United States Bromine Market Size, Share, and COVID-19 Impact Analysis, By Derivative (Organobromine, Clear Brine Fluids and Hydrogen Bromide), By Application (Flame Retardants, PTA Synthesis, Water Treatment & Biocides, HBR Flow Batteries), and Others and United States Bromine Market Insights Forecasts to 2033

Industry: Chemicals & MaterialsUnited States Bromine Market Insights Forecasts to 2033

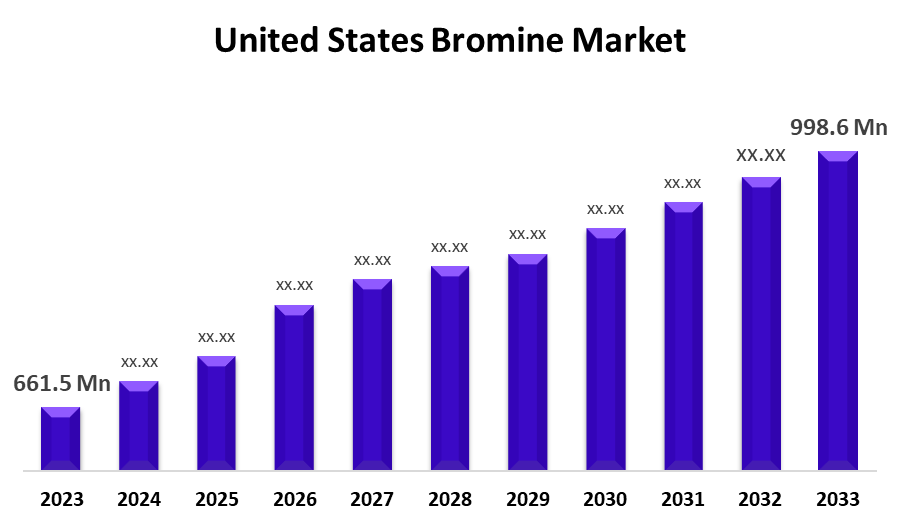

- The United States Bromine Market Size was valued at USD 661.5 Million in 2023.

- The Market Size is Growing at a CAGR of 4.2% from 2023 to 2033.

- The United States Bromine Market Size is Expected to Reach USD 998.6 Million by 2033.

Get more details on this report -

The United States Bromine Market Size is Expected to Reach USD 998.6 Million by 2033, at a CAGR of 4.2% during the forecast period 2023 to 2033.

Market Overview

When bromine, a volatile substance, evaporates quickly at room temperature, it produces a red vapour. It has nearly three times the density of water. When bromine comes into contact with flesh, it becomes corrosive and can burn it. It is also soluble in organic solvents and has a low boiling point. This type of technology is increasingly being used in the workplace and at home. It is primarily used in the production of flame retardants, which are substances added to furniture, plastics, and fabrics to reduce the risk of fire. Bromine is a chemical that is used to make a variety of products, including medications, water treatment products, and agricultural chemicals. These compounds are commonly used in the production of fuel additives, in addition to being used as a catalyst in chemical reactions.

Report Coverage

This research report categorizes the market for United States bromine market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States bromine market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the United States bromine market.

United States Bromine Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 661.5 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.2% |

| 2033 Value Projection: | USD 998.6 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Derivative, By Application |

| Companies covered:: | Mil-Spec Industries, Albemarle Corporation, Lanxessa AG, BariteWorld, Unibromo USA, Tetra Technologies and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Several organizations and businesses are working hard to develop sustainable lithium-ion battery alternatives. Bromine compounds, such as bromine-based drilling fluids, are used in the oil and gas industry to conduct drilling operations. Energy exploration and production can have an impact on bromine demand. Bromine is particularly useful in water treatment applications for controlling microorganism growth and maintaining water quality in cooling towers and swimming pools. As waterborne diseases become more prevalent, demand for bromine may rise as water treatment systems improve. The market is expected to grow due to rising pharmaceutical industries and drug development. Bromine compounds are primarily used in the pharmaceutical industry for the synthesis of medications and drugs. Growth and innovation in the pharmaceutical industry may have an impact on bromine sales in the market. Various brominated compounds, such as brominated flame retardants, have been subject to stringent environmental regulations and environmental concerns. Changes in regulations may have an impact on the demand for certain bromine products.

Restraining Factors

Bromine use and production can have a negative impact on the environment. Brominated compounds have the potential to be hazardous to both the environment and human health. Because of increased regulatory scrutiny, more environmentally friendly bromine production processes have emerged. Because of its potential toxicity and environmental impact, bromine is subject to a number of regulations and restrictions. The production, handling, and disposal of brominated compounds are highly regulated due to the bromine industry's stringent regulations. Businesses find it difficult to keep up with regulations because they can change at any time.

Market Segment

- In 2023, the hydrogen bromide segment accounted for the largest revenue share over the forecast period.

Based on the derivative, the United States bromine market is segmented into organobromine, clear brine fluids and hydrogen bromide. Among these, the hydrogen bromide segment has the largest revenue share over the forecast period, owing to its properties and versatility. It improves the properties of chemical compounds such as organobromine, terephthalic acid, inorganic bromides, zinc bromides, sodium, and calcium. Its primary applications are oxidation and catalysis.

- In 2022, the flame retardants segment accounted for the largest revenue share over the forecast period.

Based on the application, the United States bromine market is segmented into flame retardants, PTA synthesis, water treatment & biocides, and HBR flow batteries. Among these, the flame retardants segment has the largest revenue share over the forecast period. Bromine is used in a variety of industries, including shipbuilding, due to stringent fire safety regulations. When bromiated flame retardants are applied to any material, they help to prevent fires from spreading. Brominated flame retardants are one of the most commonly used flame retardants in a variety of industries.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States bromine market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Mil-Spec Industries

- Albemarle Corporation

- Lanxessa AG

- BariteWorld

- Unibromo USA

- Tetra Technologies

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In September 2020, The U.S. Department of Energy (DOE) has selected Albemarle Corporation as a critical partner for two lithium research projects over three years through a Battery Manufacturing Lab Call. On the company's approved projects, Albemarle will collaborate with two DOE labs: Argonne National Laboratory and Pacific Northwest National Laboratory.

Market Segment

This study forecasts country revenue from 2022 to 2033. Spherical Insights has segmented the United States bromine market based on the below-mentioned segments:

United States Bromine Market, By Derivative

- Organobromine

- Clear Brine Fluids

- Hydrogen Bromide

United States Bromine Market, By Application

- Flame Retardants

- PTA Synthesis

- Water Treatment & Biocides

- HBR Flow Batteries

Need help to buy this report?