United States Biopolymers Market Size, Share, and COVID-19 Impact Analysis, By Product (Bio-PE, Bio-PET, Polyhydroxyalkanoates (PHA), Polylactic Acid (PLA), Polybutylene Succinate (PBS), Polysaccharides, and Others), By Application (Films, Bottles, Fibers, Seed Coating, Vehicle Components, Medical Implants, and Other), and United States Biopolymers Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsUnited States Biopolymers Market Insights Forecasts to 2035

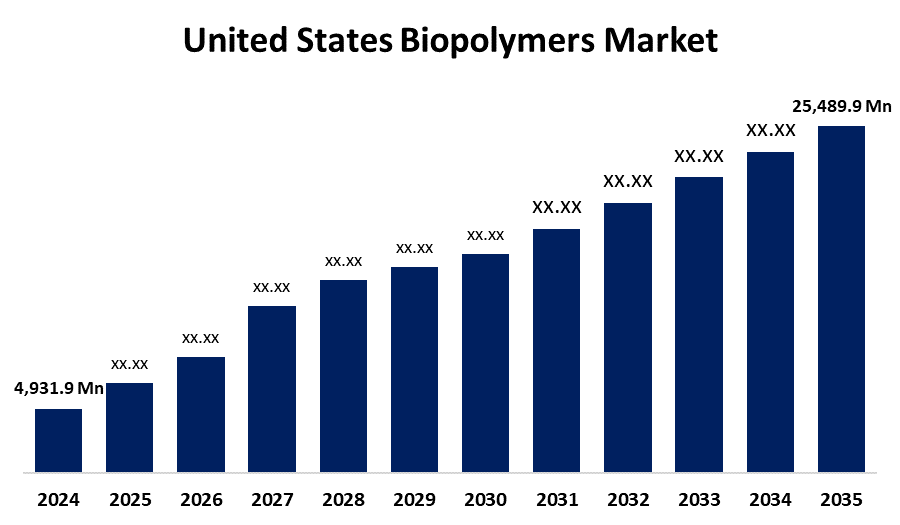

- The US Biopolymers Market Size Was Estimated at USD 4,931.9 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 16.10% from 2025 to 2035

- The US Biopolymers Market Size is Expected to Reach USD 25,489.9 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The United States Biopolymers Market Size is anticipated to reach USD 25,489.9 Million by 2035, growing at a CAGR of 16.10% from 2025 to 2035. The expansion of the United States' biopolymers market is propelled by the expanding demand for PHA-based environmental plastics

Market Overview

The natural polymers known as biopolymers are created by living things and are made up of monomeric units that are covalently bound to form bigger structures. Biopolymers are polymeric goods made from raw materials such as corn and sugarcane, as well as standing lumber and leftover wood. Unlike traditional polymers or plastics, which cause pollution, biopolymers are biodegradable. It is anticipated that perceptions of the use of bio-based polymers would rise. Biopolymers are considered a more sustainable substitute to conventionally used petroleum-based plastics, since they can naturally decompose and do not cause harm to the environment. As consumers become more aware of the impact of their carbon footprint, they are also demanding more environmentally friendly products. Governments in the US are trying to reduce plastic waste by charging extra fees for single-use plastics and encouraging the use of natural packaging alternatives. As companies and consumers grow increasingly aware of the environmental effects of traditional petrochemical-based plastics, this trend is anticipated to persist over the projected period. Research and development (R&D) projects to enhance the production processes of biopolymers from agricultural feedstocks have received substantial funding from the U.S. Department of Agriculture (USDA).

Report Coverage

This research report categorizes the market for the United States biopolymers market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States biopolymers market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States biopolymers market.

United States Biopolymers Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4,931.9 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 16.10% |

| 2035 Value Projection: | USD 25,489.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 278 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Product and By Application |

| Companies covered:: | Entec Polymers, ADM, DuPont de Nemours Inc, Biopolymer Industries, Ecovia Renewables Inc., BiologiQ, Inc., NatureWorks, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States biopolymers market is boosted by rising consciousness of the damaging effects that traditional plastics have on the environment. Traditional petrochemical-based plastics contain dangerous substances that can contaminate food and beverages and cause a host of health issues.

Restraining Factors

The United States biopolymers market faces obstacles, like bioplastics being more expensive than conventional polymers. The cost of producing bio-based polymers is typically 20–100% more than that of conventional polymers.

Market Segmentation

The United States Biopolymers Market Share is classified into product and application.

- The bio-PE segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States biopolymers market is segmented by product into bio-PE, bio-PET, polyhydroxyalkanoates (PHA), polylactic acid (PLA), polybutylene succinate (PBS), polysaccharides, and others. Among these, the bio-PE segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. Environmental concerns are the segment's driving force. Furthermore, the end-of-life issues with conventional plastics are resolved by biodegradable polyesters. Biodegradable polyesters can be used to create products that organically decompose, lowering the need for long-term disposal and promoting a circular economy.

- The bottles segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the United States biopolymers market is segmented into films, bottles, fibers, seed coating, vehicle components, medical implants, and other. Among these, the bottles segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is propelled by the change in the consumption patterns of bio-based and renewable plastics. Because they are environmentally benign, biopolymers like PLA are being employed more and more in the production of bottles.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States biopolymers market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Entec Polymers

- ADM

- DuPont de Nemours Inc

- Biopolymer Industries

- Ecovia Renewables Inc.

- BiologiQ, Inc.

- NatureWorks

- Others

Recent Development

- In July 2024, NatureWorks launched a new high-performance polylactic acid (PLA) biopolymer tailored for 3D printing applications. This innovation expands the material's potential in additive manufacturing.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States biopolymers market based on the following segments:

United States Biopolymers Market, By Product

- Bio-PE

- Bio-PET

- Polyhydroxyalkanoates (PHA)

- Polylactic Acid (PLA)

- Polybutylene Succinate (PBS)

- Polysaccharides

- Others

United States Biopolymers Market, By Application

- Films

- Bottles

- Fibers

- Seed Coating

- Vehicle Components

- Medical Implants

- Other

Need help to buy this report?