United States Bioplastics Market Size, Share, and COVID-19 Impact Analysis, By Product (Biodegradable and Non-biodegradable), By Application (Packaging, Agriculture, Consumer Goods, Textile, Automotive, Building & Construction, and Others), and United States Bioplastics Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsUnited States Bioplastics Market Insights Forecasts to 2035

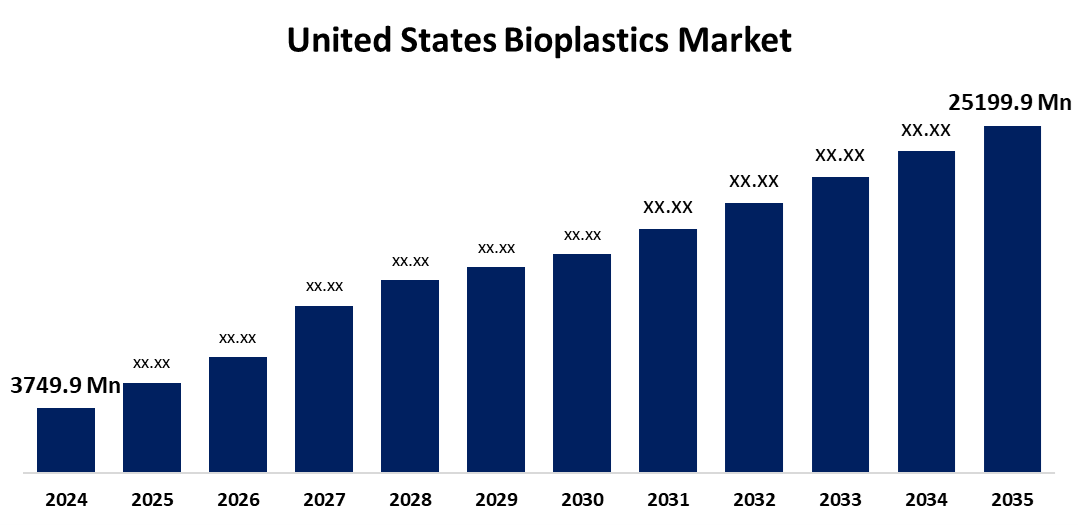

- The US Bioplastics Market Size Was Estimated at USD 3,749.9 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 18.91% from 2025 to 2035

- The US Bioplastics Market Size is Expected to Reach USD 25,199.9 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The United States Bioplastics Market Size is anticipated to reach USD 25,199.9 Million by 2035, Growing at a CAGR of 18.91% from 2025 to 2035. The expansion of the United States bioplastics market is propelled by growth in bio-based materials and technology, legislative assistance for cutting plastic waste, and rising demand for environmentally friendly packaging.

Market Overview

Bioplastics are polymers made from biological, renewable resources such as microbes, plants, or algae as opposed to fossil fuels. Growing usage of environmentally sensitive, sustainable plastic materials in a variety of end-use sectors is driving growth in the U.S. market. Bioplastic is made from renewable bio-based materials, which include plant starch, vegetable fats, waste oils, and natural sugars. Although it is biodegradable, bioplastic functions and has properties similar to those of conventional plastic. All of these product characteristics have ultimately resulted in strong demand for usage in end-use sectors that produce textile, automotive, and rigid packaging materials. It is mentioned that increased product usage from end-use markets will positively influence the U.S. bioplastics market. The United States government has imposed limitations on single-use plastics, and end-user industries like transportation and autos are starting to adopt recyclable or sustainably created components for distinctive automotive parts. Consistent with conventional plastic, bioplastic materials can also provide similar structural characteristics, i.e, strength, flexibility, and temperature stability. However, as electric vehicles become more popular, plastic materials such as engineering, thermo, and bioplastics will continue to rise. The component for automobiles is durable and light owing to specific plastic materials. All of these factors should stimulate the utilization of the product in the automotive industry.

Report Coverage

This research report categorizes the market for the United States bioplastics market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States bioplastics market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States bioplastics market.

United States Bioplastics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3,749.9 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 18.91% |

| 2035 Value Projection: | USD 25,199.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 212 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Product, By Application |

| Companies covered:: | Cargill, Trinseo PLC, NatureWorks LLC, Danimer Scientific, Dow Inc, Hallstar Industrial, Genomatica, Amcor Rigid Plastics USA, LLC, Glycosbio, Lanzatech, Myriant, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States bioplastics market is boosted by its use in final-use sectors. The prime usages of the product remain in packaging, transportation, and automotive. Bioplastics, when used in certain applications, possess the same properties as conventional plastic. Therefore, its envisioned to be the alternative for plastic waste reduction, and the product could replace or substitute for standard plastic. However, bioplastic is viewed to be an excellent material for current farming practices that are reliant, to a large extent, on agricultural films, such as greenhouse films and mulching. These uses are driving the demand for biodegradable plastic. As a result, the major producers of plastic film are creating biodegradable agricultural films that are both technically sophisticated and commercially feasible. Though these bioplastic films add to the enhanced properties, they replenish the degraded soil from the bioplastic breakdown. All these factors suggest that the demand for bioplastics from all potential end-use sectors should increase

Restraining Factors

The United States bioplastics market faces obstacles like low product availability and high production costs. Most bioplastic grades are made from biomaterial and degrade through industrial composting. Due to the high cost of the product, there are few major manufacturers in this industry. Also, availability and economic factors are expected to limit growth in the bioplastics market in the US.

Market Segmentation

The United States bioplastics market share is classified into product and application.

- The biodegradable segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States bioplastics market is segmented by product into biodegradable and non-biodegradable. Among these, the biodegradable segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is propelled by biodegradable plastics, which are being used more often for PPE and food packaging. Biodegradable plastics include PHA, PBS, PBAT, cellulose acetate, and polycaprolactone. By 2023, starch blends will lead the biodegradable product market. Starch-based polymers are made from natural materials like rice, corn, tapioca, wheat, and potatoes. Starch blends are an excellent substitute for plant-based conventional polymers due to the abundance of resources.

- The packaging segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the United States bioplastics market is segmented into packaging, agriculture, consumer goods, textile, automotive, building & construction, and others. Among these, the packaging segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled because starch blends are used in packaging for personal care products, household care products, food, and beverage products. The packaging industry uses starch blends, polyethylene terephthalate (PET), polylactic acid (PLA), PBAT, polyethylene (PE), and polybutylene (PB). The single-use bottles made from PLA are biodegradable, unlike their petroleum-based counterparts.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States bioplastics market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cargill

- Trinseo PLC

- NatureWorks LLC

- Danimer Scientific

- Dow Inc

- Hallstar Industrial

- Genomatica

- Amcor Rigid Plastics USA, LLC

- Glycosbio

- Lanzatech

- Myriant

- Others

Recent Development

- In April 2023, NatureWorks LLC launched Ingeo 6500D, a biopolymer that reduces carbon footprint by 62% and improves softness by 40% in hygiene products.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States bioplastics market based on the following segments:

United States Bioplastics Market, By Product

- Biodegradable

- Non-biodegradable

United States Bioplastics Market, By Application

- Packaging, Agriculture

- Consumer Goods

- Textile

- Automotive

- Building & Construction

- Others

Need help to buy this report?