United States Biorationals Market Size, Share, and COVID-19 Impact Analysis, By Product (Botanical, Semiochemicals, and Others), By Crop (Fruits & Vegetables, Grains, Cereals, Corn, and Others), and United States Biorationals Market Insights, Industry Trend, Forecasts to 2035

Industry: AgricultureUnited States Biorationals Market Insights Forecasts to 2035

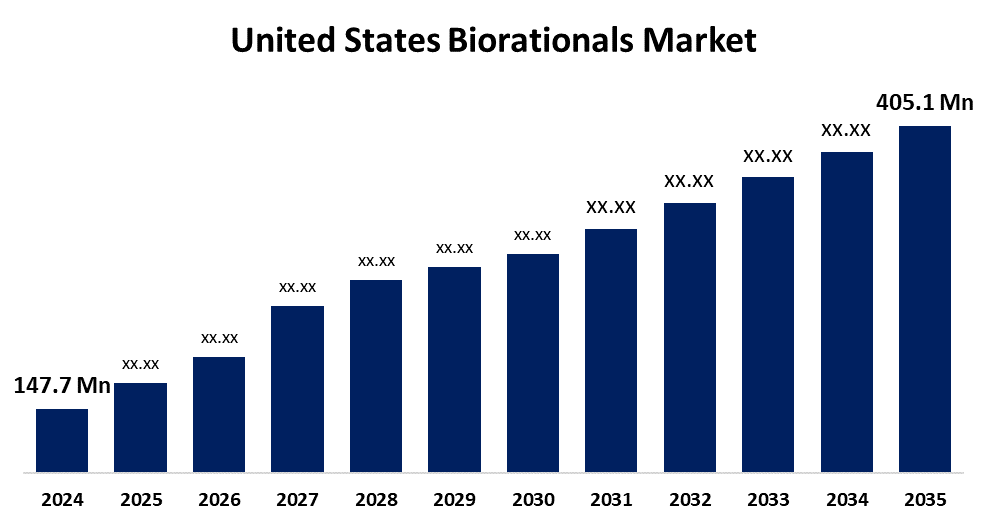

- The US Biorationals Market Size Was Estimated at USD 147.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 9.61% from 2025 to 2035

- The US Biorationals Market Size is Expected to Reach USD 405.1 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United States Biorationals Market Size is anticipated to reach USD 405.1 Million by 2035, growing at a CAGR of 9.61% from 2025 to 2035. The expansion of the United States biorationals market is propelled by the growing application of bioremediation therapy in the agricultural sector to increase insect and pest resistance because of its great efficacy.

Market Overview

Biorationals are low-impact, eco-friendly agricultural products that resemble natural substances or are sourced from biological sources. The need for bioremediation in agricultural techniques is growing since the product reduces toxic residue on fruits and vegetables and aids in reducing plant diseases and infections brought on by seeds and leaves. Additionally, the product hastens germination, stimulates pollination, increases general production, and improves yield, particularly in crops. With increasing health concerns associated with the yield and with the residue of synthetic insecticides substituted for bioproducts, the use of biorational practices is growing, and the bio-rational sector is expanding. With advances in technologies, biorenewables have the potential to combine profitability with sustainability in agriculture. The convergence of biotechnology, precision agriculture, and digital farming leads to vastly more possibilities for market expansion. Precision agriculture strategies such as drones, AI-led pest monitoring, and remote sensing guarantee less bioproduct waste and help amplify their impact on crops.

The U.S. government provides a variety of coordinated regulatory frameworks, R&D funds, and clean-economy incentives to promote the biorationals industry, particularly in agriculture. EPA, USDA, and FDA released a unified regulatory strategy in May 2024 to streamline and clarify the regulation of biotechnology goods, including botanical and microbial agents used in bioremediation. They also established a prototype web tool to help developers understand which agency is responsible for regulating each product.

Report Coverage

This research report categorizes the market for the United States biorationals market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States biorationals market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States biorationals market.

United States Biorationals Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 147.7 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 9.61% |

| 2035 Value Projection: | USD 405.1 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 179 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product and By Crop |

| Companies covered:: | Monsanto, Suterra, LLC, DuPont, Summit Chemical, Gowan Company, DuPont Nutrition & Biosciences, Koppert B.V., Bayer AG, Isagro S.P.A, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States biorationals market is boosted by the increased use of Integrated Pest Management (IPM). Biorationals are benefiting from an emphasis by farmers and agricultural professionals on sustainable methods of pest management. In achieving the objective of minimal environmental impact, IPM refers to several biological, cultural, mechanical, and chemical methods. Microbial pesticides, plant extracts, and semi-chemicals are included as not only some of the most important biorational pest management products used in IPM methodologies, but also because they function with more precision and are typically less toxic and less resilient to resistance than synthetic pesticides.

Restraining Factors

The United States biorationals market faces obstacles like the high costs associated with production and R&D. Biorationals frequently relies on elaborate fermentation, microbial culturing and extraction processes to produce their products, which typically are more expensive than traditional pesticides, which have standardized production.

Market Segmentation

The United States biorationals market share is classified into product and crop.

- The botanical segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States biorationals market is segmented by product into botanical, semiochemicals, and others. Among these, the botanical segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven because agricultural goods have zero residual. Insecticides and pesticides help to eradicate insects and other pests from manure, seeds, and soils, while not leaving dangerous chemical residue on fruits and vegetables.

- The fruits & vegetables segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the crop, the United States biorationals market is segmented into fruits & vegetables, grains, cereals, corn, and others. Among these, the fruits & vegetables segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by the demand for products generated from its crop protection operations, specifically the foliar application of pesticides and insecticides. The main source of demand is buyers of crop blocking bioreagents. Biorationals are less hazardous pesticides and insecticides that utilize organic materials for protecting crops.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States biorationals market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Monsanto

- Suterra, LLC

- DuPont

- Summit Chemical

- Gowan Company

- DuPont Nutrition & Biosciences

- Koppert B.V.

- Bayer AG

- Isagro S.P.A

- Others

Recent Development

- In March 2024, Valent BioSciences partnered with AgroFresh Solutions as Sumitomo Chemical sold Pace International to AgroFresh, forming a collaboration aimed at developing innovative postharvest biorational solutions for fresh produce, leveraging Valent’s expertise in microbial and botanical technologies.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States biorationals market based on the following segments:

United States Biorationals Market, By Product

- Botanical

- Semiochemicals

- Others

United States Biorationals Market, By Crop

- Fruits & Vegetables

- Grains

- Cereals

- Corn

- Others

Need help to buy this report?