United States Botanical Drugs Market Size, Share, and COVID-19 Impact Analysis, By Source (Algae-Based, Fungi-Based, Plant-Based, and Others), By Form (Powder, Capsules, Tablets, Solutions, and Others), By Therapeutic Indication (Gastrointestinal Disorders, Cardiovascular Diseases, Respiratory Diseases, and Others), By Distribution Channel (Retail Pharmacies, Online Providers, and Hospital Pharmacies), and US Botanical Drugs Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUSA Botanical Drugs Market Insights Forecasts to 2035

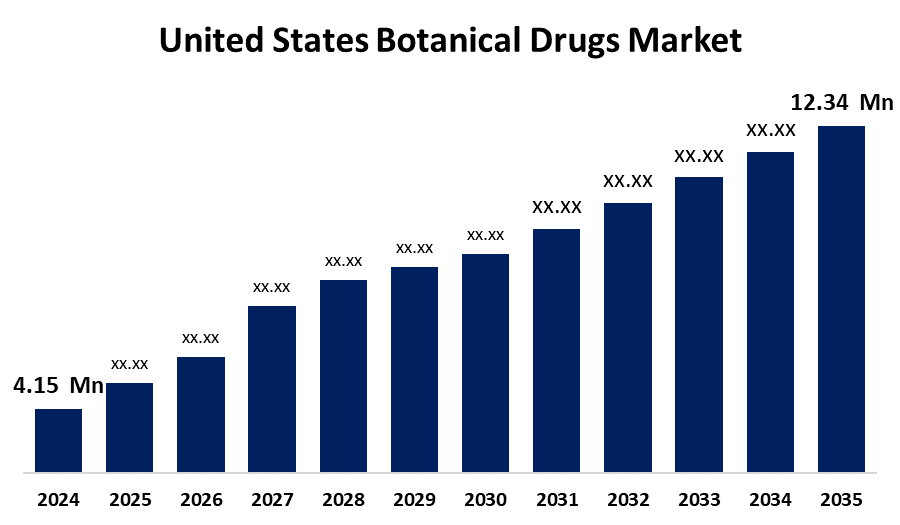

- The US Botanical Drugs Market Size was estimated at USD 4.15 Million in 2024

- The Market Size is expected to grow at a CAGR of around 10.41% from 2025 to 2035

- The USA Botanical Drugs Market Size is expected to reach USD 12.34 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the US Botanical Drugs Market is anticipated to reach USD 12.34 million by 2035, growing at a CAGR of 10.41% from 2025 to 2035. This growth is attributed to increasing consumer preference, advancements in extraction technologies, FDA support, rising chronic disease incidences, and growing awareness of botanical drug benefits.

Market Overview

The market for botanical drugs in the US depends predominantly on pharmaceuticals made from plants that are used to treat, diagnose, or prevent human illnesses. These medications have to satisfy stringent FDA approval procedures for quality, safety, and efficacy, unlike dietary supplements. Products made from botanical drugs are meant for use in identifying, treating, curing, mitigating, or preventing human illnesses. They are made up of vegetable materials, including macrofungi, algae, and plant materials. These products may come in a variety of forms, including topicals, elixirs, tablets, capsules, solutions, and injections. Their complex mixtures, lack of an active ingredient, and significant human use are some of their distinctive characteristics. The market is anticipated to be driven by government initiatives and a greater emphasis on herbal medicines. The demand for botanical drugs is supported by low technical expertise and low capital investments. The healthcare industry's emphasis on creating novel medications is additionally anticipated to fuel market demand.

The increasing prevalence of gastrointestinal diseases escalates the need for botanical drugs and medicinal supplements derived from plants and herbal sources, leading to the acceleration of the market growth. For instance, the data provided by Oshi Health states that in April 2020, gastrointestinal diseases, such as IBD, GRD, and IBS, affected up to 70 million Americans annually, twice as many as those with diabetes. The direct healthcare costs for these diseases are estimated to be $136 billion in the U.S., surpassing heart disease and mental health disorders.

Report Coverage

This research report categorizes the market for the US botanical drugs market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US botanical drugs market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US botanical drugs market.

