United States Bucket Testing Software Market Size, Share, and COVID-19 Impact Analysis, By Type (Web Based, Mobile Based, Full Stack), By Application (Email Marketing, Product Pricing), By End User (Large Enterprises, SMEs) and United States Bucket Testing Software Market Insights Forecasts to 2033

Industry: Electronics, ICT & MediaUnited States Bucket Testing Software Market Insights Forecasts to 2033

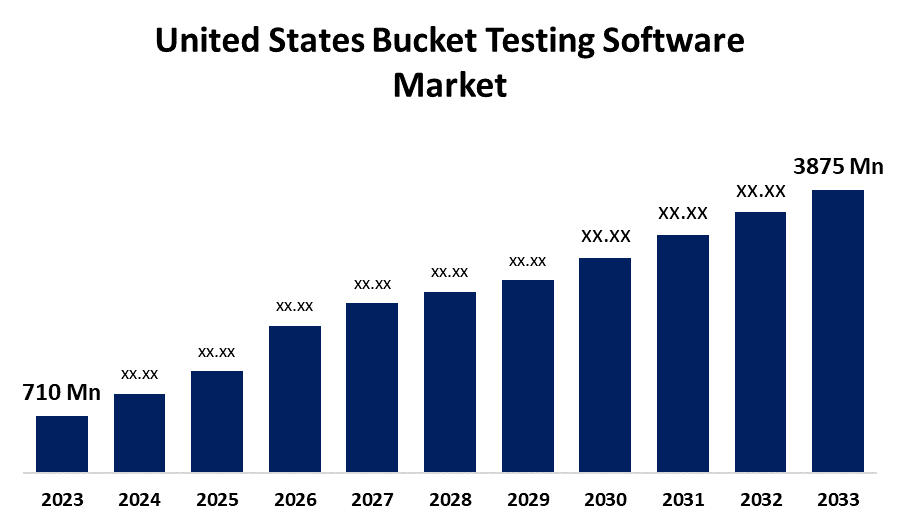

- The United States Bucket Testing Software Market Size was valued at USD 710 Million in 2023.

- The Market Size is Growing at a CAGR of 18.5% from 2023 to 2033.

- The United States Bucket Testing Software Market Size is Expected to Reach USD 3875 Million by 2033.

Get more details on this report -

The United States Bucket Testing Software Market Size is expected to reach USD 3875 Million by 2033, at a CAGR of 18.5% during the forecast period 2023 to 2033.

Market Overview

The United States bucket testing software market is expanding rapidly, owing to a shift in digital optimization strategies. As businesses strive to improve user experiences and increase online engagement, the demand for sophisticated testing solutions has grown dramatically. Bucket testing software has emerged as a critical tool, enabling businesses to run-controlled experiments and optimize various aspects of their digital platforms. This includes improving website layouts, experimenting with different content variations, and fine-tuning user interfaces. The market is seeing increased adoption across a variety of industries, from e-commerce to SaaS, as businesses recognize the importance of data-driven decision-making in remaining competitive. Businesses are using bucket testing software to iteratively refine and optimize their digital presence in the dynamic and competitive online landscape, with the goal of improving conversion rates, lowering bounce rates, and, ultimately, increasing overall customer satisfaction. As a result, the United States bucket testing software market is poised for long-term growth as businesses prioritize agile and evidence-based approaches to digital experience optimization.

Report Coverage

This research report categorizes the market for United States bucket testing software market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States bucket testing software market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the United States bucket testing software market.

