, and cultivation.

- The marijuanas segment accounted for the largest share of the US cannabis market in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

On the basis of source, the United States cannabis market is divided into hemp and marijuanas. Among these, the marijuanas segment accounted for the largest share of the United States cannabis market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. This is because of its market dominance in medical and adult-use sales, collecting more revenue than hemp-derived products. Marijuana's greater THC concentration fuels demand, particularly in states with legal adult-use markets. Hemp-derived CBD is readily available, but marijuana-based products fetch premium prices and greater consumer demand, gaining market leadership.

- The THC segment accounted for a substantial share of the U.S. cannabis market in 2023 and is anticipated to grow at a rapid pace during the projected period.

On the basis of derivatives, the U.S. cannabis market is divided into CBD and THC. Among these, the THC segment accounted for a substantial share of the U.S. cannabis market in 2023 and is anticipated to grow at a rapid pace during the projected period. This is due to their control over recreational and medical cannabis retail sales. THC products, such as flowers, edibles, and vapes, produce more revenue since they are retailed in licensed dispensaries. Though CBD is favored for wellness and pet items, THC's psychoactive properties stimulate more consumer demand and market value.

- The indoor cultivation segment accounted for the largest share of the US cannabis market in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

On the basis of cultivation, the United States cannabis market is divided into indoor cultivation and outdoor cultivation. Among these, the indoor cultivation segment accounted for the largest share of the United States cannabis market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. This due to year-round production, higher potency, and consistent quality. Indoor facilities provide controlled environments, lessening the threats of pests and weather. Though outdoor cultivation is cheaper, indoor-grown cannabis fetches premium prices, rendering it the better option for medical and recreational markets, particularly in states with heavy regulations.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the USA cannabis market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Tilray Brands

- Canopy Growth Corporation

- Medical Marijuana, Inc.

- Aurora Cannabis

- CHARLOTTE’S WEB

- The Cronos Group

- Organigram Holding, Inc

- NuLeaf Naturals, LLC

- CV Sciences, Inc.

- Irwin Naturals

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2024, Rodedawg International Industries, Inc., a cannabis distributor and producer, launched the Nutrient CBD, which consists of five new SKUs, including two CBD Oil Tinctures, two CBD Creams, and one CBD Roll-On, to address the different needs of consumers who look for natural and effective wellness solutions.

Market Segment

This study forecasts revenue at the USA, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the US cannabis market based on the below-mentioned segments:

United States Cannabis Market, By Source

- Hemp

- Marijuanas

United States Cannabis Market, By Derivatives

- CBD

- THC

United States Cannabis Market, By Cultivation

- Indoor Cultivation

- Outdoor Cultivation

Need help to buy this report?