United States Biscuits Market Size, Share, and COVID-19 Impact Analysis, By Type (Unorganized and Organized), By Product (Cream Wafer, Crackers, Cookies, Filled/Coated Biscuits, and Others), By Source (Millets, Oats, Wheat, and Others), By Distribution Channel (Convenience Stores, Specialist Retail Stores, Supermarkets, E-Commerce, and Others), and United States Biscuits Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesUnited States Biscuits Market Insights Forecasts to 2035

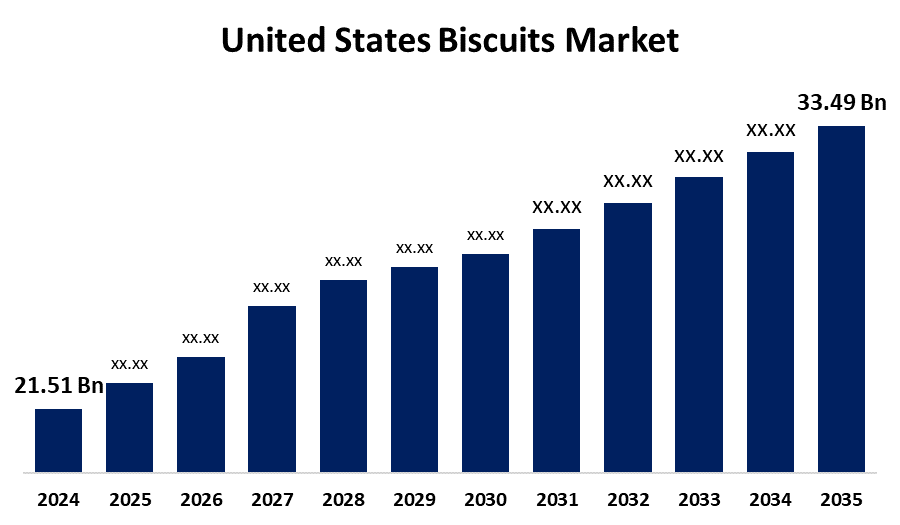

- The USA Biscuits Market Size was Estimated at USD 21.51 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.11% from 2025 to 2035

- The US Biscuits Market Size is Expected to reach USD 33.49 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States Biscuits Market Size is Anticipated to Reach USD 33.49 Billion by 2035, Growing at a CAGR of 4.11% from 2025 to 2035. The growth of this market is attributed to the rising demand for various biscuits from children and adults, the availability of biscuits in various colors, flavors, shapes, and aesthetic appearances of the biscuits drives the need for biscuits among the US population.

Market Overview

The manufacturing, distribution, and consumption of a variety of biscuit varieties, such as cookies, crackers, filled biscuits, and cream wafers, are all included in the USA biscuit market. The term biscuit, derived from the Latin biscoctus, meaning twice-cooked or baked, originated in Roman times when certain foods needed thorough drying for extended storage. Globally, including in the US, where they are called chemically leavened bread products, biscuits, cookies, and crackers are extensively utilized. In the Middle Ages, dough pieces were baked and dried in cooler ovens to create biscuits for mariners. When kept away from moisture and airborne oxygen, these wheat-flour biscuits maintain low moisture content and a long shelf life. These foods were initially manufactured for convenience. Biscuits serve as energy foods consumed between meals, derived from unpalatable dough transformed through heat in an oven into appetizing products. They are convenient, inexpensive, and incorporate digestive and dietary principles. The quality of biscuits depends on the nature and quantity of the ingredients used, with the finished product's quality primarily influenced by the relationship between raw material characteristics (flour) and product quality. Water is the most critical ingredient in dough formation, helping to solubilize other ingredients, hydrate proteins and carbohydrates, and bind gluten networks. Sugar influences dough behavior, with excess sugar resulting in softening. Fat contributes plasticity and acts as a lubricant, with larger quantities requiring less water for softness. Baking powder increases the product's volume and facilitates digestibility. Milk is typically utilized in dry, non-fat form, enhancing color, taste, and creamy consistency.

