United States Botulinum Toxin Market Size, Share, and COVID-19 Impact Analysis, By Type (Botulinum Toxin Type A and Botulinum Toxin Type B), By End user (Specialty & Dermatology Clinics, Hospitals & Clinics, and Others), and United States Botulinum Toxin Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited States Botulinum Toxin Market Insights Forecasts to 2035

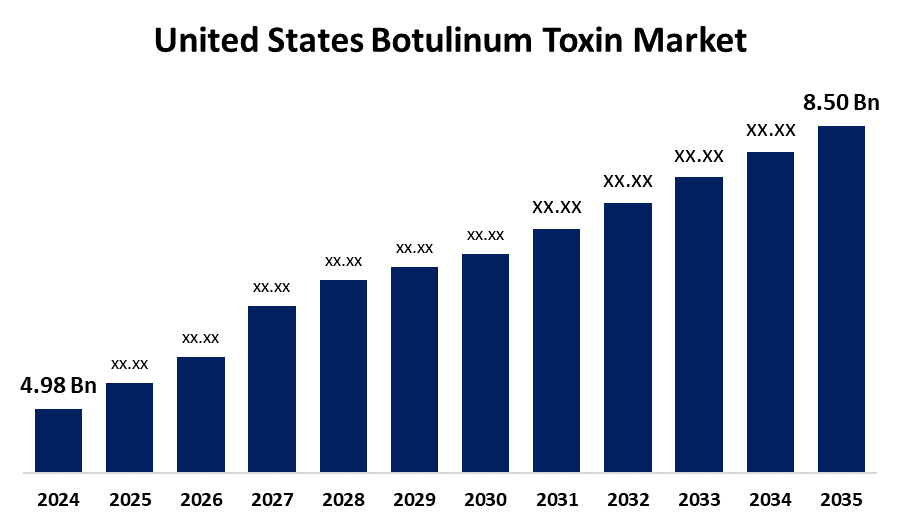

- The United States Botulinum Toxin Market Size was Estimated at USD 4.98 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.98% from 2025 to 2035

- The United States Botulinum Toxin Market Size is Expected to Reach USD 8.50 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the United States Botulinum Toxin Market Size is Anticipated to Reach USD 8.50 Billion by 2035, Growing at a CAGR of 4.98% from 2025 to 2035. The U.S. botulinum toxin market growth is driven by rising demand for non-invasive cosmetic procedures, increased awareness of aesthetic and therapeutic benefits, and expanding applications in medical conditions like migraines and muscle disorders. Advances in safer, longer-lasting formulations and greater availability through specialty clinics also boost adoption, supported by favourable regulatory frameworks and growing disposable incomes.

Market Overview

The United States botulinum toxin market encompasses the development, manufacturing, and distribution of botulinum toxin products used primarily for cosmetic and therapeutic purposes. These products, mainly botulinum toxin type A, are widely employed to treat wrinkles, muscle spasticity, chronic migraines, and hyperhidrosis. Market growth is driven by increasing consumer demand for minimally invasive aesthetic procedures, rising awareness about cosmetic treatments, and expanding therapeutic applications. The presence of well-established companies with advanced formulations strengthens the market by offering safe and effective treatment options. Opportunities lie in ongoing research and development for new indications, improved toxin variants with longer-lasting effects, and expanding use in dermatology and neurology. Additionally, the growing number of specialty clinics enhances treatment accessibility. Government initiatives, such as the FDA’s streamlined approval processes and support for clinical research, further facilitate innovation and product availability. Overall, the U.S. market is poised for steady growth due to technological advancements, increasing patient awareness, and favourable healthcare infrastructure.

Report Coverage

This research report categorizes the market for the United States botulinum toxin market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States botulinum toxin market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States botulinum toxin market.

United States Botulinum Toxin Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4.98 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 4.98% |

| 2035 Value Projection: | USD 8.50 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 160 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By End user, and COVID-19 Impact Analysis. |

| Companies covered:: | Galderma Laboratories, L.P., AbbVie Inc., Revance Therapeutics, Inc., Evolus, Inc., Supernus Pharmaceuticals, Inc., US WorldMeds, LLC, Pfizer Inc., Zimmer Biomet, Anika Therapeutics Inc., Suneva Medical, Inc., Syneron Candela, Medytox USA, Daewoong Pharmaceutical USA, Eisai Inc., Hugel America and Others. |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rising demand for minimally invasive cosmetic procedures aimed at reducing wrinkles and fine lines, and increasing awareness of aesthetic treatments, along with growing disposable incomes, encourages more patients to seek botulinum toxin injections. Additionally, expanding applications in therapeutic areas such as migraine, muscle spasticity, and hyperhidrosis boost market growth. The approval of newer botulinum toxin formulations with improved efficacy and safety profiles also attracts healthcare providers and patients alike. Additionally, technological advancements and strategic collaborations among key players enhance product availability and adoption. The growing popularity of specialty and dermatology clinics offering personalized treatments further drives the market, making botulinum toxin therapy more accessible and convenient for consumers across the U.S.

Restraining Factors

The high treatment costs limit access for many patients, safety concerns and potential side effects reduce consumer confidence. Additionally, the rise of Imitation products poses health risks and damages trust. Strict regulatory requirements also slow product approvals, hindering innovation and delaying market entry for newer, potentially more effective formulations.

Market Segmentation

The United States botulinum toxin market share is classified into type and end user.

- The botulinum toxin type A segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States botulinum toxin market is segmented by type into botulinum toxin type A and botulinum toxin type B. Among these, the botulinum toxin type A segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to its widespread use in both cosmetic and therapeutic applications. It offers longer-lasting effects, higher efficacy, and fewer side effects compared to type B. Popular brands further drive its dominance, supported by strong clinical adoption and continuous innovation across aesthetic and medical fields.

- The specialty & dermatology segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States botulinum toxin market is segmented by end user into specialty & dermatology clinics, hospitals & clinics, and others. Among these, the specialty & dermatology segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to their focus on aesthetic treatments, high patient volume, and expertise in administering cosmetic injectables. These clinics offer personalized care, quick procedures, and growing accessibility, making them the preferred choice for botulinum toxin applications, especially in facial rejuvenation and wrinkle reduction.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States botulinum toxin market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Galderma Laboratories, L.P.

- AbbVie Inc.

- Revance Therapeutics, Inc.

- Evolus, Inc.

- Supernus Pharmaceuticals, Inc.

- US WorldMeds, LLC

- Pfizer Inc., Zimmer Biomet

- Anika Therapeutics Inc.

- Suneva Medical, Inc.

- Syneron Candela

- Medytox USA

- Daewoong Pharmaceutical USA

- Eisai Inc.

- Hugel America

- Others

Recent Developments:

- In October 2024, the AbbVie company (NYSE: ABBV) announced the U.S. FDA approval of BOTOX® Cosmetic for temporary improvement in the appearance of moderate to severe vertical bands connecting the jaw and neck (platysma bands) in adults.1 BOTOX® Cosmetic is the first and only product with four aesthetic indication areas: forehead lines, frown lines, crow's feet lines, and now platysma bands, making it the first product of its kind to go beyond the face.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the USA, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States botulinum toxin market based on the below-mentioned segments:

U.S. Botulinum Toxin Market, By Type

- Botulinum Toxin Type A

- Botulinum Toxin Type B

U.S. Botulinum Toxin Market, By End-user

- Specialty & Dermatology Clinics

- Hospitals & Clinics

- Others

Need help to buy this report?