United States Butter Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Salted Butter, Unsalted Butter, Whipped Butter, and Clarified Butter), By Sales Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retail, and Specialty Stores), and United States Butter Market Insights, Industry Trend, Forecasts to 2035.

Industry: Consumer GoodsUnited States Butter Market Insights Forecasts to 2035

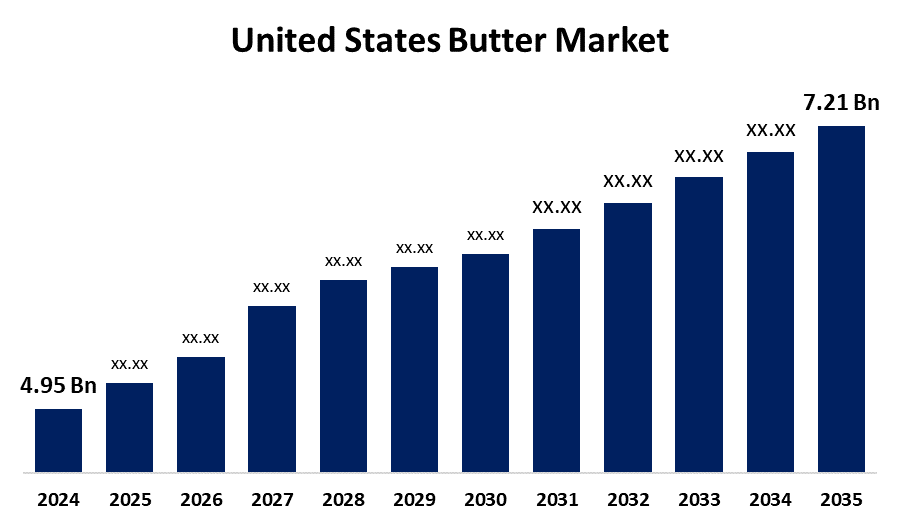

- The United States Butter Market Size was estimated at USD 4.95 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.48% from 2025 to 2035

- The United States Butter Market Size is Expected to Reach USD 7.21 Billion by 2035

Get more details on this report -

The United States Butter Market Size is anticipated to reach USD 7.21 Billion by 2035, growing at a CAGR of 3.48% from 2025 to 2035. The butter market in the US is expanding, spurred by the rising popularity of organic, grass-fed, and artisanal butter products; advancements in butter production and packaging continue to occur. Other noteworthy drivers of market growth include a shift toward natural food products, increased demand for healthy fats, and the revival of home-baking.

Market Overview

The global butter market includes an entire process of butter production, distribution, and consumption; as well as by-products relating to both flavored butters and plant-based butter substitutes. The market is a fundamental sector in the global food industry. As consumer health concerns continue to rise, consumers look for food products that are labeled as natural, additive-free, and more recently as fat-free alternatives. Increased information around dietary fat and its role in health, has propelled the healthier movement towards other options. The movement towards healthier options and attention to the food consumers are eating is evidenced even further as more home cooks and bakers are seeking quality ingredients like butter. The increase in at home cooking and baking has increased demands for butter. The increasing preferences for high-fat diets with the ketogenic and paleo diets highlight butter consumption as a preferred form of fat incorporating the idea of back-to-basics food consumption which has also been a trend in the United States food market area. Market strength is supported by an infrastructure that includes modern production facilities, effective supply chains, and more targeted marketing campaigns. Domestic consumption remains high in the U.S. because butter continues to be used in traditional recipes and in contemporary culinary development. Butter's weight in the United States is part of the prior agricultural history of the country during colonial days when butter was a much-traded and important product for a home. Early butter production was a labor-intensive process that depended on families making their butter on family farms as they did for all of the products they made at their farm. When butter production moved to commercial production, many systems were developed to manufacture butter more efficiently, and the quality of butter was enhanced through the use of more sophisticated technologies.

Within the U.S, the Butter Market has opportunities to serve niche markets in lactose-free and flavored butter. Also there has been an increase in interest for specialty butters made with herbs, spices or other products that would be attractive to health conscious and gourmet consumers. The trend of sustainable food sourcing has seen a prolonged increase of interest. Whenever prices dropped, the United States government would offer direct payments to dairy farmers to stabilize the butter market and to support domestic production. Food Safety Modernization Act (FSMA), or Act to Prevent Food Safety Hazards (FSMA) under the Food Safety and Inspection Service of the USDA, establishes requirements for food production, processing, and packaging to ensure that butter manufacturers use proper quality control processes and maintain sanitary food production facilities.

Report Coverage

This research report categorizes the market for the United States butter market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States butter market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States butter market.

