United States Biopharmaceuticals Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Recombinant Proteins, Cellular Therapies, Vaccines, and Monoclonal Antibodies), By Route of Administration (Subcutaneous, Intramuscular, and Intravenous), By Application (Infectious Diseases, Cardiovascular Diseases, Oncology, and Autoimmune Diseases), By End-User (Pharmaceutical Companies, Hospitals, and Biotechnology Companies), and US Biopharmaceuticals Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUSA Biopharmaceuticals Market Insights Forecasts to 2035

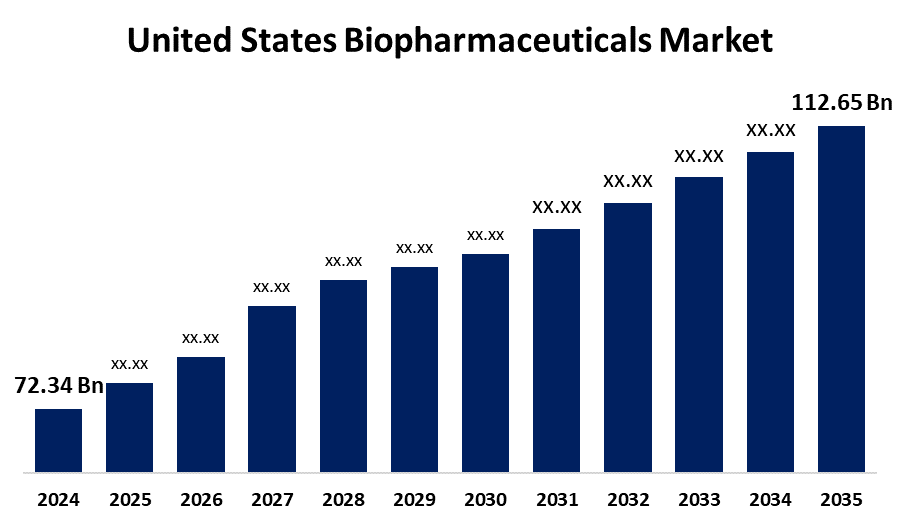

- The US Biopharmaceuticals Market Size was Estimated at USD 72.34 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.11% from 2025 to 2035

- The USA Biopharmaceuticals Market Size is Expected to Reach USD 112.65 Billion by 2035

Get more details on this report -

According to a research report published By Spherical Insights & Consulting, the US Biopharmaceuticals Market Size is Anticipated to reach USD 112.65 Billion by 2035, Growing at a CAGR of 4.11% from 2025 to 2035. The market growth is attributed to the increasing prevalence of chronic illness, technological advancements in biopharmaceuticals, and the increasing proportion of biopharmaceuticals.

Market Overview

The United States biopharmaceuticals market is categorized under the pharmaceuticals, which deals with the development, production, and commercialization of biopharmaceuticals, medicines that are derived from living organisms. Protein agents known as biopharmaceuticals can be made from animal sources, genetically modified cell lines, monoclonal, fully humanized cytokines, antibodies, chimeric proteins, receptor proteins, or blood or blood products. Recombinant DNA technology is used to create these biopharmaceutical compounds, which can be simple or complex molecules. They are made in different cell lines and include oligonucleotides, ribozymes, and chemically synthesized peptides for medicinal purposes. Large molecule medications, or biopharmaceuticals, are hundreds of times bigger than small molecule or traditional pharmaceutical medications. Biopharmaceuticals come in two varieties: biosimilars and biologics. Large molecules made from proteins that are grown in cells and refined into active agents are known as biologics, whereas products that are very similar to biologics that have already received approval are known as biosimilars. Biopharmaceuticals are intended for use in in vivo diagnostic, therapeutic, or preventative purposes. The marketed products of the biopharmaceuticals are Humira (adalimumab), Avastin (bevacizumab), Lantus (insulin glargine), etc.

Various government initiatives drive the market growth. For instance, the goal of the NIST biomanufacturing program is to assist the US biopharmaceutical industry in manufacturing affordable, high-quality protein medications around the world. It advances the development, characterization, and manufacturing of protein drugs by creating standards, measurement science, and sophisticated tools. To evaluate and validate present and future measurement requirements associated with the production of protein drugs, the program works in conjunction with industry participants, the FDA, and international standards organizations.

The increasing prevalence of chronic diseases escalates the need for biopharmaceutical drugs which resulting in market growth. For instance, the data provided by the American Heart Association states that in 2021, heart disease and stroke were the leading causes of death in the United States, accounting for 40.3% of all deaths. Other leading causes included stroke (17.5%), high blood pressure (13.4%), heart failure (9.1%), and artery diseases (2.6%). Coronary heart disease (CHD) caused 375,476 deaths, while stroke caused 7.44 million deaths worldwide. In the United States, sudden cardiac arrest mortality was 20,114. Tobacco contributed to 7.43 million deaths worldwide, with smoking being the leading risk factor for premature mortality and years of life with disability or injury. In 2021, 103,294 US deaths were attributed to diabetes.