United States Botanical Drugs Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4.15 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 10.41% |

| 2035 Value Projection: | USD 12.34 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 125 |

| Segments covered: | By Source, By Form, By Therapeutic Indication, By Distribution Channel and COVID-19 Impact Analysis |

| Companies covered:: | Ransom Naturals Ltd, Zein Pharma, Tsumura & Co., Devonian Health Group Inc., KPC Pharmaceuticals, Abbott Laboratories, Evonik, Jguar Health, Inc., Boiron, Wilson Drugs & Pharmaceuticals Private Limited, Himalya Wellness Company, and Others key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

Improvements in botanical research and clinical trials, which demonstrate the therapeutic potential of plant-based compounds, propel the market for botanical drugs. Clinical trials are being used to develop these medications, confirming their safety and effectiveness and leading to market acceptance and regulatory approval. One of the main global drivers of the growing demand for natural treatments is the increased awareness and acceptance of herbal medicine. Demand for the product is anticipated to be driven by government initiatives for the use and approval of botanical drugs, which require less technical know-how and low capital expenditures. The market is expanding as a result of the increasing use of botanical medicine in dermatology, which is fueled by the prevalence of skin conditions and the demand for potent medications to treat long-term conditions like diabetes and cancer.

Restraining Factors

The US market for botanical drugs faces obstacles such as supply chain limitations, competition from synthetic drugs, complicated FDA approval, and supply chain issues.

Market Segmentation

The USA botanical drugs market share is classified into source, form, therapeutic indication, and distribution channel.

- The plant-based segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US botanical drugs market is segmented by source into algae-based, fungi-based, plant-based, and others. Among these, the plant-based segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to the growing research on the phytochemical constituents of the plants, extensive usage of the polyphenols and flavonoids supplements, and effective and eligible.

- The tablets segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US botanical drugs market is segmented by form into powder, capsules, tablets, solutions, and others. Among these, the tablets segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental expansion is attributed to the ease of administration, patient compliance, longer shelf life, greater physical and chemical stability, better disintegration rate, and rapid onset of action.

- The cardiovascular diseases segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US botanical drugs market is segmented by therapeutic indication into gastrointestinal disorders, cardiovascular diseases, respiratory diseases, and others. Among these, the cardiovascular diseases segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is attributed to the increasing prevalence of cardiovascular diseases such as myocardial infarction and angina, a rising proportion of the geriatric population, sedentary lifestyles, and lack of physical exercise.

- The hospital pharmacies segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US botanical drugs market is segmented by distribution channel into retail pharmacies, online providers, and hospital pharmacies. Among these, the hospital pharmacies segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is driven by the increasing admissions for the IPD and OPD services, provision of compounding and dispensing medications, personalized counselling and disease awareness, and offers discounts.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US botanical drugs market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Ransom Naturals Ltd

- Zein Pharma

- Tsumura & Co.

- Devonian Health Group Inc.

- KPC Pharmaceuticals

- Abbott Laboratories

- Evonik

- Jguar Health, Inc.

- Boiron

- Wilson Drugs & Pharmaceuticals Private Limited

- Himalya Wellness Company

- Others

Recent Developments:

- In March 2025, Ajna BioSciences PBC and Charlotte's Web Holdings Inc. received FDA Investigational New Drug (IND) application clearance for their oral multi-cannabinoid drug, AJA001, for the treatment of autism spectrum disorder symptoms, marking a first for botanical drug development.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the US botanical drugs market based on the below-mentioned segments:

US Botanical Drugs Market, By Source

- Algae-Based

- Fungi-Based

- Plant-Based

- Others

US Botanical Drugs Market, By Form

- Powder

- Capsules

- Tablets

- Solutions

- Others

US Botanical Drugs Market, By Therapeutic Indication

- Gastrointestinal Disorders

- Cardiovascular Diseases

- Respiratory Diseases

- Others

US Botanical Drugs Market, By Distribution Channel

- Retail Pharmacies

- Online Providers

- Hospital Pharmacies

Need help to buy this report?