United States Butter Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4.95 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.48% |

| 2035 Value Projection: | USD 7.21 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 213 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Product Type (Salted Butter, Unsalted Butter, Whipped Butter, and Clarified Butter), By Sales Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retail, and Specialty Stores) |

| Companies covered:: | Borden Dairy Company, Organic Valley, Land O’Lakes, Kirkland Signature, President Butter, Hopkins Butter, Plugra, BelGioioso Cheese, Dairy Farmers of America, Tillamook, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the US Butter Market Industry is greatly driven by the growing awareness of health among consumers in the United States. More and more people are realizing the benefits of their consumption regarding healthy natural fats and butter and high-quality demand has increased. The heightened use of dairy based ingredients in foods has positively impacted the US Butter Market Industry. Many food manufacturers are choosing to replace artificially produced ingredients with natural ingredients, increasing the demand for butter as an item of necessity. A movement toward clean label has also increased the demand for natural butter in the food industry. Additionally, the shift in consumer preferences towards natural and organic products has created a growth opportunity for the USA butter market. The recovery and growth of the foodservice industry in the United States are paramount to the US Butter Market Industry. Eating out has become a common phenomenon, and with the increased demand for fine dining restaurants and food establishments, consumers are determined that their dining experience be filled with genuine washes of flavor. Butter has been offered as a principal raw material by chefs and restaurant owners for use in different types of cuisine. The increase in consumption of dairy-based ingredients for the making of various food products is a boon for the US Butter Market Industry. They have started switch-ing away from artificial ingredients to real and natural ingredients. That leaves butter measuring up since it is a primary ingredient. Consumers have also been more aware of the health benefits of butter, harming free omega-3 claims and a natural fat type composition. As such, consumers are finding butter to be a better-for-you alternative. Additionally, more disposable income allows for the purchase of premium butter products.

Restraining Factors

The butter industry has been under sustainability pressures as a result of environmental considerations. As demand for sustainable products continues to spike, butter makers are taking a more thoughtful look at their environmental impact, and especially trying to produce more sustainably. Sustainable production is an important trend in almost all industries, and so butter being among the goods consumers think of as appealing will have to conform. Price instability is another source of resistance for market growth because fluctuations in the cost of butterfat, milk, and other dairy inputs can be impacted by things like feed prices, climate changes, and global trade disruptions. Price instability can be difficult for smaller butter makers who may struggle to adjust to rushes in input prices which makes market participation difficult. Changes with supply chain robustness include climate related events and political instability which can drive supply shortages and price instability. Changes occurring in online grocery and home delivery may also lead to lesser impulse buying and cross category which impact butter sales in the forecasted period. The slow process of obtaining government approvals for health claims and certifications can hinder the growth of specific butter products, especially those with novel ingredients or health benefits restrain the market growth.

Market Segmentation

The United States butter market share is classified into product type and sales channel.

- The salted butter segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States butter market is segmented by product type into salted butter, unsalted butter, whipped butter, and clarified butter. Among these, salted butter the segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The market leader position for salted butter exists because consumers prefer it over unsalted butter and it provides a longer storage period which makes it the top choice in household kitchens. The foodservice industry relies heavily on salted butter as a popular ingredient for cooking and baking applications which continues to cement its position in the market. The product remains highly attractive to people who seek stronger flavor experiences particularly when they prepare baked goods and savory meals.

- The supermarkets/hypermarkets segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States butter market is segmented by sales channel into supermarkets/hypermarkets, convenience stores, online retail, and specialty stores. Among these, supermarkets/hypermarkets the segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. Segmental growth is mainly because of their extensive availability and the user-friendly experience they deliver to the public. Supermarkets draw consumers through their extensive selection of butter products which include many different brand names and varieties. The increase in butter sales results from different factors such as rising consumer interest in organic items and healthier fat alternatives and heightened dairy product consumption. The majority of butter-related retail transactions take place in supermarkets and hypermarkets which together act as the main distribution outlets.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States butter market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Borden Dairy Company

- Organic Valley

- Land O'Lakes

- Kirkland Signature

- President Butter

- Hopkins Butter

- Plugra

- BelGioioso Cheese

- Dairy Farmers of America

- Tillamook

- Others

Recent Developments:

- In August 2022, Dairy Farmers of America (DFA), a national milk marketing cooperative in the US, has purchased two ESL processing plants from dairy company SmithFoods. Executive vice president of DFA, stated, There is growing consumer interest in extended shelf-life dairy products and this acquisition is part of our strategy to increase commercial investments and expand our ownership in this area.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States Butter Market based on the below-mentioned segments:

United States Butter Market, By Product Type

- Salted Butter

- Unsalted Butter

- Whipped Butter

- Clarified Butter

United States Butter Market, By Sales Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail

- Specialty Stores

Need help to buy this report?