United States Bone Pain Treatment Market Size, Share, and COVID-19 Impact Analysis, By Type (Ibuprofen, Acetaminophen, Paracetamol, and Morphine), By Antibiotics (Ciprofloxacin, Clindamycin, and Vancomycin), and United States Bone Pain Treatment Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited States Bone Pain Treatment Market Insights Forecasts to 2035

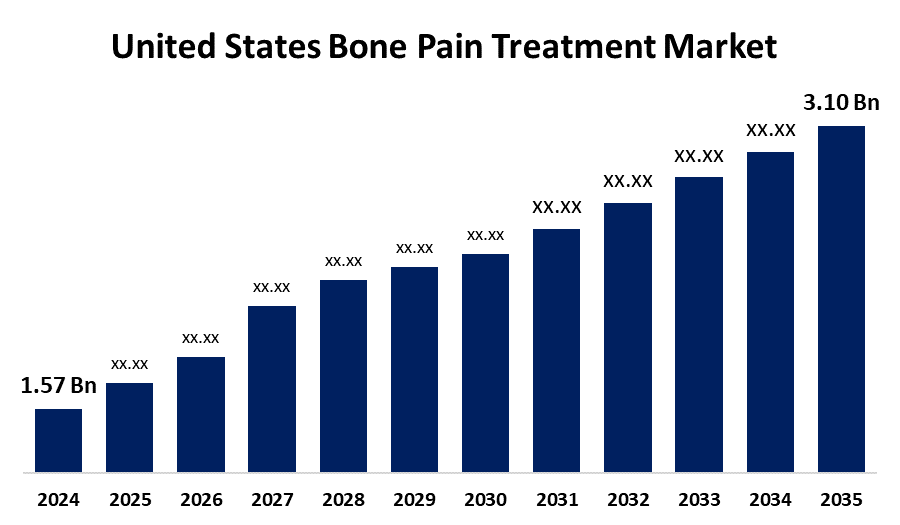

- The USA Bone Pain Treatment Market Size was estimated at USD 1.57 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.38% from 2025 to 2035

- The U.S. Bone Pain Treatment Market Size is Expected to Reach USD 3.10 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States bone pain treatment market is anticipated to reach USD 3.10 billion by 2035, growing at a CAGR of 6.38% from 2025 to 2035. The U.S. bone pain treatment market is growing due to an aging population, rising prevalence of bone disorders like arthritis and osteoporosis, and advancements in therapies such as biologics and minimally invasive procedures. Increased healthcare access and greater public awareness also boost treatment rates, collectively driving strong demand for innovative and effective bone pain management solutions.

Market Overview

The United States bone pain treatment market refers to the segment of the healthcare industry focused on diagnosing and managing pain caused by bone-related disorders, including arthritis, osteoporosis, fractures, and cancer-related bone pain. The U.S. bone pain treatment market is expanding steadily, mainly due to the country’s aging population, which increases the number of chronic bone disorders, and ongoing advancements in biologics, regenerative therapies, and minimally invasive procedures that enhance treatment outcomes. The market’s strengths include a well-developed healthcare infrastructure, high levels of healthcare expenditure, and a robust presence of pharmaceutical and biotech companies actively investing in pain management innovation. Opportunities continue to emerge in personalized medicine, digital health solutions for remote patient monitoring, and reaching underserved populations. Moreover, the U.S. government provide strong support and funding. Institutions such as the National Institute of Arthritis and Musculoskeletal and Skin Diseases (NIAMS) and the Congressionally Directed Medical Research Programs fund promising research initiatives focused on improving chronic pain treatment options.

Report Coverage

This research report categorizes the market for the United States bone pain treatment market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the USA bone pain treatment market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.S. bone pain treatment market.

United States Bone Pain Treatment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.57 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.38% |

| 2035 Value Projection: | USD 3.10 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 112 |

| Segments covered: | By Type, By Antibiotics and COVID-19 Impact Analysis |

| Companies covered:: | Pfizer, Johnson and Johnson, Amgen, Gilead Sciences, Eli Lilly, Bristol-Myers Squibb, AbbVie, Regeneron Pharmaceuticals, Novartis, Merck and Co., Mallinckrodt Pharmaceuticals, Horizon Therapeutics, Alkermes, Biohaven Pharmaceuticals, Medtronic, Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The most significant driver is the aging population, as older adults are more prone to conditions like osteoporosis, arthritis, and fractures. Rising prevalence of chronic bone-related disorders, including bone metastases and autoimmune diseases, further increases demand for effective treatment options. Technological advancements in biologics, regenerative medicine, and minimally invasive procedures have improved treatment outcomes, encouraging wider adoption. Increased public awareness about bone health, along with better access to healthcare services, supports early diagnosis and intervention. Additionally, a strong pharmaceutical pipeline and continuous investment in research and development by biotech firms are accelerating the availability of innovative therapies, contributing significantly to market expansion.

Restraining Factors

The high therapy costs, strict regulatory approvals, and growing concerns over opioid use. Limited access to advanced treatments and strong market competition further hinder growth. These challenges affect innovation, delay product launches, and restrict patient access, ultimately slowing the overall market expansion and treatment effectiveness.

Market Segmentation

The United States bone pain treatment market share is classified into type and antibiotics.

- The ibuprofen segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The USA bone pain treatment market is segmented by type and ibuprofen, acetaminophen, paracetamol, and morphine. Among these, the ibuprofen segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to Its widespread use stems from over-the-counter availability, affordability, and effectiveness in reducing inflammation and pain. Ibuprofen's favorable safety profile compared to opioids like morphine makes it a preferred choice among healthcare providers and patients for managing mild to moderate bone pain.

- The vancomycin segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The U.S. bone pain treatment market is segmented by antibiotics into ciprofloxacin, clindamycin, and vancomycin. Among these, the vancomycin segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because it is widely used for treating severe bone infections, particularly those caused by methicillin-resistant Staphylococcus aureus (MRSA). Its effectiveness against resistant bacteria and critical role in hospital settings make vancomycin the preferred antibiotic for managing complex osteomyelitis and related bone infections.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States bone pain treatment market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Pfizer

- Johnson & Johnson

- Amgen

- Gilead Sciences

- Eli Lilly

- Bristol-Myers Squibb

- AbbVie

- Regeneron Pharmaceuticals

- Novartis

- Merck & Co.

- Mallinckrodt Pharmaceuticals

- Horizon Therapeutics

- Alkermes

- Biohaven Pharmaceuticals

- Medtronic

- Others

Recent Developments:

- In In March 2024, Medtronic announced that it had received FDA 510(k) clearance for the OsteoCool™ 2.0 Bone Tumor Ablation System. The updated system enabled simultaneous use of four internally cooled probes, improving flexibility for treating painful bone metastases and benign bone tumors. It marked a notable advancement in minimally invasive spine tumor care.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the USA, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the U.S. bone pain treatment market based on the below-mentioned segments:

United States Bone Pain Treatment Market, By Type

- Ibuprofen

- Acetaminophen

- Paracetamol

- Morphine

United States Bone Pain Treatment Market, By Antibiotics

- Ciprofloxacin

- Clindamycin

- Vancomycin

Need help to buy this report?