United States Bottling Line Machinery Market Size, Share, and COVID-19 Impact Analysis, By Application (Water, Soft Drinks, Alcoholic Beverages, Juice, and Milk), By Machine Type (Rinser, Filler, Capper, Labeler, and Conveyor), and United States Bottling Line Machinery Market Insights, Industry Trend, Forecasts to 2035

Industry: Machinery & EquipmentUnited States Bottling Line Machinery Market Insights Forecasts to 2035

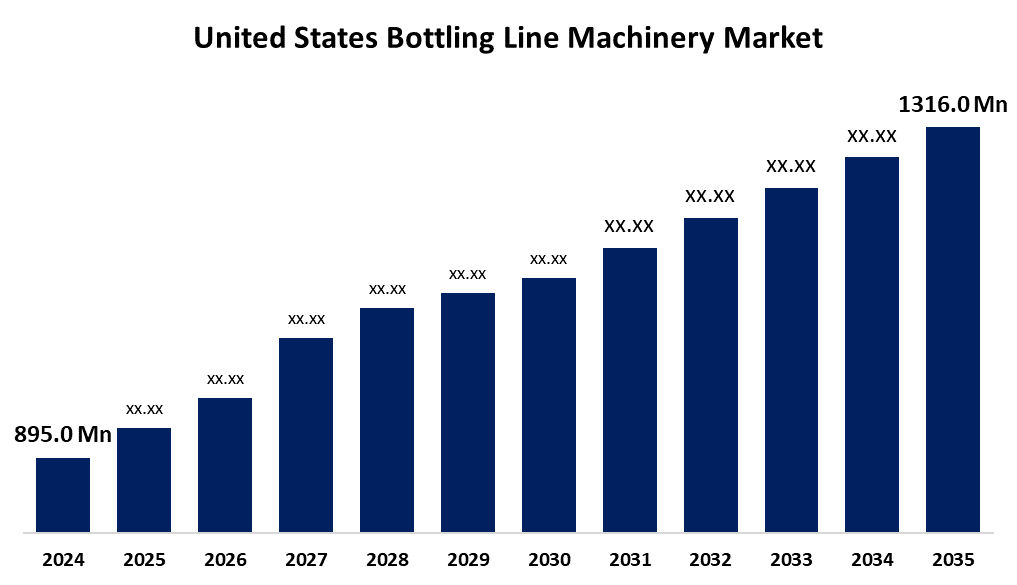

- The U.S. Bottling Line Machinery Market Size was Estimated at USD 895.0 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.57% from 2025 to 2035

- The USA Bottling Line Machinery Market Size is Expected to Reach USD 1316.0 Million By 2035.

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States Bottling Line Machinery Market Size is Anticipated to reach USD 1316.0 Million by 2035, Growing at a CAGR of 3.57% from 2025 to 2035. The Growth of the United States bottling line machinery market is driven by rising demand for packaged beverages, advancements in automation and AI, and increased pharmaceutical applications. Sustainability trends, e-commerce expansion, and the need for flexible, efficient production systems also contribute. Additionally, strict government regulations promote the adoption of modern, compliant machinery, further boosting market development.

Market Overview

The United States bottling line machinery market refers to the automated systems used for filling and packaging beverages, pharmaceuticals, and other liquid products. This growth is primarily driven by the rising demand for packaged beverages such as bottled water, soft drinks, and functional drinks, as well as the increasing need for pharmaceutical bottling solutions. Technological advancements in automation, artificial intelligence, and robotics have significantly boosted production efficiency and reduced labor dependence. The market is further strengthened by a robust U.S. manufacturing base, continuous innovation, and strict quality control standards. Opportunities lie in the growing push for sustainability, with increased demand for energy-efficient, eco-friendly bottling solutions, and the expansion of e-commerce, which requires flexible and scalable bottling systems. Government initiatives and regulations, such as NSF/ANSI and ISO/TC standards, ensure hygiene and safety in bottling processes, encouraging the adoption of advanced, compliant machinery.

Report Coverage

This research report categorizes the market for the United States bottling line machinery market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States bottling line machinery market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States bottling line machinery market.

United States Bottling Line Machinery Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 895.0 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 3.57% |

| 2035 Value Projection: | USD 1316.0 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Application, By Machine Type, and COVID-19 Impact Analysis. |

| Companies covered:: | Barry-Wehmiller Companies, ProMach Inc., Accutek Packaging Equipment, APACKS, Dixie Canner Co., Uni-Pak, ASBECO, FS-Elliott, Rotex Global, Oystar USA, and Others. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing demand for packaged beverages, including soft drinks, bottled water, and functional beverages, is a primary driver. This surge in demand has led manufacturers to invest in advanced bottling technologies to enhance production efficiency and meet consumer expectations. Technological advancements, particularly in automation and robotics, have revolutionized bottling processes. The integration of artificial intelligence (AI), machine learning, and the Internet of Things (IoT) enables real-time monitoring, predictive maintenance, and improved operational efficiency, reducing downtime and enhancing product quality. Additionally, the growing emphasis on sustainability has prompted the development of energy-efficient machinery and eco-friendly packaging solutions, aligning with environmental regulations and consumer preferences.

Restraining Factors

The High initial capital expenditures for advanced automated systems deter small and medium-sized enterprises from adopting new technologies. Additionally, the complexity of maintaining sophisticated equipment requires specialized skills, leading to increased operational costs. Environmental regulations further challenge companies to retrofit existing lines to meet sustainability standards, adding to financial and operational burdens.

Market Segmentation

The United States bottling line machinery market share is classified into application and machine type.

- The water segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States bottling line machinery market is segmented by application into water, soft drinks, alcoholic beverages, juice, and milk. Among these, the water segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is attributed to the increased demand for advanced automotive and efficient filling solutions in the bottling industry. Additionally, advancements, e-commerce and direct-to-consumer sales channels has further fueled the need for flexible bottling systems.

- The filler segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States bottling line machinery market is segmented by machine type into rinser, filler, capper, labeler, and conveyor. Among these, the filler segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the consumers' increased concerns related to health and urbanization, leading to a growth in packaged drinking water demand. Advancements in automation and technology have led to increased demand for efficient and precise filling solutions across various industries, including food and beverages, pharmaceuticals, and cosmetics.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States bottling line machinery market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Barry-Wehmiller Companies

- ProMach Inc.

- Accutek Packaging Equipment

- APACKS

- Dixie Canner Co.

- Uni-Pak

- ASBECO

- FS-Elliott

- Rotex Global

- Oystar USA

- Others

Recent Developments:

- In October 2024, Accutek introduced filling machines with multi-stroke functionality, enabling precise, incremental fills. These machines are controlled via an intuitive touchscreen interface, enhancing fill accuracy and operational efficiency.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the U.S., regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States bottling line machinery market based on the below-mentioned segments:

USA Bottling Line Machinery Market, By Application Type

- Water

- Soft Drinks

- Alcoholic Beverages

- Juice

- Milk

USA Bottling Line Machinery Market, By Machine Type

- Rinser

- Filler

- Capper

- Labeler,

- Conveyor

Need help to buy this report?