United States Brachytherapy Market Size, Share, and COVID-19 Impact Analysis, By Product (Seeds, Electronic Brachytherapy, and Applicators & Afterloaders), By Application (Prostate Cancer, Breast Cancer, Gynaecological Cancer, and Others), and United States Brachytherapy Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited States Brachytherapy Market Insights Forecasts to 2035

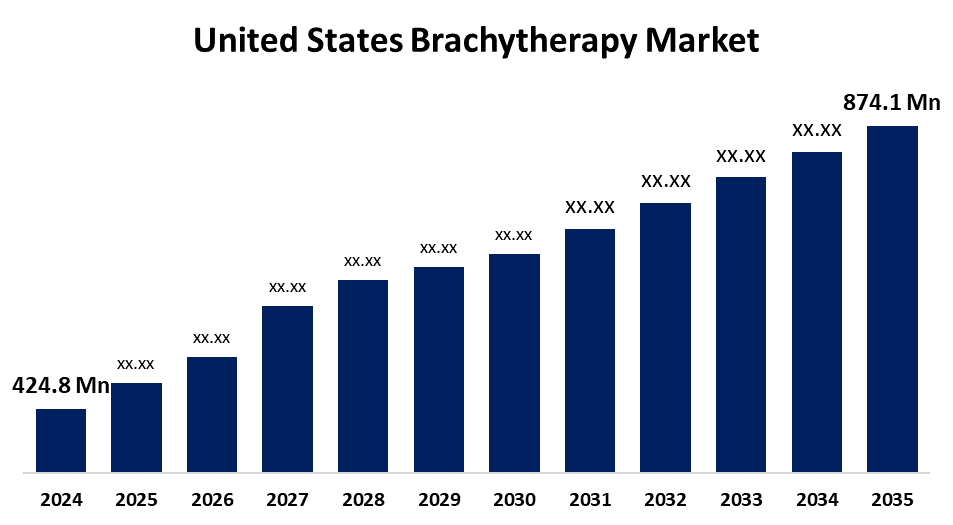

- The US Brachytherapy Market Size Was Estimated at USD 424.8 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.75% from 2025 to 2035

- The US Brachytherapy Market Size is Expected to Reach USD 874.1 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States Brachytherapy Market is anticipated to reach USD 874.1 million by 2035, growing at a CAGR of 6.75% from 2025 to 2035. The expansion of the United States brachytherapy market is propelled by the rising incidence of cancer, improvements in technology, and a notable increase in the use of brachytherapy.

Market Overview

Brachytherapy, referred to as internal radiation therapy, is a cancer treatment in which a sealed radioactive source is positioned inside or close to a tumour to give high radiation doses to the cancer cells while limiting exposure to nearby healthy tissue. Radiation therapy can have a curative, palliative, or preventive effect. Also, it can be delivered on its own or together with immunotherapy, chemotherapy, or surgery as an adjuvant. More physicians are applying radiation therapy because of its various applications. New advancements in radiation therapy allow for to delivery of high doses to the region of interest, with the least harm to surrounding healthy tissues. Radiation therapy has seen demand increase because of improved cure rates and more opportunities for localized tumor control. There are promising encourages for development in the use of artificial intelligence (AI) for planning and delivery of brachytherapy. AI can improve technical advances, increase planning speeds, optimize dose distribution, improve treatment precision, and develop new investments. Emerging economies present unexplored markets for brachytherapy and offer a possible substantial economic growth opportunity. The growth and support for healthcare infrastructure and awareness of new cancer treatment options assist in supporting these economies. Collaborations among stakeholders, hospitals, and academia could provide opportunities for market development with support for new brachytherapy solutions, expedite regulatory approvals, and enhance market access.

Report Coverage

This research report categorizes the market for the United States brachytherapy market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States brachytherapy market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States brachytherapy market.

United States Brachytherapy Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 424.8 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.75% |

| 2035 Value Projection: | USD 874.1 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 122 |

| Segments covered: | By Product, By Application, and COVID-19 Impact Analysis |

| Companies covered:: | IsoRay, Roper Technologies Inc, Becton Dickinson and Co, Best Medical International Inc., Best Vascular Inc., Boston Scientific Corporation, COOK Medical Inc, C. R. Bard Inc., Gammex Inc., Oncura Inc, Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States brachytherapy market is boosted by the increasing number of diseases like prostate, breast, and cervical cancers. A variety of initiatives, including incentives, grants, and campaigns aimed at raising general awareness about cancer care, are stimulating and developing the pillar of cancer treatment infrastructure that enables professionals to spend funds on brachytherapy services and equipment. Brachytherapy is becoming a common therapeutic strategy for cancer management because it can provide a highly targeted and effective treatment, either as an individual treatment plan or as a complementary part of a larger treatment plan. As cancers continue to grow, the desire and need for new treatment options, like those offered through brachytherapy treatment options will increase.

Restraining Factors

The United States brachytherapy market faces obstacles as it requires some infrastructure and equipment to accomplish treatment planning, planning for delivery of radiotherapy, and ensuring patient safety, which can represent a considerable initial capital investment.

Market Segmentation

The United States brachytherapy market share is classified into product and application.

- The applicators & afterloaders segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States brachytherapy market is segmented by product into seeds, electronic brachytherapy, and applicators & afterloaders. Among these, the applicators & afterloaders segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by the fact that they are less invasive and more effective than some other forms of treatment. A device, called an afterloader, is used to transport the radioactive sources to the treatment site. A radioactive source is briefly placed in the tumor and removed for HDR brachytherapy.

- The prostate cancer segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the United States brachytherapy market is segmented into prostate cancer, breast cancer, gynaecological cancer, and others. Among these, the prostate cancer segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled as it has several advantages compared to other therapies. These advantages will make the procedure attractive to most patients and include a shorter treatment duration, faster recovery time, low risk of side effects due to accurate and precise radiation dosing, an effective therapy for patients with cancer recurrence, and the opportunity to safely increase the delivered dose to the tumor while limiting the dose to adjacent organs, like the rectum, bladder, and urethra.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States brachytherapy market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- IsoRay

- Roper Technologies Inc

- Becton Dickinson and Co

- Best Medical International Inc.

- Best Vascular Inc.

- Boston Scientific Corporation

- COOK Medical Inc

- C. R. Bard Inc.

- Gammex Inc.

- Oncura Inc

- Others

Recent Development

- In May 2024, GT Medical teamed up with Theragenics Corporation to expand GammaTile Therapy availability for brain tumors.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States brachytherapy market based on the following segments:

United States Brachytherapy Market, By Product

- Seeds

- Electronic Brachytherapy

- Applicators & Afterloaders

United States Brachytherapy Market, By Application

- Prostate Cancer

- Breast Cancer

- Gynaecological Cancer

- Others

Need help to buy this report?