United States Camping and Caravanning Market Size, Share, and COVID-19 Impact Analysis, By Destination Type (State or National Park Campgrounds, Privately Owned Campgrounds, Public or Privately Owned Land Other Than a Campground, Backcountry, National Forest or Wilderness Areas, Parking Lots, and Others), By Type of Camper (Car Camping, RV Camping, Backpacking, and Others), and United States Camping and Caravanning Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsUnited States Camping and Caravanning Market Insights Forecasts to 2035

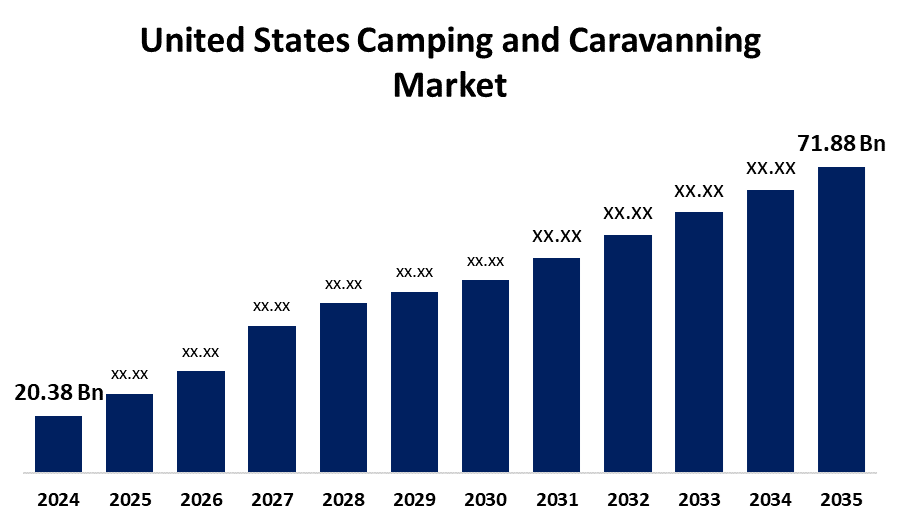

- The U.S. Camping and Caravanning Market Size Was Estimated at USD 20.38 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 12.14% from 2025 to 2035

- The USA Camping and Caravanning Market Size is Expected to Reach USD 71.88 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the US Camping and Caravanning Market Size is Anticipated to reach USD 71.88 Billion by 2035, growing at a CAGR of 12.14% from 2025 to 2035. The U.S. camping and caravanning market is thriving, driven by outdoor recreation trends, RV popularity, and flexible travel preferences, with strong participation from families, retirees, and remote workers seeking nature-based experiences.

Market Overview

The United States camping and caravanning market encompasses the industry involved in providing services and products related to outdoor recreational activities, specifically camping and caravanning. This market includes entities that operate campgrounds, RV parks, and related facilities, as well as manufacturers and retailers of camping and caravanning equipment. Moreover, the growth factors in the U.S. camping and caravanning market include the rise of digital nomadism, increased interest in remote work from scenic locations, and growth of off-grid, tech-enabled camping gear. Additionally, social media trends showcasing minimalist, nature-centric lifestyles have significantly boosted interest among younger, eco-conscious demographics seeking alternative travel experiences. Furthermore, innovations like solar-powered RVs, smart camping gear, and mobile booking apps enhance convenience and sustainability. Key players such as Kampgrounds of America (KOA), Airstream, and Winnebago drive growth through tech integration, nationwide expansion, and lifestyle-focused marketing strategies.

Report Coverage

This research report categorizes the market for the U.S. camping and caravanning market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States camping and caravanning market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the USA camping and caravanning market.

United States Camping and Caravanning Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 20.38 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 12.14% |

| 2035 Value Projection: | USD 71.88 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Destination Type, By Type of Camper and COVID-19 Impact Analysis |

| Companies covered:: | Forest River, Kampgrounds of America (KOA), Grand Design RV, Road Bear RV, Winnebago Industries, Thousand Trails, Coachmen RV, Thor Industries, Camping World Holdings, Newmar and others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Driving the U.S. camping and caravanning market are increasing interest in budget-friendly travel, national park tourism, and health-conscious outdoor activities. Growth in family and multi-generational travel, coupled with expanding campground infrastructure and improved vehicle financing options, also supports broader consumer participation across various income and lifestyle segments.

Restraining Factors

Restraining factors include high upfront costs of RVs, limited campground availability during peak seasons, lack of infrastructure in remote areas, and weather dependency, which can discourage long-term or spontaneous camping plans.

Market Segmentation

The United States camping and caravanning market share is classified into destination type and type of camper.

- The state or national park campgrounds segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States camping and caravanning market is segmented by destination type into state or national park campgrounds, privately owned campgrounds, public or privately owned land other than a campground, backcountry, national forest or wilderness areas, parking lots, and others. Among these, the state or national park campgrounds segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. These destinations are popular due to their scenic beauty, affordability, and well-maintained infrastructure. Government backing ensures accessibility, safety, and amenities, attracting both first-time and experienced campers seeking nature-rich, family-friendly outdoor experiences across the country.

- The RV camping segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States camping and caravanning market is segmented by type of camper into car camping, RV camping, backpacking, and others. Among these, the RV camping segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Its popularity is driven by comfort, mobility, and self-contained amenities, which make it perfect for families and retirees. The growth of remote work and long-distance travel has also spurred RV adoption as a versatile, lifestyle-based camping solution.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US camping and caravanning market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Forest River

- Kampgrounds of America (KOA)

- Grand Design RV

- Road Bear RV

- Winnebago Industries

- Thousand Trails

- Coachmen RV

- Thor Industries

- Camping World Holdings

- Newmar

- Others

Recent Developments:

- In January 2023, THOR Industries (THO) partnered with SpaceX's Starlink to incorporate flat high-performance Starlinks. Even while moving, it offers high-speed, low-latency internet to select motorized RVs in the United States within the THOR family of companies in 2023. THOR will also consider bringing Starlink's cutting-edge connectivity solutions to other RVs produced by their operating companies.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the USA camping and caravanning market based on the below-mentioned segments:

United States Camping and Caravanning Market, By Destination Type

- State or National Park Campgrounds

- Privately Owned Campgrounds

- Public or Privately Owned Land Other Than a Campground

- Backcountry

- National Forest or Wilderness Areas

- Parking Lots

- Others

United States Camping and Caravanning Market, By Type of Camper

- Car Camping

- RV Camping

- Backpacking

- Others

Need help to buy this report?