United States C-arms Market Size, Share, and COVID-19 Impact Analysis, By Type (Fixed C-arms, Mobile C-arms {Full-Size C-arms, Mini C-arms}), By Application (Orthopedics & Trauma, Cardiology, Neurology, Gastroenterology, Oncology, Others) By Detector (Flat Panel Detector, Image Intensifier), By End-User (Hospitals, Ambulatory Surgical Centers, and Specialty Clinics), and US C-arms Market Insights Forecasts to 2032

Industry: HealthcareUnited States C-arms Market Insights Forecasts to 2032

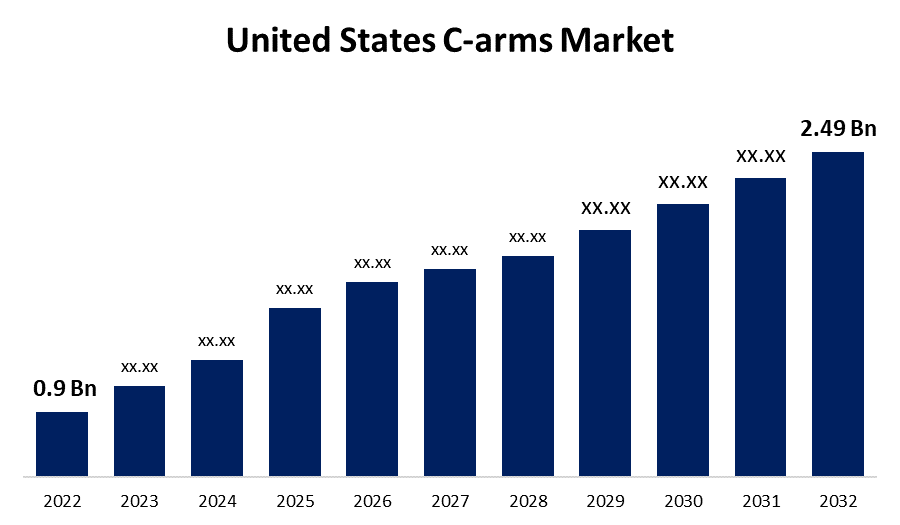

- The United States C-arms Market Size was valued at USD 0.94 Billion in 2022.

- The Market Size is Growing at a CAGR of 10.2% from 2022 to 2032.

- The United States C-arms Market Size is expected to reach 2.49 Billion by 2032.

Get more details on this report -

The United States C-arms Market Size is expected to reach USD 2.49 Billion by 2032, at a CAGR of 10.2% during the forecast period 2022 to 2032.

Market Overview

The C-arm is a medical imaging device that uses X-ray technology and can be used in many different kinds of operation rooms within a clinic. The name is derived from the C-shaped arm that connects the X-ray source and X-ray detector. C-Arms are made up of an X-Ray source generator and an image intensifier for a flat panel detector. It is frequently used for intra-operative imaging in surgery, orthopedics, traumatology, vascular surgery, and cardiology. The device generates high-resolution X-ray images in real time, allowing the surgeon to monitor progress at any point during the surgical process. The rising prevalence of chronic diseases, as well as the increasing number of surgical procedures in fields such as orthopedics, gastroenterology, urology, and others, are driving demand for C-arm machines. Another important factor driving the growth of the US C-arms market is the patient population's preference for minimally invasive surgeries over traditional procedures due to multiple advantages.

Additionally, the rising focus of the market players on developing and introducing novel imaging technologies to cater to the American population's rising demand is another important factor which is driving U.S. C-arms market growth during forecast period.

Report Coverage

This research report categorizes the market for the United States C-arms market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States c-arms market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States c-arms market.

United States C-arms Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 0.94 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 10.2% |

| 2032 Value Projection: | USD 2.49 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type, By Application, By Detector and By End-User |

| Companies covered:: | Siemens Healthcare GmbH, Koninklijke Philips N.V., GE HealthCare, Shimadzu Corporation, Hologic Inc., Ziehm Imaging GmbH, CANON MEDICAL SYSTEMS CORPORATION, Fujifilm Holdings Corporation, and Other key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

C-Arm systems are well-known for their mobility, as they can be moved from one place to another. The unique semi-circular design allows the physician to move it more freely, covering the entire body of the patient and taking images as needed. Additionally, C-arms use Flat Panel Detectors (FPDs), which have several advantages over traditional X-ray film imaging. High sensitivity, short processing time, low geometric distortion, and improved image quality are some of the key advantages. Another major factor contributing to the growing adoption of these products is the increased focus of key market players on developing and introducing new products with FPD technology. The increasing efforts of major players to develop and introduce new products is the main factor which is fuel the U.S. C-arms market growth during the forecast period.

