United States Cake Market Size, Share, and COVID-19 Impact Analysis, By Product (Cupcakes, Sponge Cakes, Dessert Cakes, and Others), By Distribution Channel (Foodservice and Retail), and United States Cake Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesUnited States Cake Market Insights Forecasts to 2035

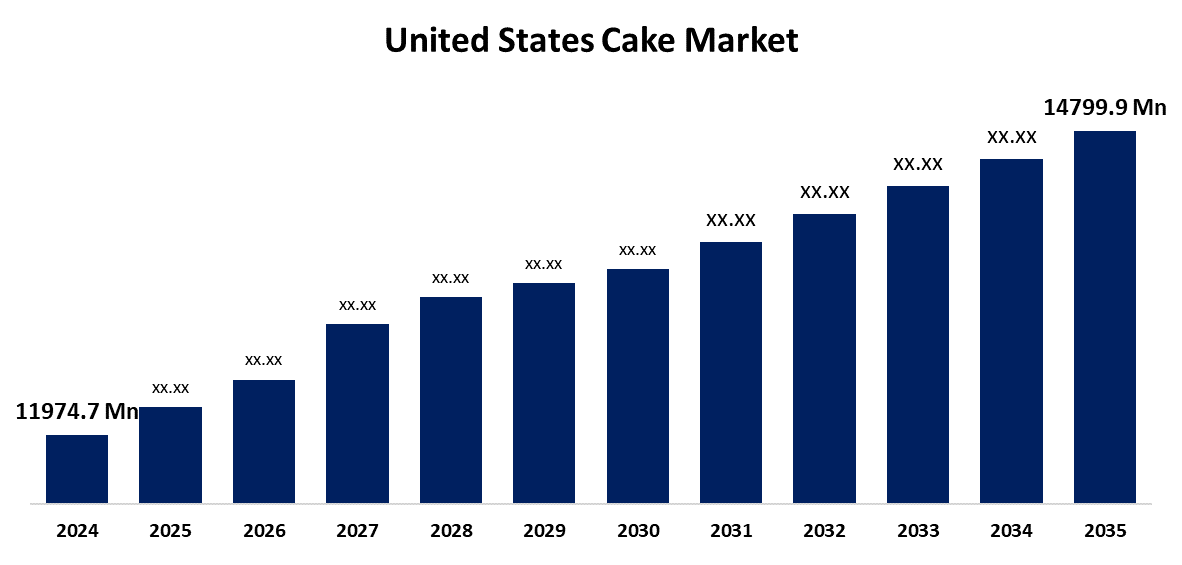

- The US Cake Market Size Was Estimated at USD 11974.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 1.94% from 2025 to 2035

- The US Cake Market Size is Expected to Reach USD 14799.9 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the United States Cake Market Size is Anticipated to Reach USD 14799.9 Million by 2035, Growing at a CAGR of 1.94% from 2025 to 2035. The expansion of the United States cake market is propelled by the widespread use of cake cutting to commemorate a variety of milestones and special occasions.

Market Overview

A cake is often created with a batter consisting of flour, sugar, eggs, oil, liquid, and a leavening agent such as baking soda or powder. Cakes are sweet baked foods made with flour. Furthermore, as millennials and Gen Z consumers increasingly demand cakes as dessert items after meals at dine-out and parties during weekends, the market will keep rising during the projected run period. The gluten-free and organic diet trends that have emerged due to coeliac disease and gluten sensitivity, beginning with health issues and moving towards lifestyle trends, continue to emerge. Non-celiac gluten sensitivity awareness is also on the rise along with a growing level of consumers interested in gluten-free products. Customers who are concerned about their health have expanded the market for delectable cakes that are gluten-free to individuals following a gluten-restricted diet. Consumers are also more willing to pay more for unique cakes that are artisanal, handmade, presented well, including designs, dietary requirements, and messages. This trend is particularly significant with younger consumers and urban markets.

The United States government supports local food systems and small companies through a number of initiatives that boost the cake and bakery market. The USDA's Regional Food Business Centres and Resilient Food Systems Infrastructure have awarded hundreds of millions of dollars in grants to improve local processing capacity, including school and community bakeries, assisting them with staff training, equipment installation, and production expansion.

Report Coverage

This research report categorizes the market for the United States cake market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States cake market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States cake market.

United States Cake Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 11974.7 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 1.94% |

| 2035 Value Projection: | USD 14799.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 160 |

| Tables, Charts & Figures: | 150 |

| Segments covered: | By Product, By Distribution Channel and COVID-19 Impact Analysis. |

| Companies covered:: | Bake’n Joy Foods, McKee Foods Corporation, JM Smucker Co, Campbell Soup Company, Pepperidge Farm, Bimbo Bakeries USA, Hostess Brands, Inc., McKee Foods, Balconi S.p.A. and Others. |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States cake market is boosted by the demand for higher-end and convenience-based food products. Increasing urbanisation has led to more disposable packaged and ready-to-eat cakes being purchased. Celebration and personal spending are being fuelled and facilitated by an increasing number of dual-income households and working professionals. Purchasing bakery items in urban areas is made easier due to better distribution infrastructure. Modern supermarkets and cafe culture are critical to purchasing cakes. Urbanisation also promotes the consumption of cakes, where adoption is higher, enhancing the potential for growth of the cake industry.

Restraining Factors

The United States cake market faces obstacles like the Increasing input costs will be driven by inflation, and consumer demand will be affected by the volatility of input costs, such as eggs, dairy products, wheat, and sugar. Smaller producers may be challenged to absorb higher input costs.

Market Segmentation

The United States cake market share is classified into product and distribution channel.

- The dessert cakes segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States cake market is segmented by product into cupcakes, sponge cakes, dessert cakes, and others. Among these, the dessert cakes segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven as it is the most popular dessert at restaurants and events, dessert cakes, including wedding cakes and ice cream cakes, are still a common choice for celebrations and special events. The customizability of dessert cakes ensures specificity in preferences.

- The retail segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the United States cake market is segmented into foodservice and retail. Among these, the retail segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by consumers who are looking for more unique and high-quality cakes beyond the ordinary, from specialty and artisan cakes for dietary needs, including low-sugar, sugar-free, vegan, or gluten-free.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States cake market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Bake'n Joy Foods

- McKee Foods Corporation

- JM Smucker Co

- Campbell Soup Company

- Pepperidge Farm

- Bimbo Bakeries USA

- Hostess Brands, Inc.

- McKee Foods

- Balconi S.p.A.

- Others

Recent Development

- In February 2023, Bimbo Bakeries USA, a subsidiary of Grupo Bimbo, introduced Entenmann’s first baked donut cake. These are made with ‘‘real ingredients” and contain no artificial colors or high fructose corn syrup, making them an acceptable snack that can be enjoyed as a breakfast, midday, or evening snack.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States cake market based on the following segments:

United States Cake Market, By Product

- Cupcakes

- Sponge Cakes

- Dessert Cakes

- Others

United States Cake Market, By Distribution Channel

- Foodservice

- Retail

Need help to buy this report?