United States Business Travel Market Size, Share, and COVID-19 Impact Analysis, By Type (Budget, Cruise, Luxury, Specialty, and Business Travel), By Age Group (Millennial, Generation Z, and Baby Boomers), and US Business Travel Market Insights, Industry Trend, Forecasts to 2035

Industry: Automotive & TransportationUSA Business Travel Market Insights Forecasts to 2035

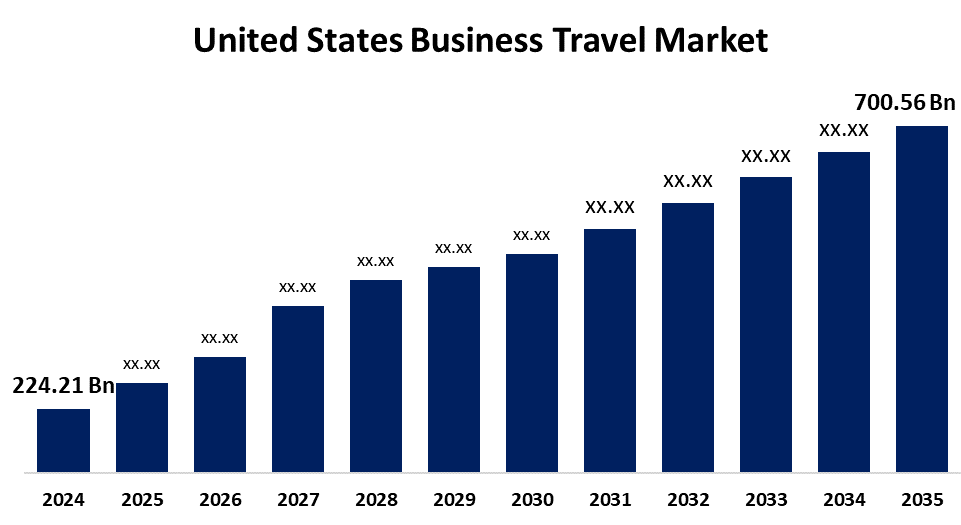

- The US Business Travel Market Size was Estimated at USD 224.21 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 10.91% from 2025 to 2035

- The USA Business Travel Market Size is Expected to Reach USD 700.56 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the US Business Travel Market Size is Anticipated to reach USD 2.587 Billion by 2035, Growing at a CAGR of 10.91% from 2025 to 2035. The US business travel market is primarily driven by domestic networks, international travel demand, and the weakening dollar, attracting more visitors to the country for business purposes.

Market Overview

The business travel market in the United States includes both managed and unmanaged travel, including airfare, hotel, food, and associated services, as well as professional travel for corporate meetings, trade exhibitions, marketing events, and business expansion. A nation's economy, GDP growth, industrial production, and job creation all depend on SMEs. Their expansion is being propelled by government assistance and the growing number of SMEs in both developed and developing nations. Trends impacting corporate travel are causing major changes in business travel. It entails taking advantage of new business growth potential in addition to attending conferences and seminars. Business travel is important for teamwork, networking, customer relations, and professional development. Due to the availability of hybrid modes and the demand for environmentally friendly travel options, the business travel market in the United States is anticipated to grow. The market is anticipated to expand as a result of rising domestic travel, female business travel, Gen Z travel, and millennials.

Report Coverage

This research report categorizes the market for the US business travel market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US business travel market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US business travel market.

United States Business Travel Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 224.21 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 10.91% |

| 2035 Value Projection: | USD 700.56 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 160 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Type, By Age Group and COVID-19 Impact Analysis. |

| Companies covered:: | Topdeck Travel Ltd., BCD Travel, Exodus Travels Ltd., Intrepid Travel, TCS World Travel, Booking Holdings Inc., American Express, Abercrombie and Kent UA LLC, and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Business travel has changed dramatically as a result of technological advancements, which have improved efficiency, convenience, and the overall travel experience. Travel planning is now more convenient and easier due to virtual and augmented reality technologies. Travelers are now safer because of security technologies like biometric identification, real-time tracking, and emergency support systems. By giving access to the greatest services, cutting down on administrative overhead costs, and guaranteeing adherence to travel regulations, technologies also help businesses maximize their travel expenditures. The market is anticipated to grow even more as a result of businesses implementing technology. Corporate events are essential for brand awareness, employee motivation, customer behavior influence, and strategy communication. The travel demand has further increased due to the expansion of small and medium-sized businesses (SMEs).

Restraining Factors

The US business travel market is hindered by economic uncertainty, government policies, rising costs, virtual meetings, environmental concerns, and geopolitical instability, affecting companies' ability to expand and adapt.

Market Segmentation

The USA business travel market share is classified into type and age group.

- The luxury segment held the fastest CAGR rate in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US business travel market is segmented by type into budget, cruise, luxury, specialty, and business travel. Among these, the luxury segment held the fastest CAGR rate in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to high-net-worth individuals and corporate executives seeking comfort, exclusivity, and premium services during business trips. Key trends include personalized experiences, sustainable luxury, and technological integration.

- The millennial segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US business travel market is segmented by age group into millennial, generation Z, and baby boomers. Among these, the millennial segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is owing to a growing demographic with tech-savvy, experience-driven, and flexible travel preferences. They prefer digital solutions, work-life integration, sustainability, customizable itineraries, and networking opportunities.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US business travel market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Topdeck Travel Ltd.

- BCD Travel

- Exodus Travels Ltd.

- Intrepid Travel

- TCS World Travel

- Booking Holdings Inc.

- American Express

- Abercrombie and Kent UA LLC

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the US business travel market based on the below-mentioned segments:

US Business Travel Market, By Type

- Budget

- Cruise

- Luxury

- Specialty

- Business Travel

US Business Travel Market, By Age Group

- Millennial

- Generation Z

- Baby Boomers

Need help to buy this report?