United States Blister Packaging Market Size, Share, and COVID-19 Impact Analysis, By Process (Cold Forming and Thermoforming), By Material (Paper & Paperboard, Aluminum, and Plastic), By End-User (Pharmaceuticals, Consumer Goods, Industrial, and Others), and US Blister Packaging Market Insights, Industry Trend, Forecasts to 2035

Industry: Advanced MaterialsUSA Blister Packaging Market Insights Forecasts to 2035

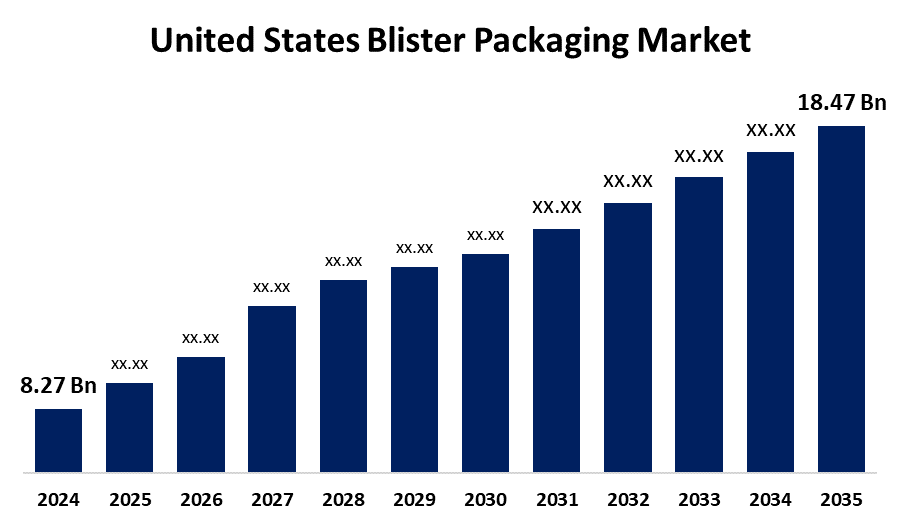

- The US Blister Packaging Market Size was estimated at USD 8.27 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.58% from 2025 to 2035

- The USA Blister Packaging Market Size is expected to reach USD 18.47 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the US Blister Packaging Market is anticipated to reach USD 18.47 billion by 2035, growing at a CAGR of 7.58% from 2025 to 2035. The expansion of the healthcare and pharmaceutical industries and an upsurge in the consumer goods and retail sectors drive the market growth.

Market Overview

Pre-formed plastic packaging for consumer goods, medications, and food items is the main focus of the US blister packaging market. These products are popular because they provide protection, tamper-evidence, and an extended shelf life. A transparent, sealed cover called blister packaging is used to safeguard goods, improve visibility, and prolong their shelf life. It is frequently applied to food items, medications, and small consumer goods. A pre-made plastic pocket or cavity that has been sealed with paperboard, aluminum foil, or a combination of these materials makes up blister packaging. Its primary advantages are tamper resistance, product protection, and eye-catching display. It is frequently used to improve safety, visibility, and shelf life in the packaging of food products, medications, and small consumer goods. For blister packaging, the US is a significant regional market, especially for the pharmaceutical and medical sectors. Blisters preserve medications' integrity over an extended period by shielding them from moisture, contamination, and tampering. To comply with strict drug safety regulations as well as product labeling and traceability standards, pharmaceutical companies use blister packaging. Additionally, blisters provide better portability and user-friendly designs for dietary supplements and over-the-counter medications. Additionally, manufacturers are demanding sustainable resources like biodegradable films and recyclable plastics, which is changing environmental trends.

Report Coverage

This research report categorizes the market for the US blister packaging market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US blister packaging market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US blister packaging market.

United States Blister Packaging Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 8.27 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.58% |

| 2035 Value Projection: | USD 18.47 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 215 |

| Tables, Charts & Figures: | 113 |

| Segments covered: | By Process, By Material, By End-User and COVID-19 Impact Analysis |

| Companies covered:: | Klockner Pentaplast Group, Smurfit WestRock, VisiPak, Amcor PLC, Tekni-Plex, Inc., DuPont de Nemours, Inc., Blisterpak, Inc., Constantia Flexibles GmbH, Sonoco Products Company, and Others Key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The rising need for healthcare products, especially among the elderly, and the increased emphasis on personalized medicine are driving the blister packaging market globally. Benefits of blister packaging include product protection, preventing contamination, extending shelf life, and improving patient care by providing dosage control and compliance data. The market has greatly advanced due to technological advancements that have improved strength, weight reduction, and use capacities. With features like child resistance and easy access opening facilities, modern blister packs are safer for users and can be used by a wider range of customers. The trend toward personalized medicine and the increase in chronic illnesses are the main drivers of blister packaging demand. Because of these developments, the market has changed dramatically, becoming more affordable and available to a larger range of consumers.

Restraining Factors

Environmental concerns, high production costs, stringent regulations, a lack of recyclables, competition from alternative packaging options, and consumer preferences for minimal packaging constitute a number of the constraints affecting the US blister packaging market that could impede its growth.

Market Segmentation

The USA blister packaging market share is classified into process, material, and end-user.

- The thermoforming segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US blister packaging market is segmented by process into cold forming and thermoforming. Among these, the thermoforming segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is attributed to the versatility, durability, aesthetic appeal, light weight, efficiency, and growing use in pharmaceuticals.

- The plastic segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US blister packaging market is segmented by material into paper & paperboard, aluminum, and plastic. Among these, the plastic segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is ascribed to rising use of plastic blisters, affordability, transparency, and high durability.

- The pharmaceuticals segment accounted for a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US blister packaging market is segmented by end-user into pharmaceuticals, consumer goods, industrial, and others. Among these, the pharmaceuticals segment accounted for a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is driven by security, regulatory compliance, and patient compliance. They enable track-and-trace, serialization, and prevent counterfeiting. Unit dose packaging reduces errors, prevents missed doses, and simplifies medication regimen management. These blister packs are ideal for OTC pain relievers and clinical trials.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US blister packaging market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Klockner Pentaplast Group

- Smurfit WestRock

- VisiPak

- Amcor PLC

- Tekni-Plex, Inc.

- DuPont de Nemours, Inc.

- Blisterpak, Inc.

- Constantia Flexibles GmbH

- Sonoco Products Company

- Others

Recent Development

- In November 2024, Bayer introduced a first-of-its-kind PET blister packaging for its Aleve healthcare brand, reducing its carbon footprint by 38% and promoting environmental stewardship by eliminating the use of PVC, a common sustainability challenge in over-the-counter products.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the US blister packaging market based on the below-mentioned segments:

US Blister Packaging Market, By Process

- Cold Forming

- Thermoforming

US Blister Packaging Market, By Material

- Paper & Paperboard

- Aluminum

- Plastic

US Blister Packaging Market, By End-User

- Pharmaceuticals

- Consumer Goods

- Industrial

- Others

Need help to buy this report?