United States Cannabidiol Market Size, Share, and COVID-19 Impact Analysis, By Source Type (Hemp and Marijuana), By Sales Type (B2B and B2C), and United States Cannabidiol Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited States Cannabidiol Market Size Insights Forecasts to 2035

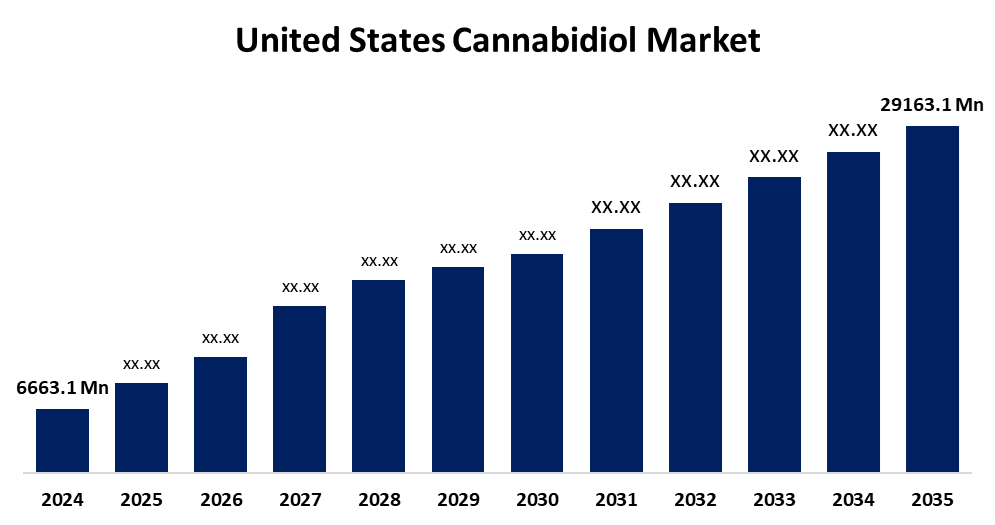

- The US Cannabidiol Market Size Was Estimated at USD 6663.1 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 14.36% from 2025 to 2035

- The US Cannabidiol Market Size is Expected to Reach USD 29163.1 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the United States Cannabidiol Market Size is anticipated to reach USD 29163.1 million by 2035, growing at a CAGR of 14.36% from 2025 to 2035. The expansion of the United States cannabidiol market is propelled by the growing legalization of hemp-based products.

Market Overview

The cannabis plant contains a naturally occurring, non-toxic cannabinoid called cannabidiol (CBD). To meet consumer demand, businesses are launching varieties of cannabidiol products, including edibles, topicals, and drinkable forms. The CBD industry's growth potential has certainly benefited from the rise of e-commerce, allowing businesses to expand their reach and sell through online channels. Given the volume of research being done on cannabidiol's medicinal uses in neurological illnesses, the market for this compound has potential. There is hope for CBD's paradigm-shifting effects on medical processes and patient outcomes as future research plans continue to overcome barriers and utilize its full potential. The therapeutic application of CBD is further researched in neurological disorders in the context of the healthcare industry, which focuses on the neurology sector. Several studies have indicated that CBD, a non-psychoactive component of cannabis, is a viable therapeutic option in neurology.

The U.S. government has taken many important steps to control and promote the market for cannabidiol. Officially codified in USDA's Domestic Hemp Production Program, the Farm Bill eliminated hemp, i.e, ≤0.3% THC, from Schedule I and permitted the legal production of CBD produced from hemp in all states, granting access to interstate commerce and crop insurance.

Report Coverage

This research report categorizes the market for the United States cannabidiol market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States cannabidiol market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States cannabidiol market.

United States Cannabidiol Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 6663.1 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 14.36% |

| 2035 Value Projection: | USD 29163.1 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 189 |

| Tables, Charts & Figures: | 128 |

| Segments covered: | By Source Type, By Sales Type and COVID-19 Impact Analysis |

| Companies covered:: | NuLeaf Naturals, Folium Biosciences, Medical Marijuana Inc, ENDOCA, Cannoid, LLC, Canopy Growth Corporation, Elixinol, NuLeaf Naturals, Isodiol International, and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States cannabidiol market is boosted because of increased awareness of menopausal symptoms, the growing number of women approaching menopause as the female population ages, and consumer desire for safe, efficient treatment choices. Natural and non-hormonal treatments, over-the-counter, customised solutions, and innovations like telemedicine platforms, dietary supplements, and AI-powered wellness tools are all becoming increasingly popular. When combined, these sociocultural, demographic, and product innovation trends are propelling strong market growth.

Restraining Factors

The United States cannabidiol market faces obstacles like the absence of a regulatory framework and the risks of product contamination, particularly in the space of health care. These issues of product safety and regulation restrict market growth and decrease consumer acceptance and confidence.

Market Segmentation

The United States cannabidiol market share is classified into source type and sales type.

- The hemp segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States cannabidiol market is segmented by source type into hemp and marijuana. Among these, the hemp segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by the consumers' understanding of the health benefits and higher demand from the pharmaceutical industry. The demand for cannabidiol in the pharmaceutical realm is expected to increase as the legalisation of medical cannabis continues to grow and consumers are becoming more discretionary with their income.

- The B2B segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the sales type, the United States cannabidiol market is segmented into B2B and B2C. Among these, the B2B segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by the growing number of wholesalers carrying CBD oil and the increasing demand for the raw material. The US, which has legalised CBD products, has also increased consumer acceptance and ability to supply new products.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States cannabidiol market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- NuLeaf Naturals

- Folium Biosciences

- Medical Marijuana Inc

- ENDOCA

- Cannoid

- LLC

- Canopy Growth Corporation

- Elixinol

- NuLeaf Naturals

- Isodiol International

- Others

Recent Development

- In June 2024, Rodedawg International Industries, Inc., a cannabis manufacturer and distributor, introduced the Nutrient CBD, which includes five innovative SKUs, such as two CBD Oil Tinctures, two CBD Creams, and one CBD Roll-On, to meet the various needs of consumers seeking natural and effective wellness solutions.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States cannabidiol market based on the following segments:

United States Cannabidiol Market, By Source Type

- Hemp

- Marijuana

United States Cannabidiol Market, By Sales Type

- B2B

- B2C

Need help to buy this report?