The biscuit production process involves four primary steps: mixing ingredients, hydrating flour, dissolving sugar, and kneading the hydrated flour. Sheeting the dough is crucial for forming a three-dimensional gluten structure. Ideal baking conditions yield biscuits with desirable properties, minimal moisture content, and low production costs. The expansion of biscuits occurs through gas release, including carbon dioxide from leavening agents, alongside water converting into steam. The biscuits are then cooled on conveyors at room temperature, with metal parts detected and sealed after cooling. Increased product innovation and competition are driving growth in the biscuit market. As new products emerge, early adopters are attracted, and the industry advances. This expansion is propelled by consumer demand for sugar-free options and granola bars, among other healthy snack varieties. Owing to the rise of hypermarkets, shopping centers, and online platforms, biscuits in a wide variety of flavors, textures, and qualities are now accessible to customers in the US.

Report Coverage

This research report categorizes the market for United States biscuits market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States biscuits market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States biscuits market.

United States Biscuits Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 21.51 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 4.11% |

| 2035 Value Projection: | USD 33.49 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By Product, By Source and COVID-19 Impact Analysis. |

| Companies covered:: | The Campbell’s Company, Kellanova, Ferrero, PARLE, Mondelez International, Nestle, PARTNERS, United Biscuits, General Mills, Britannia Industries, and Others. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Sedentary lifestyles, rising disposable income, and rapid urbanization are some of the factors driving the biscuit market. The proliferation of supermarkets and shopping centers has made a broader variety of biscuits, with diverse flavors and shapes, more visible. Innovative ideas and marketing tactics, such as television commercials, are also facilitating market expansion. Customers seek portable, easy-to-transport snack options because they lead hectic lives. For this reason, biscuits are gaining popularity due to their convenience and easy consumption. Consumers are drawn to new tastes, ingredient combinations, and formats, which is boosting sales and fostering customer loyalty. Producers are also exploring new market niches, such as organic, vegan, or gluten-free products. The demand for premium and gourmet biscuits with distinctive ingredients and luxurious packaging is also on the rise. Furthermore, through online channels, specialty and smaller biscuit brands can reach a broader audience and offer unique products not readily available in local markets. Convenience and innovation in the biscuit industry are increasingly vital, as evidenced by the market's optimistic outlook.

Restraining Factors

The biscuits market in the US region deals with certain challenges such as a stringent regulatory framework, supply chain disruptions, fluctuations in the cost of raw materials, alterations in the environmental conditions, and complexity in the production process.

Market Segmentation

The United States biscuits market share is classified into type, product, source, and distribution channel.

- The organized segment held the largest market share of 76.21% in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States biscuits market is segmented by type into unorganized and organized. Among these, the organized segment held the largest market share of 76.21% in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental expansion is driven by technological innovations, rising awareness of healthy lifestyles, availability, and cost-effectiveness.

- The crackers segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States biscuits market is segmented by product into cream wafer, crackers, cookies, filled/coated biscuits, and others. Among these, the crackers segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is easy to store, light, a novelty in packaging, and increases the utilization of crackers in households.

- The wheat segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The USA biscuits market is segmented by source into millets, oats, wheat, and others. Among these, the wheat segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The sector growth is attributed to the increasing cultivation of wheat in the farming sectors, rich in fibers, nutritious, longer shelf life, provides a dietary source of carbohydrates, and a source of energy and vitamins.

- The supermarket segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States biscuits market is segmented by distribution channel into convenience stores, specialist retail stores, supermarkets, e-commerce, and others. Among these, the supermarket segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental expansion is attributed to the rising preference for offline shopping, availability of a wide range of products, consumer preference, high quality and superior products, and offers discounts.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States biscuits market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- The Campbell’s Company

- Kellanova

- Ferrero

- PARLE

- Mondelez International

- Nestle

- PARTNERS

- United Biscuits

- General Mills

- Britannia Industries

- Others

Recent Developments:

- In May 2025, Pillsbury introduced BIG COOKIES cookie dough, a larger version of its classic cookie size, with three indulgent flavors and a baking time of 17-21 minutes. The dough is available in six-count packs and is filled with delicious ingredients.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the US biscuits market based on the below-mentioned segments:

United States Biscuits Market, By Type

- Unorganized

- Organized

United States Biscuits Market, By Product

- Cream Wafer

- Crackers

- Cookies

- Filled/Coated Biscuits

- Others

United States Biscuits Market, By Source

- Millets

- Oats

- Wheat

- Others

United States Biscuits Market, By Distribution Channel

- Convenience Stores

- Specialist Retail Stores

- Supermarkets

- E-Commerce

- Others

Need help to buy this report?