Restraining Factors

The rising demand for C-arm machines among the U.S. healthcare providers is causing manufacturers and suppliers to step up their efforts to meet this demand while enhancing the supply chain. This factor is also increasing major market player's sales of refurbished C-arms to healthcare providers. The high cost of new machine and increasing number of dealers of pre-owned medical devices in the U.S. is another factor contributing to the increasing use of refurbished products among healthcare service providers which anticipated to slow the U.S. C-arms market growth during forecast period.

Market Segment

- In 2022, the mobile C-arms segment is expected to hold the largest share of the United States C-arms market during the forecast period.

Based on the type, the United States C-arms market is classified into fixed C-arms, mobile C-arms (full-size c-arms, mini c-arms). Among these, the mobile C-arms segment is expected to hold the largest share of the United States C-arms market during the forecast period. The growth can be attributed due to the increasing use of these devices in healthcare facilities. One of the prominent advantages of the product that will increase its adoption is its ease of movement and positioning, which allows the patient to move around to get an optimum angle for a high-quality image. The growing awareness of the benefits of mobile c-arms in trauma and spine and joint surgeries is growing the use of full-size c-arms in these procedures, accelerating segment growth during the forecast period.

- In 2022, the cardiology segment accounted for the largest revenue share over the forecast period.

Based on the application, the United States C-arms market is segmented into orthopedics & trauma, cardiology, neurology, gastroenterology, oncology, and others. Among these, the cardiology segment has the largest revenue share over the forecast period. The rising prevalence of cardiovascular diseases and the increasing number of cardiac procedures are two major factors driving the use of c-arm machines during cardiac surgeries. Achieve the high-quality visualization required for complex cardiac procedures. OEC C-arms provide exceptional image quality at a low dose for effective interventional imaging. Interventionalists and surgeons can clearly see the border of the heart, leads, and small guidewires in cardiac imaging. During cardiac procedures, dynamic range management allows for excellent resolution, even with motion.

- In 2022, the flat panel detector (FPD) segment accounted for the largest revenue share over the forecast period.

Based on the detector, the United States c-arms market is segmented into flat panel detector (FPD) and image intensifier. Among these, the flat panel detector (FPD) segment has the largest revenue share over the forecast period. Several advantages of these detectors, including high-resolution images and a compact structure, are driving the segmental growth. Along with this, the increasing availability of technologically advanced flat panel detectors is a major factor driving the segmental growth during forecast period.

- In 2022, the hospitals segment accounted for the largest revenue share over the forecast period.

Based on the end user, the United States C-arms market is segmented into hospitals, ambulatory surgical centers, and specialty clinics. Among these, the hospitals segment has the largest revenue share over the forecast period. The reason for the expansion is the increase in the number of surgical procedures in various areas such as cardiology and oncology, among others, in hospitals. Real-time views of the gallbladder, liver, bone, and other structures can be obtained during surgeries. Multiple views of the same part are possible, allowing systems to later reconstruct a 3D model of the inner parts.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States C-arms market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Siemens Healthcare GmbH

- Koninklijke Philips N.V.

- GE HealthCare

- Shimadzu Corporation

- Hologic Inc.

- Ziehm Imaging GmbH

- CANON MEDICAL SYSTEMS CORPORATION

- Fujifilm Holdings Corporation

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2023, Canon Medical Systems Corporation established Celex, a multipurpose C-arm system with advanced DR technology that offers a wide range of radiographic imaging capabilities.

- In November 2021, Fujifilm Holdings Corporation introduced the Persona CS mobile C-arm to expand its product portfolio and provide better image guidance in a variety of procedures such as orthopedic, trauma, and pain management.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2032. Spherical Insights has segmented the United States c-arms market based on the below-mentioned segments:

United States C-arms Market, By Type

- Fixed C-arms

- Mobile C-arms {Full-Size C-arms, Mini C-arms}

United States C-arms Market, By Application

- Orthopedics & Trauma

- Cardiology

- Neurology

- Gastroenterology

- Oncology

- Others

United States C-arms Market, By Detector

- Flat Panel Detector

- Image Intensifier

United States C-arms Market, By End User

- Hospitals

- Ambulatory Surgical Centers

- Specialty Clinics

Need help to buy this report?