United States Bucket Testing Software Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 710 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 18.5% |

| 2033 Value Projection: | USD 3875 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application, By End User |

| Companies covered:: | Optimizely, Adobe Target, Google Optimize, VWO (Visual Website Optimizer), Split.io, Apptimize, LaunchDarkly, Convert and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rapid adoption of agile development methodologies has become a pillar of modern software development practices, propelling the United States bucket testing software market. Organizations around the world are adopting agile software development approaches because of their ability to improve collaboration, flexibility, and responsiveness in the face of changing project requirements. Agile development emphasizes iterative cycles and continuous integration, which necessitates robust testing solutions that can be seamlessly integrated into the development pipeline. Bucket testing software is critical in this context, allowing developers to run controlled experiments, A/B testing, and multivariate testing in real time. As companies strive to release high-quality software at a faster rate, the demand for bucket testing software grows, making it a key driver in the US market's upward trend. The growing reliance on cloud computing services, combined with the ongoing wave of digital transformation initiatives, is driving the United States bucket testing software market. As businesses move their operations to the cloud and create a variety of web and mobile applications, the need for comprehensive testing solutions grows.

Restraining Factors

Data security and privacy concerns are a significant restrain for the United States bucket testing software market. As businesses conduct experiments involving sensitive user data, ensuring compliance with privacy regulations and protecting against potential breaches is critical. Mishandling personal information during testing procedures can result in legal ramifications and undermine user trust. To protect user data during the testing process, software providers must prioritize robust security measures such as encryption protocols and industry standard compliance.

Market Segment

- In 2023, the web-based segment accounted for the largest revenue share over the forecast period.

Based on the type, the United States bucket testing software market is segmented into web based, mobile based, and full stack. Among these, the web-based segment has the largest revenue share over the forecast period. Due to the growing demand for improving user experiences on websites, web-based bucket testing software has become widely adopted. As businesses prioritize their online presence, the demand for efficient testing solutions to improve website layouts, content variations, and user interfaces has grown. Web-based bucket testing software offers businesses a simple and accessible platform for conducting controlled experiments, allowing them to refine and personalize digital content based on user behavior. This segment's dominance is bolstered by the growing importance of web applications in a variety of industries, including e-commerce, finance, healthcare, and more.

- In 2023, the email marketing segment accounted for the largest revenue share over the forecast period.

Based on the application, the United States bucket testing software market is segmented into email marketing and product pricing. Among these, the email marketing segment has the largest revenue share over the forecast period. Email marketing's ascendancy in the bucket testing software landscape is driven by the critical role email campaigns play in businesses' digital marketing strategies across a wide range of industries. Email marketing remains a foundation for customer engagement, communication, and conversion, and the ability to optimize email content through controlled experiments is critical. Bucket testing software designed specifically for email marketing applications allows businesses to refine and personalize email campaigns by testing elements such as subject lines, content variations, and call-to-action buttons. This optimization is critical for increasing open rates, click-through rates, and overall campaign effectiveness.

- In 2023, the large enterprises segment accounted for the largest revenue share over the forecast period.

Based on the end-user, the United States bucket testing software market is segmented into large enterprises and SMEs. Among these, the large enterprises segment has the largest revenue share over the forecast period. Large enterprises, with their vast resources and complex software ecosystems, have been at the forefront of implementing bucket testing software to optimize their digital offerings and improve user experience. The segmental strong dominance can be attributed to a variety of factors, including the need for large enterprises to maintain a competitive edge in the digital landscape, the need to scale and customize testing processes for diverse product lines, and the growing reliance on data-driven decision-making to drive business growth. Furthermore, the increased emphasis on customer satisfaction and the need to reduce the risks associated with software updates and feature releases have prompted large corporations to invest heavily in bucket testing software solutions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States bucket testing software market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Optimizely

- Adobe Target

- Google Optimize

- VWO (Visual Website Optimizer)

- Split.io

- Apptimize

- LaunchDarkly

- Convert

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts country revenue from 2022 to 2033. Spherical Insights has segmented the United States bucket testing software market based on the below-mentioned segments:

United States Bucket Testing Software Market, By Type

- Web Based

- Mobile Based

- Full Stack

United States Bucket Testing Software Market, By Application

- Email Marketing

- Product Pricing

United States Bucket Testing Software Market, By End User

- Large Enterprises

- SMEs

Need help to buy this report?