Report Coverage

This research report categorizes the market for the US biopharmaceuticals market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US biopharmaceuticals market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US biopharmaceuticals market.

United States Biopharmaceuticals Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 72.34 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 4.11% |

| 2035 Value Projection: | USD 112.65 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 160 |

| Tables, Charts & Figures: | 140 |

| Segments covered: | By Product Type, By Route, By Application, By End-User and COVID-19 Impact Analysis. |

| Companies covered:: | AbbVie, Sanofi, Gilead Sciences, Novartis, Bristol Myers Squibb, Moderna, Biogen, Pfizer, Eli Lilly and Company, AstraZeneca, Vertex Pharmaceuticals, Johnson and Johnson, and Others. |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Growing investments in government initiatives and regulatory approvals:

The biopharmaceutical market forecast emphasizes how crucial government programs and healthcare expenditures are to the sector's growth. Budgets for healthcare, including money for biopharmaceutical research and development, are rising across the globe. Government support for the biopharmaceutical sector is evident in the high level of healthcare spending in the US, which provides funds to support the development, adoption, and research of cutting-edge treatments. This assistance improves biopharmaceutical companies' capacity for development and speeds up the commercialization of novel medications, enabling patients to obtain them. With the FDA streamlining the approval procedures for new treatments, the US regulatory landscape is growing more encouraging of biopharmaceutical innovation. Through encouraging more investment in the US biopharmaceutical market, this support positions the industry for rapid growth and advancements.

Rising incidence of chronic diseases and advancements in biopharmaceuticals:

Growing rates of chronic illnesses like cancer, diabetes, heart disease, and autoimmune disorders are driving the biopharmaceutical market. These illnesses need ongoing care, and biopharmaceuticals are frequently used in their management and therapy. The demand for these products stems from the need for cancer vaccines and monoclonal antibodies, which are more effective and have fewer side effects than conventional therapies. Increased funding for treating chronic illnesses and large investments in R&D by pharmaceutical companies are driven by this demand. Next-generation sequencing, high-throughput screening, and genetic engineering advancements are essential for better and safer drug development and molecular understanding of diseases.

Restraining Factors

The USA biopharmaceuticals market faces regulatory complexity, high R&D costs, pricing pressures, intellectual property concerns, supply chain disruptions, and market competition. The FDA approval process, high R&D costs, and government-imposed price controls may impede the market growth.

Market Segmentation

The USA biopharmaceuticals market share is classified into product type, route of administration, application, and end-user.

- The monoclonal antibodies segment held a significant share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The US biopharmaceuticals market is segmented by product type into recombinant proteins, cellular therapies, vaccines, and monoclonal antibodies. Among these, the monoclonal antibodies segment held a significant share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segmental expansion is attributed to the effectiveness against chronic diseases, adaptability, high specificity, higher binding affinity, and high selectivity.

- The intravenous segment accounted for a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US biopharmaceuticals market is segmented by route of administration into subcutaneous, intramuscular, and intravenous. Among these, the intravenous segment accounted for a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is driven by the improved bioavailability, rapid onset of action, greater efficacy, and accurate dosage form.

- The oncology segment held a significant share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The US biopharmaceuticals market is segmented by application into infectious diseases, cardiovascular diseases, oncology, and autoimmune diseases. Among these, the oncology segment held a significant share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The sector growth is attributed to the rising cases of cancer in the United States, advancements in chemotherapies, the growing trend of targeted therapies, and precision medicines.

- The hospitals segment accounted for a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US biopharmaceuticals market is segmented by end-user into pharmaceutical companies, hospitals, and biotechnology companies. Among these, the hospitals segment accounted for a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is owing to the increasing admissions in the hospitals, growing demand for biologics, availability of research centers, and growing clinical studies in the hospitals.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US biopharmaceuticals market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AbbVie

- Sanofi

- Gilead Sciences

- Novartis

- Bristol Myers Squibb

- Moderna

- Biogen

- Pfizer

- Eli Lilly and Company

- AstraZeneca

- Vertex Pharmaceuticals

- Johnson and Johnson

- Others

Recent Developments:

- In March 2025, Cadrenal Therapeutics, Inc., a biopharmaceutical company, announced manufacturing and supply chain milestones for its lead drug candidate, tecarfarin, a novel oral vitamin K antagonist anticoagulant designed to address unmet anticoagulation therapy needs.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the US biopharmaceuticals market based on the below-mentioned segments:

US Biopharmaceuticals Market, By Product Type

- Recombinant Proteins

- Cellular Therapies

- Vaccines

- Monoclonal Antibodies

US Biopharmaceuticals Market, By Route of Administration

- Subcutaneous

- Intramuscular

- Intravenous

US Biopharmaceuticals Market, By Application

- Infectious Diseases

- Cardiovascular Diseases

- Oncology

- Autoimmune Diseases

US Biopharmaceuticals Market, By End-User

- Pharmaceutical Companies

- Hospitals

- Biotechnology Companies

Need help to buy this report?